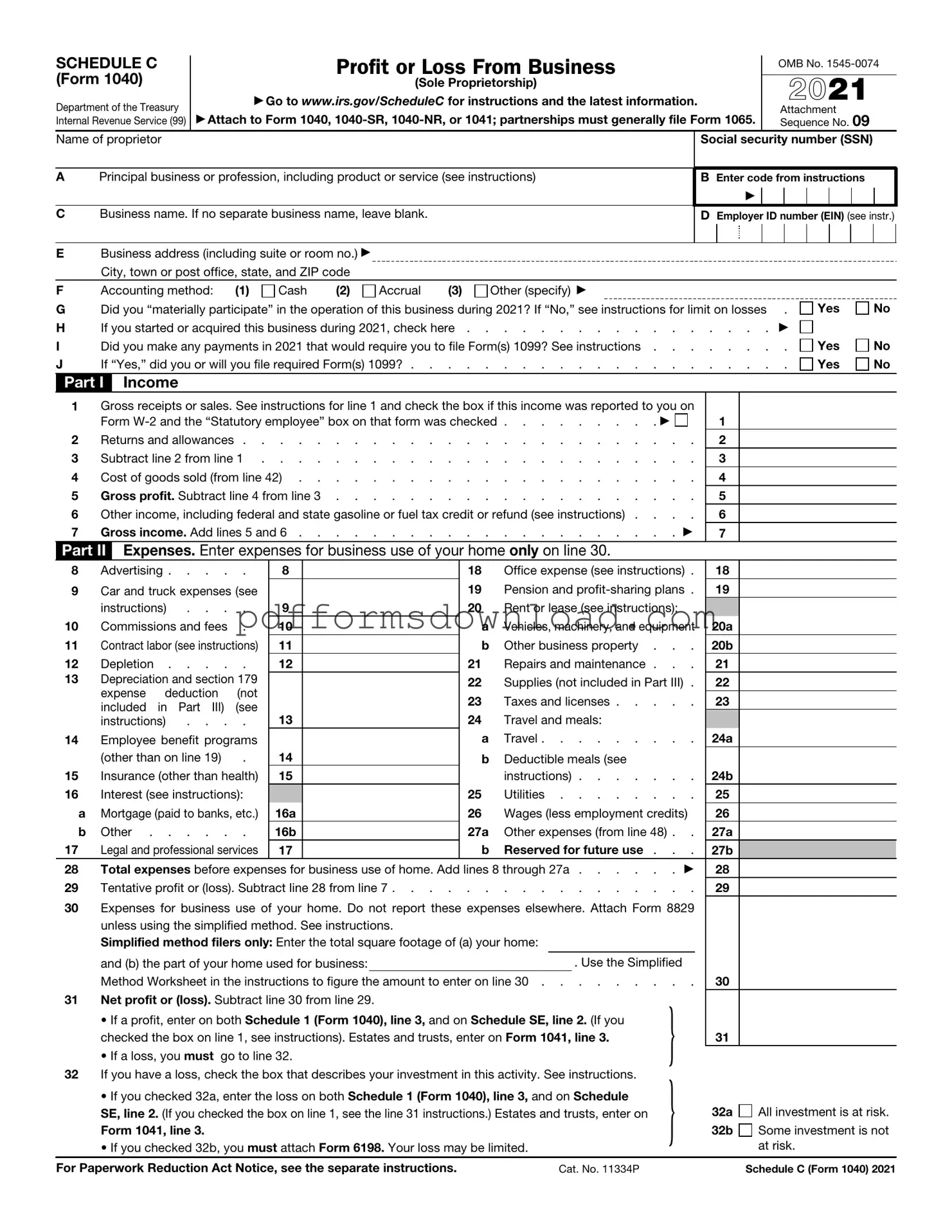

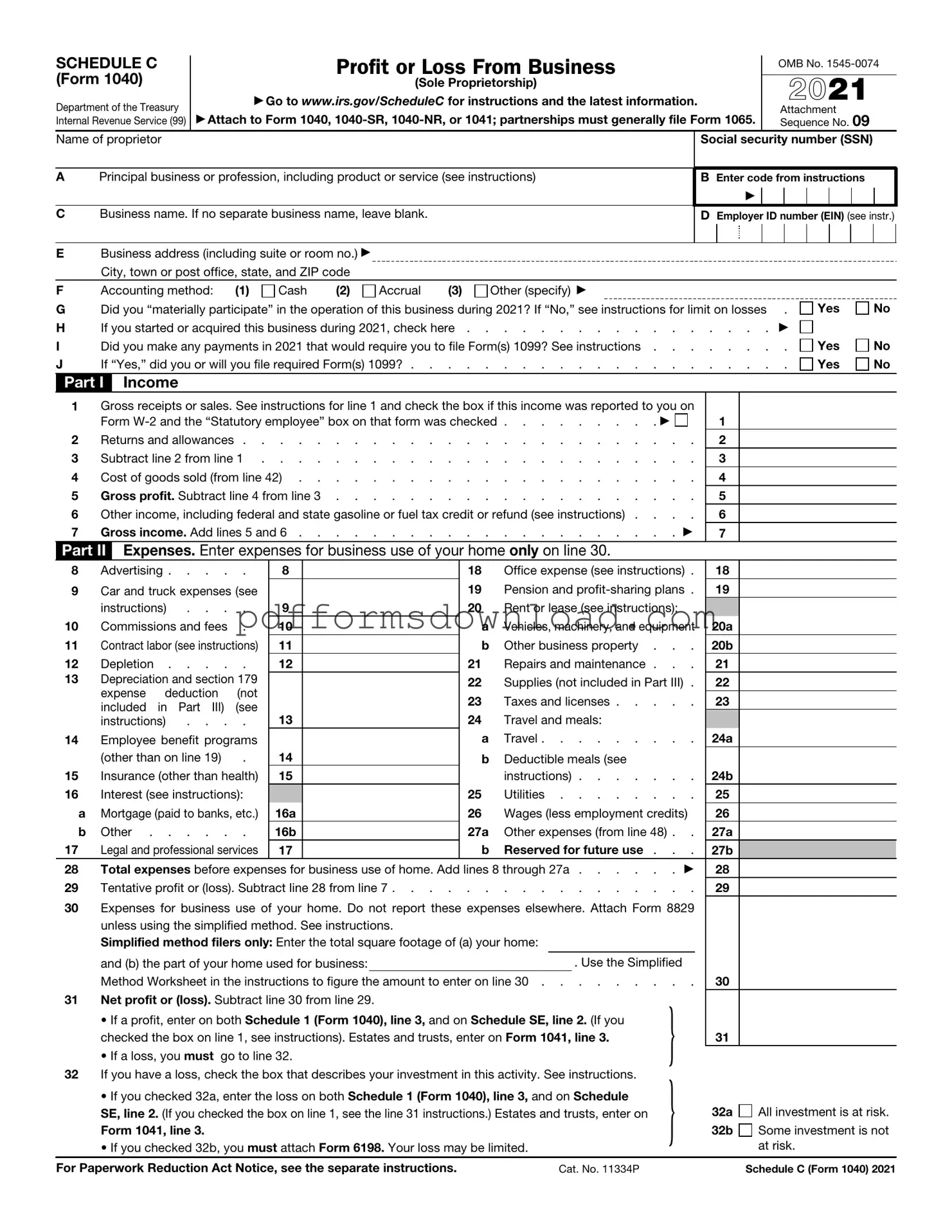

Download IRS Schedule C 1040 Template

The IRS Schedule C (Form 1040) is a tax form used by sole proprietors to report income or loss from their business activities. This form provides essential information about a business's earnings and expenses, helping to determine the net profit or loss for the year. Understanding how to accurately complete Schedule C is crucial for ensuring compliance with tax regulations.

Ready to fill out your Schedule C? Click the button below for guidance!

Make This Document Now

Download IRS Schedule C 1040 Template

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your IRS Schedule C 1040 online — edit, save, and download easily.