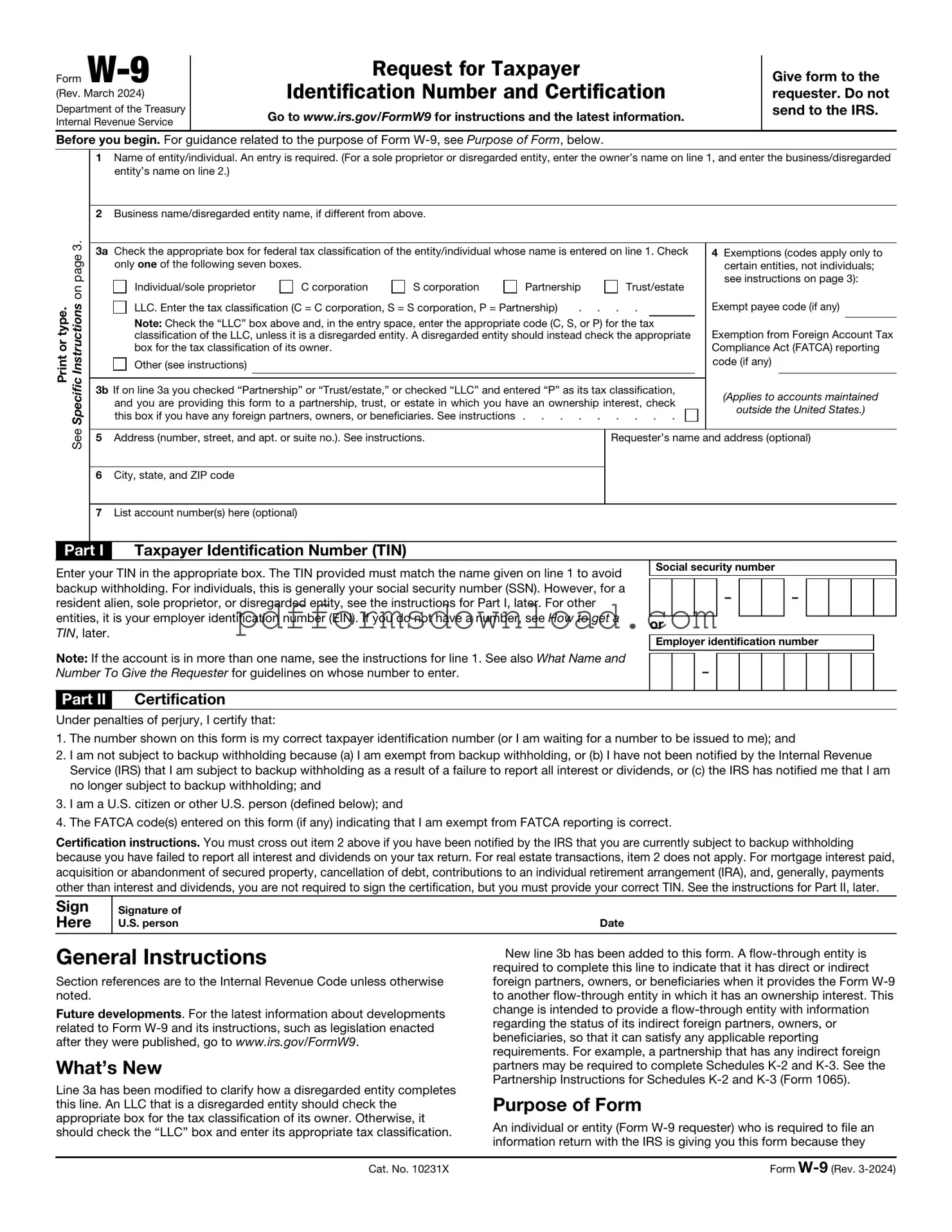

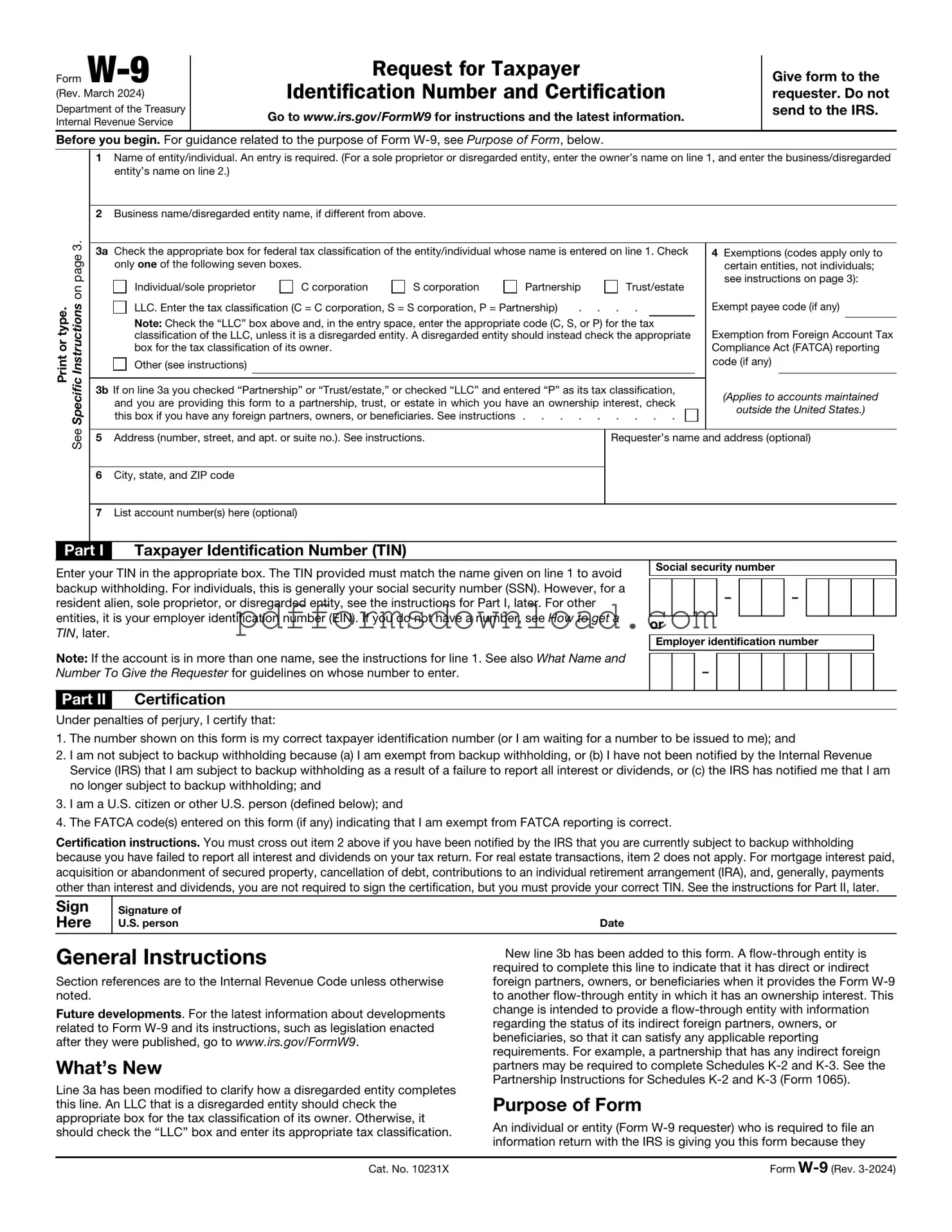

Download IRS W-9 Template

The IRS W-9 form is a crucial document used by individuals and businesses to provide their taxpayer identification information to the IRS. This form is essential for those who receive income that needs to be reported, ensuring compliance with tax regulations. If you need to fill out the W-9 form, click the button below to get started.

Make This Document Now

Download IRS W-9 Template

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your IRS W-9 online — edit, save, and download easily.