What is a Letter of Intent to Lease Commercial Property?

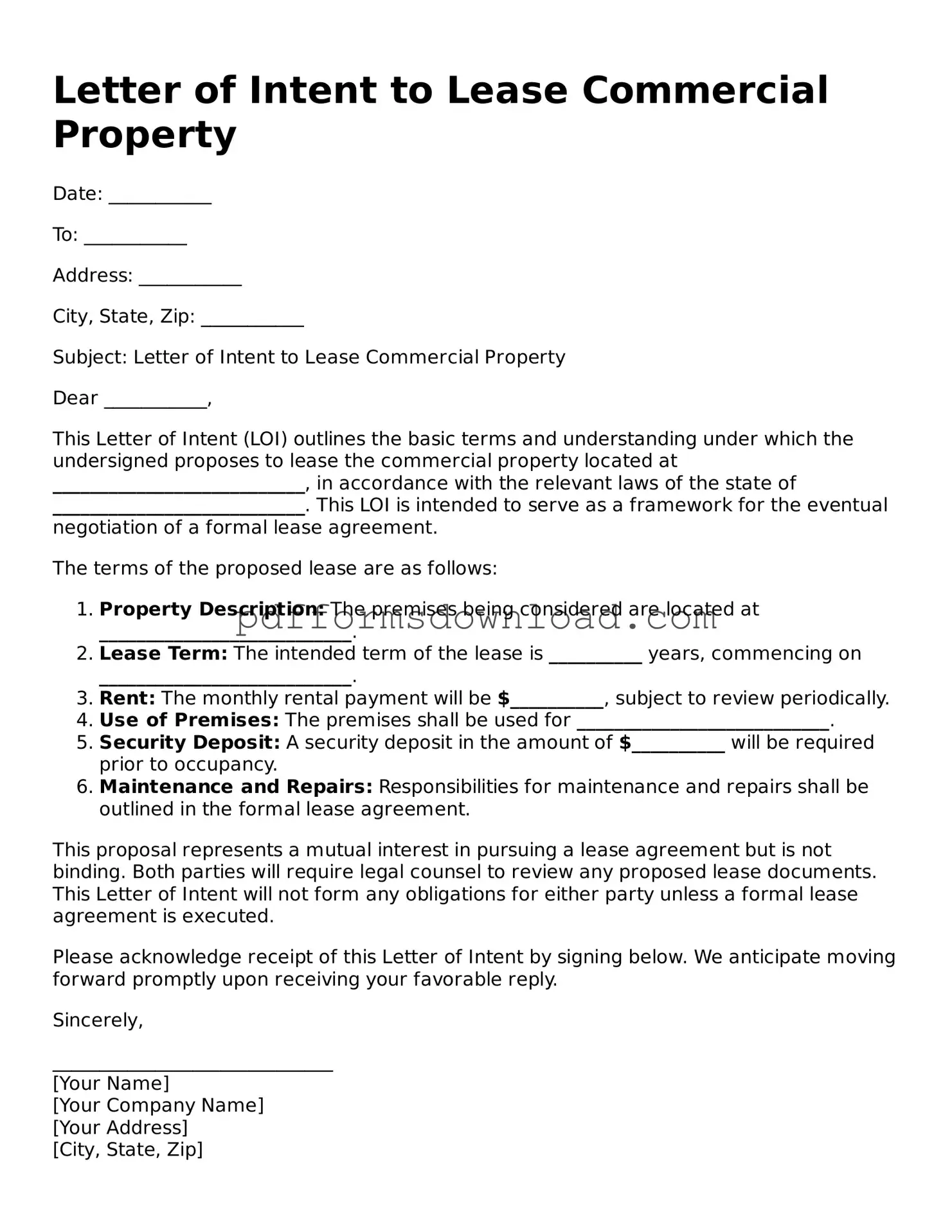

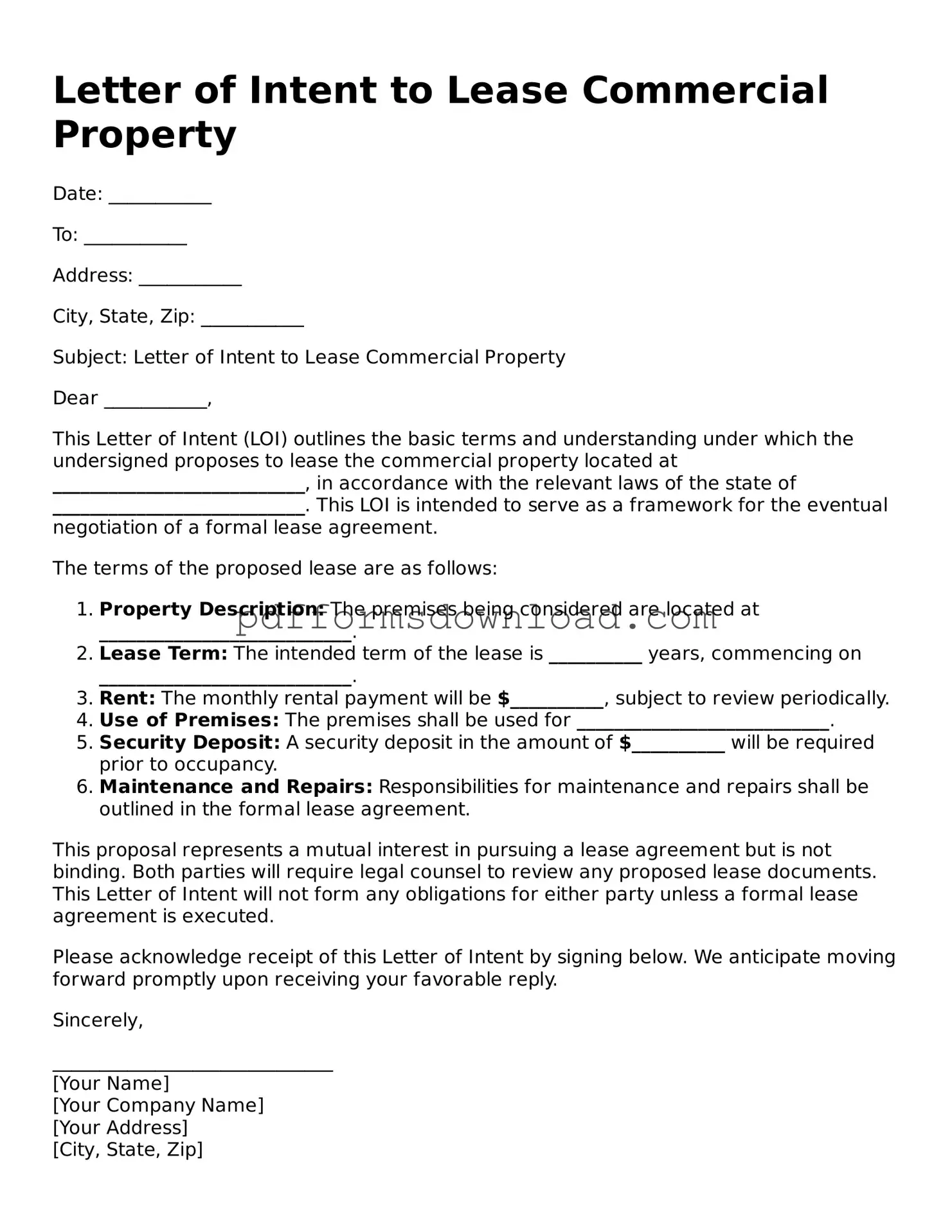

A Letter of Intent (LOI) to lease commercial property is a preliminary document that outlines the basic terms and conditions of a proposed lease agreement. It serves as a starting point for negotiations between the landlord and the tenant. While it is not legally binding, it expresses the intent of both parties to enter into a lease agreement under the specified terms.

Why is a Letter of Intent important?

The LOI is important because it clarifies the key points of the lease before the formal contract is drafted. This can include details such as rent amount, lease duration, and any special conditions. By outlining these terms early, both parties can avoid misunderstandings and streamline the negotiation process.

Is a Letter of Intent legally binding?

Generally, a Letter of Intent is not legally binding. It is meant to express intent rather than create legal obligations. However, some sections of the LOI, such as confidentiality or exclusivity clauses, may be binding. It is essential to read the document carefully and understand which parts may carry legal weight.

What should be included in a Letter of Intent?

A comprehensive LOI typically includes the following elements: the names of the parties involved, a description of the property, proposed lease terms (such as rent, duration, and renewal options), responsibilities for maintenance and repairs, and any contingencies that must be met. Including these details helps ensure clarity and sets the stage for the lease agreement.

How long does it take to draft a Letter of Intent?

The time it takes to draft a Letter of Intent can vary. If both parties are in agreement on the basic terms, it may take just a few hours to draft. However, if there are significant negotiations or disagreements, the process could take several days or even weeks. Clear communication can help expedite this process.

Can I negotiate the terms in a Letter of Intent?

Yes, negotiating the terms in a Letter of Intent is common. Both parties should feel free to discuss and modify terms to reach a mutually agreeable position. This document is meant to facilitate discussion, and changes can be made until both parties are satisfied with the proposed terms.

What happens after the Letter of Intent is signed?

Once the Letter of Intent is signed, the next step is usually to draft a formal lease agreement based on the terms outlined in the LOI. This formal lease will include more detailed legal language and may go through additional negotiations. It is advisable for both parties to consult with legal professionals during this phase.

Can a Letter of Intent be rescinded?

Yes, a Letter of Intent can be rescinded, as it is not a legally binding contract. Either party can withdraw their interest at any time before a formal lease agreement is executed. However, it is courteous to communicate this decision as soon as possible to avoid wasting time and resources.

Who should draft the Letter of Intent?

While either party can draft the Letter of Intent, it is often beneficial to have a legal professional involved. This ensures that the document accurately reflects the intentions of both parties and includes all necessary terms. A legal advisor can also help identify any potential issues that may arise in the future.

Are there any risks associated with a Letter of Intent?

One risk associated with a Letter of Intent is the potential for misunderstandings if the document is not clear. Since it is a preliminary agreement, the terms may not be fully fleshed out, leading to disputes later on. Additionally, if any binding clauses are included, parties should be aware of their obligations under those terms. Clear communication and careful drafting can help mitigate these risks.