What is a Letter of Intent to Purchase Business?

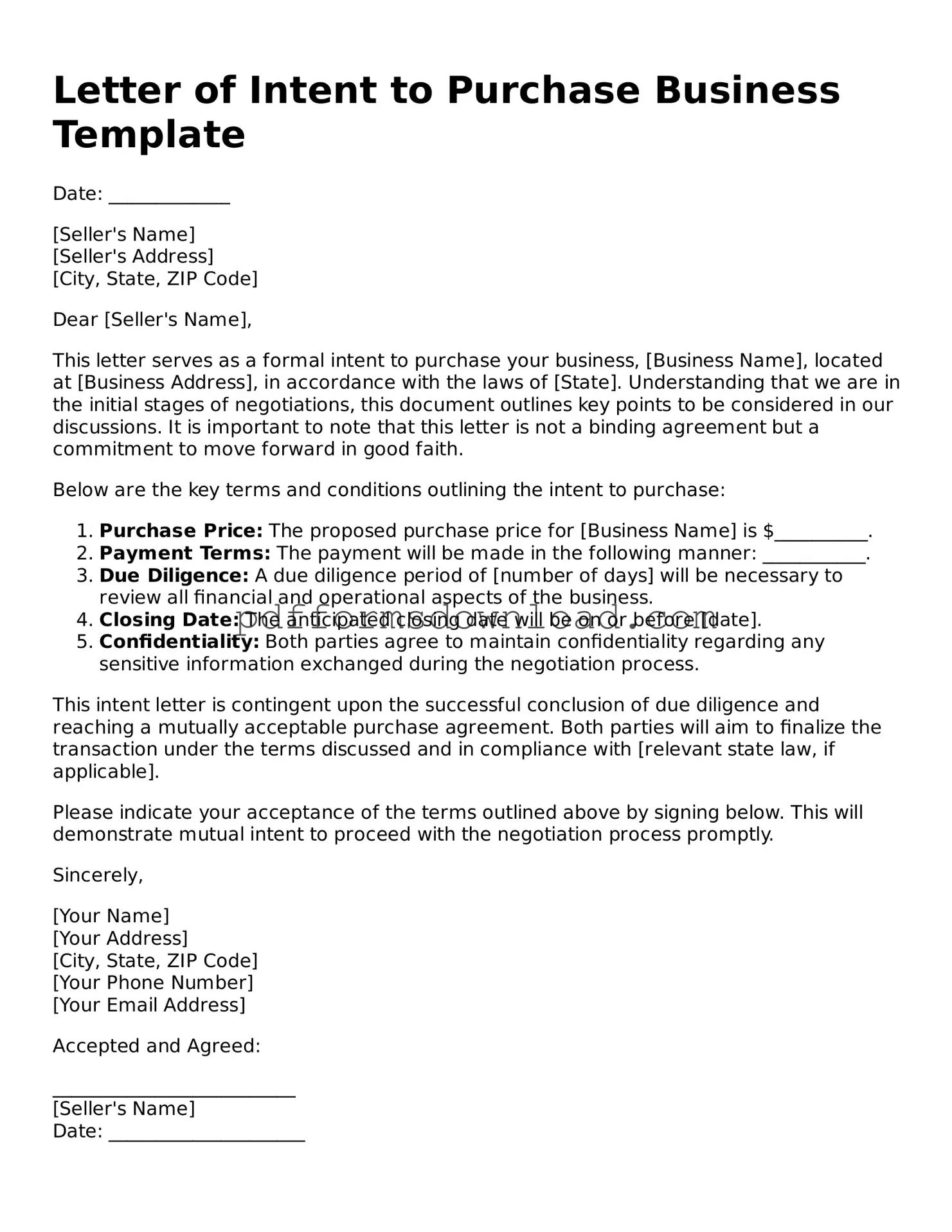

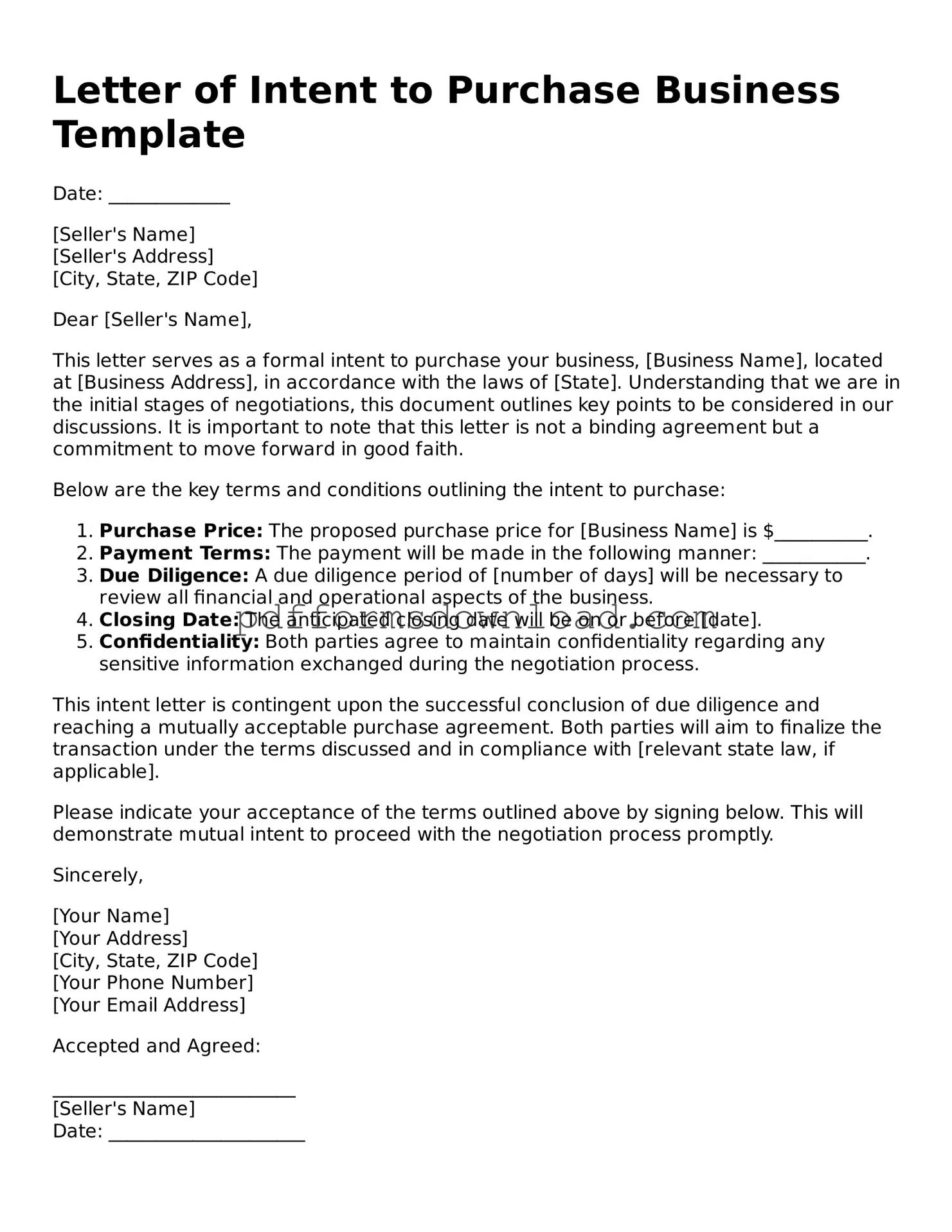

A Letter of Intent (LOI) to Purchase Business is a document that outlines the preliminary understanding between a buyer and a seller regarding the sale of a business. This letter serves as a formal expression of interest and sets the stage for further negotiations. While it is not a legally binding contract, it typically includes essential terms such as the purchase price, payment structure, and any conditions that must be met before the sale can proceed. It helps both parties clarify their intentions and expectations before entering into a more detailed agreement.

Why is a Letter of Intent important in a business transaction?

The Letter of Intent plays a crucial role in business transactions by establishing a framework for negotiations. It allows both parties to agree on key terms before investing significant time and resources into the due diligence process. By clearly outlining the intentions of both the buyer and the seller, the LOI can help prevent misunderstandings and provide a basis for further discussions. Additionally, it can signal to third parties, such as lenders or investors, that serious negotiations are underway, which may facilitate financing or other arrangements needed for the transaction.

What should be included in a Letter of Intent to Purchase Business?

An effective Letter of Intent should include several key components. First, it should clearly identify the parties involved—the buyer and the seller. Next, it should outline the proposed purchase price and any payment terms, such as whether the payment will be made in cash, through financing, or a combination of both. Additionally, the LOI should specify any conditions that must be met before the sale can be finalized, such as due diligence or regulatory approvals. Finally, including a timeline for the transaction and any confidentiality agreements can help protect both parties’ interests during the negotiation process.

Is a Letter of Intent legally binding?

Generally, a Letter of Intent is not legally binding in the same way that a formal purchase agreement is. However, certain provisions within the LOI may be binding, particularly those related to confidentiality or exclusivity. It is important for both parties to clearly indicate which parts of the LOI are intended to be binding and which are not. To avoid confusion, legal counsel can be consulted to ensure that the document accurately reflects the intentions of both parties and provides the necessary protections during the negotiation process.