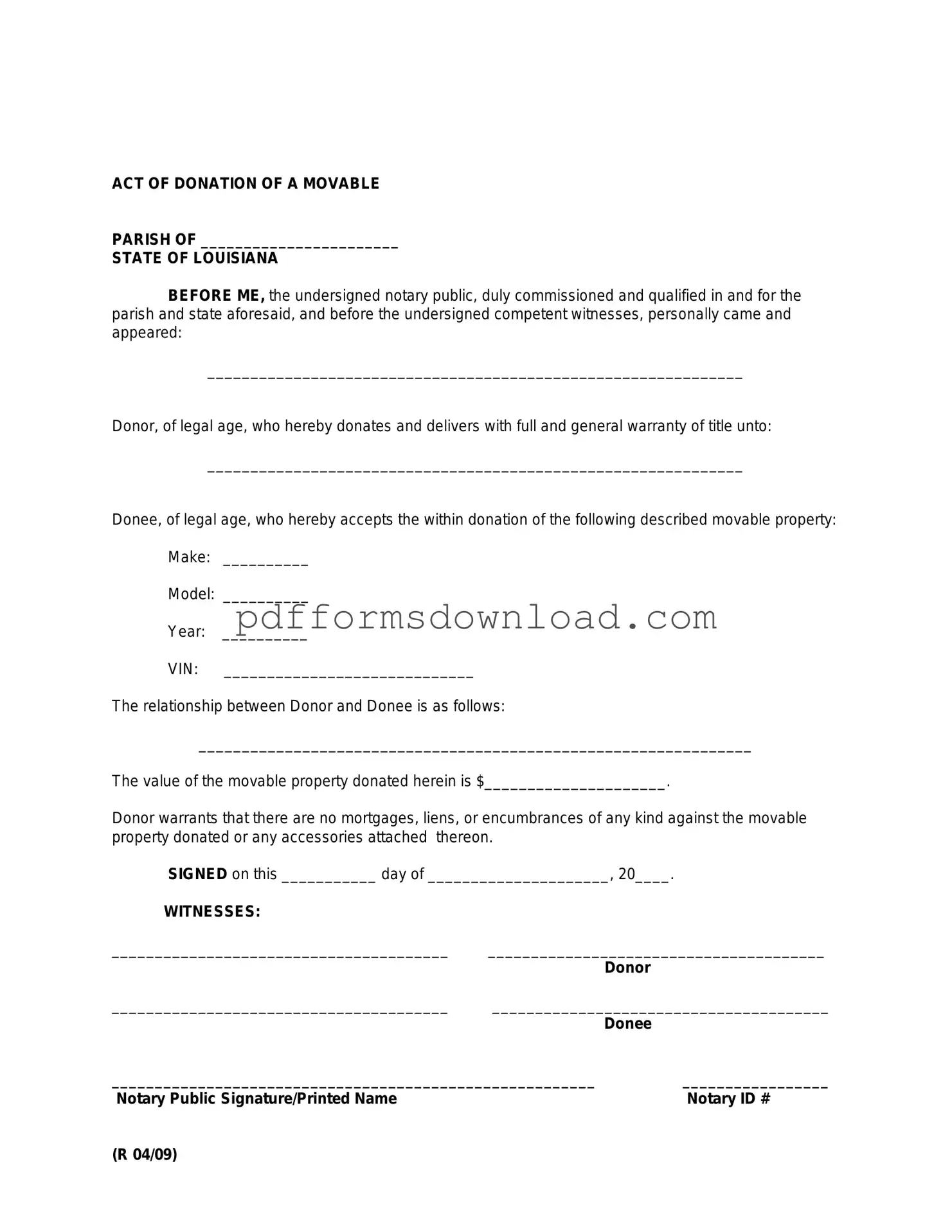

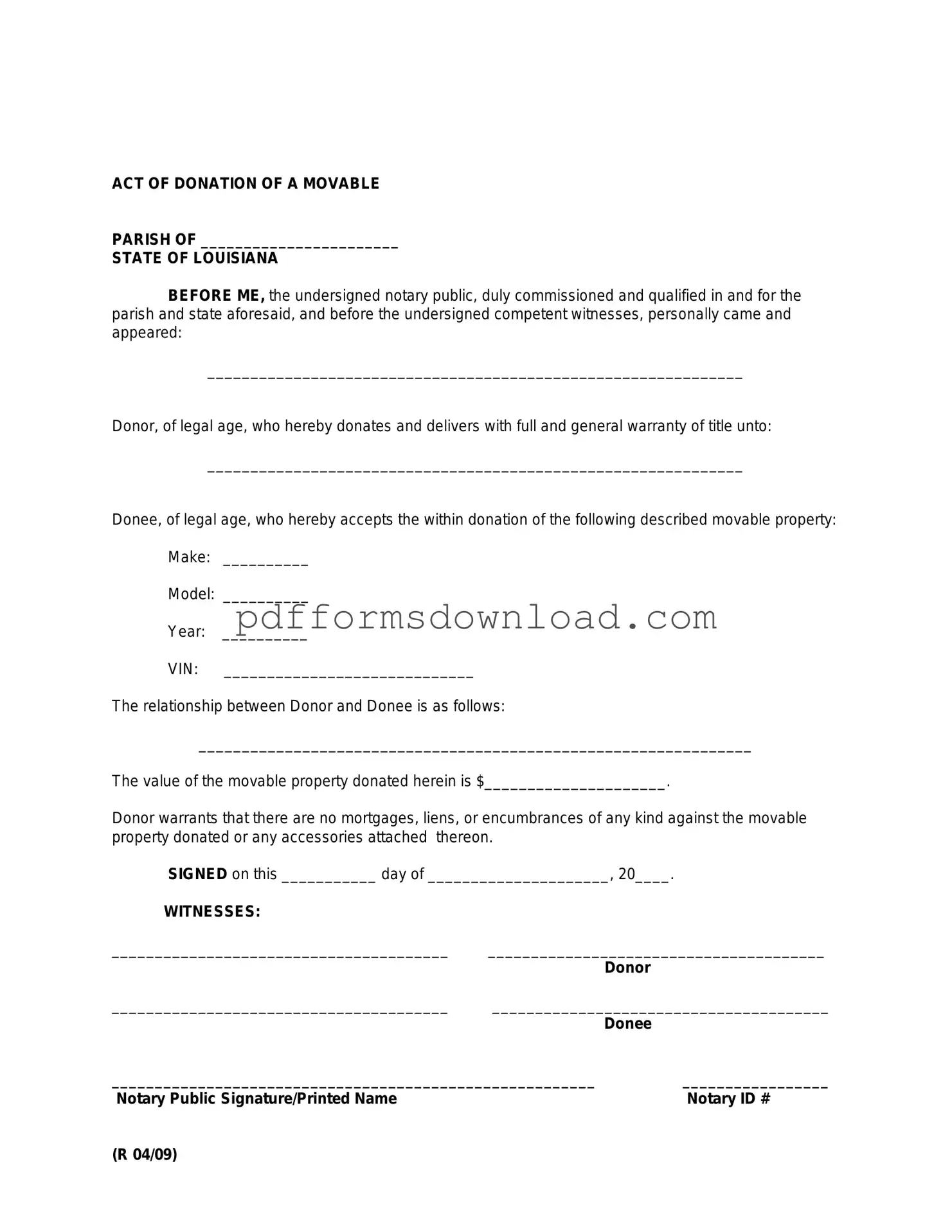

What is the Louisiana Act of Donation Form?

The Louisiana Act of Donation Form is a legal document that allows an individual to transfer ownership of property to another person without receiving payment in return. This form is often used for gifts of real estate or personal property. It serves as a formal record of the donation, ensuring that both the donor and recipient have a clear understanding of the transaction. By completing this form, the donor expresses their intent to give the property, while the recipient accepts the gift, thereby creating a legally binding agreement.

Who can use the Louisiana Act of Donation Form?

Any individual who wishes to donate property in Louisiana can use this form. This includes parents giving property to their children, friends gifting items to one another, or even charitable organizations receiving donations. However, it is essential that the donor has the legal right to transfer the property and that the recipient is capable of accepting it. If the property involves complex issues, such as joint ownership or liens, it may be wise to seek legal advice before proceeding.

What information is required to complete the form?

To complete the Louisiana Act of Donation Form, several key pieces of information must be provided. This includes the full names and addresses of both the donor and the recipient. A detailed description of the property being donated is also necessary, whether it is real estate or personal items. Additionally, the form typically requires the date of the donation and any specific terms or conditions related to the gift. Accuracy is crucial, as any errors could lead to complications in the future.

Is the Louisiana Act of Donation Form legally binding?

Yes, the Louisiana Act of Donation Form is legally binding once it is properly executed. This means that both the donor and recipient must sign the document in the presence of a notary public. The notary's role is to verify the identities of the parties involved and ensure that the signatures are authentic. Once notarized, the form becomes an official record of the donation, protecting the rights of both parties and helping to prevent disputes down the line.

Are there any tax implications associated with using the Act of Donation Form?

Yes, there can be tax implications when using the Louisiana Act of Donation Form. Generally, the donor may be subject to gift tax if the value of the donated property exceeds a certain threshold. However, many individuals fall under the annual exclusion limit, which allows for tax-free gifts up to a specified amount. Recipients should also be aware that they may need to report the gift on their tax returns. Consulting a tax professional can provide clarity on how the donation may affect both parties financially.