Download Membership Ledger Template

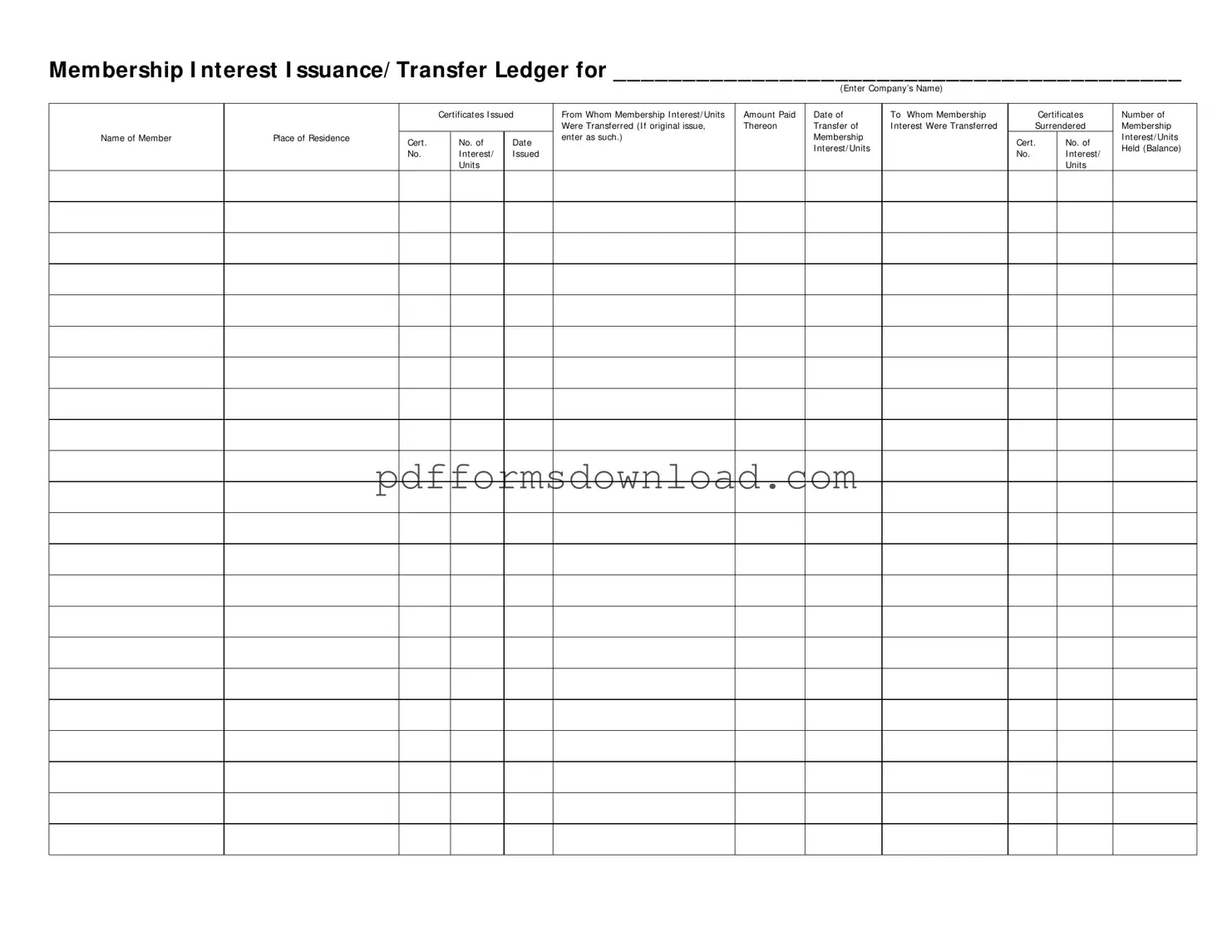

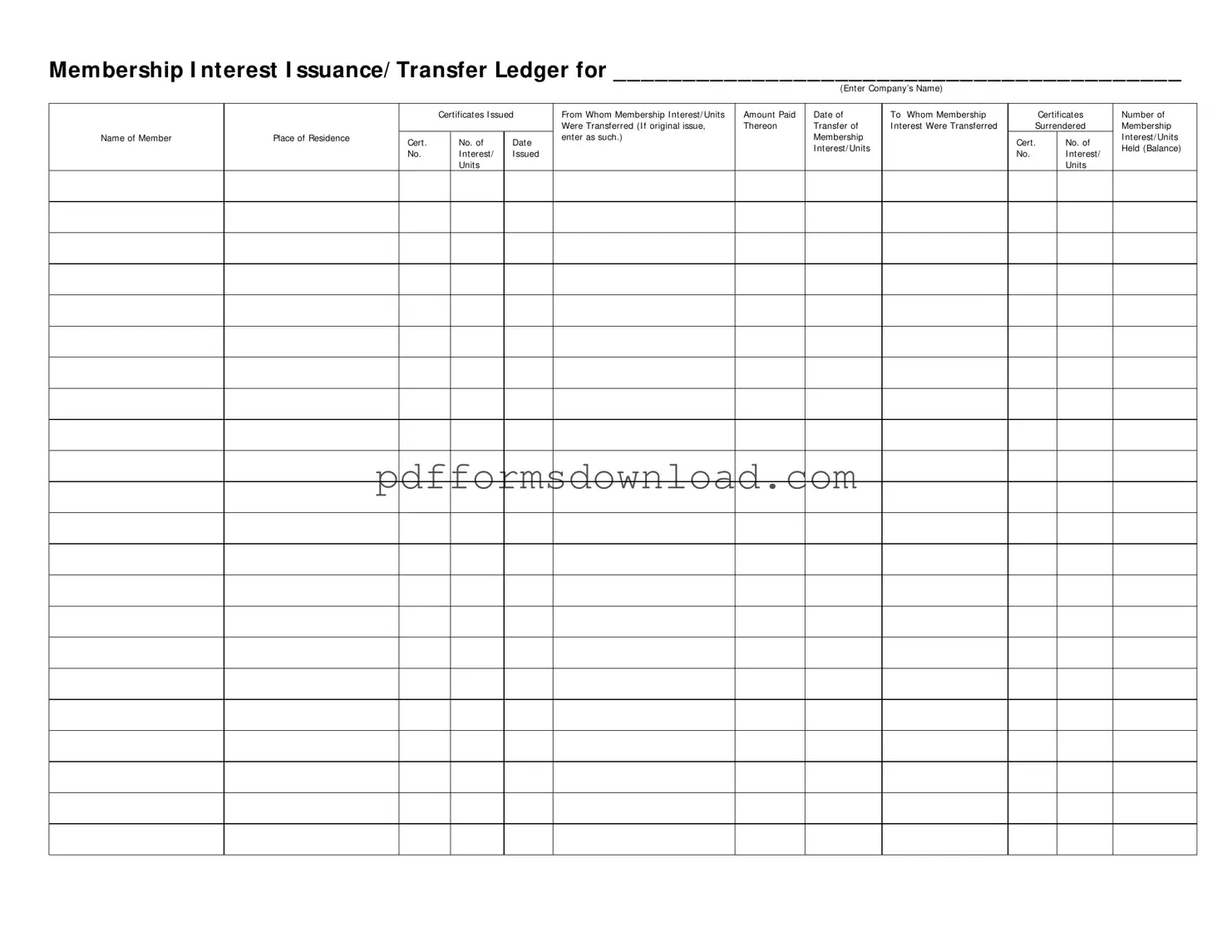

The Membership Ledger form is a crucial document used to track the issuance and transfer of membership interests within a company. It provides a clear record of who holds membership interests, the amounts paid, and any transfers that occur over time. To ensure accurate record-keeping, fill out the form by clicking the button below.

Make This Document Now

Download Membership Ledger Template

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your Membership Ledger online — edit, save, and download easily.