Download Mortgage Statement Template

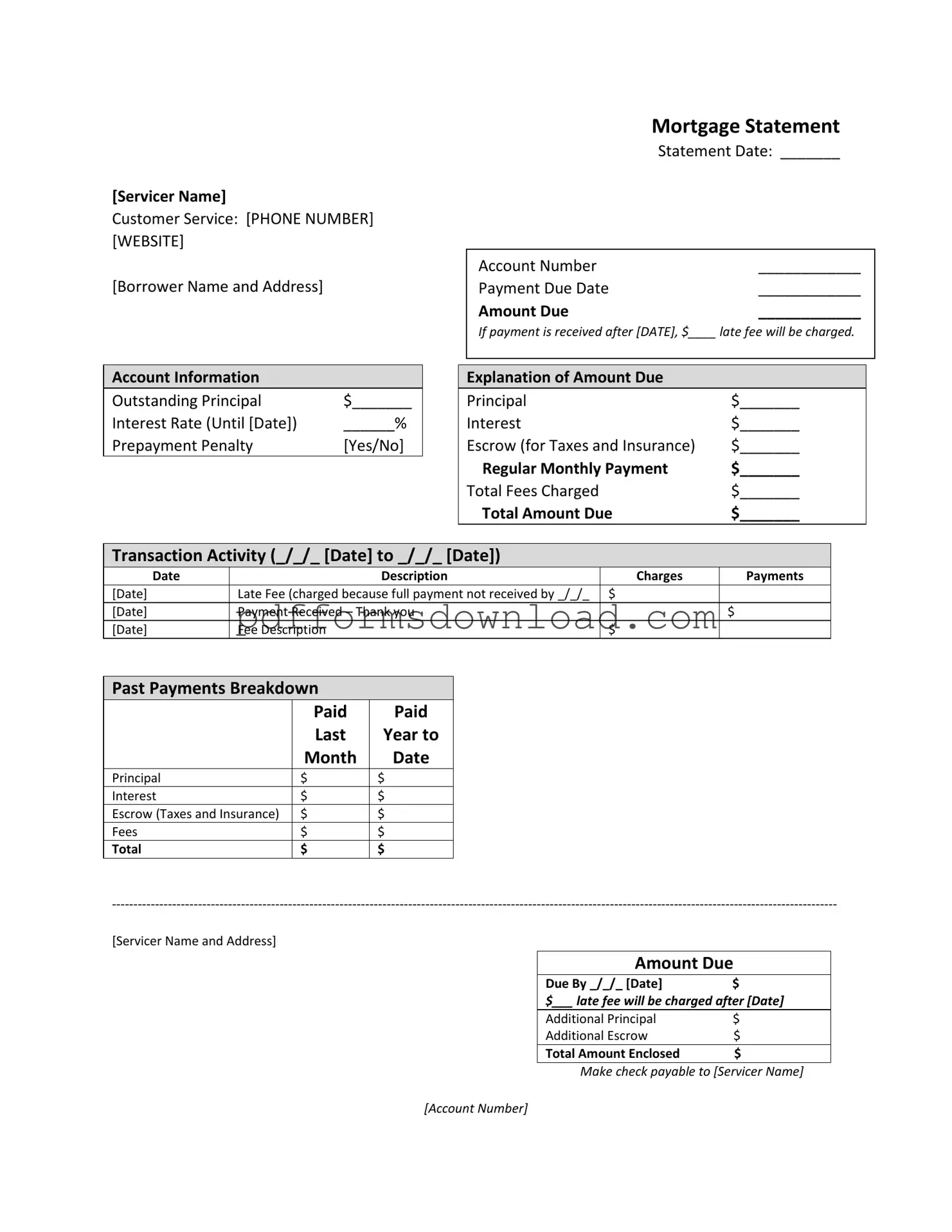

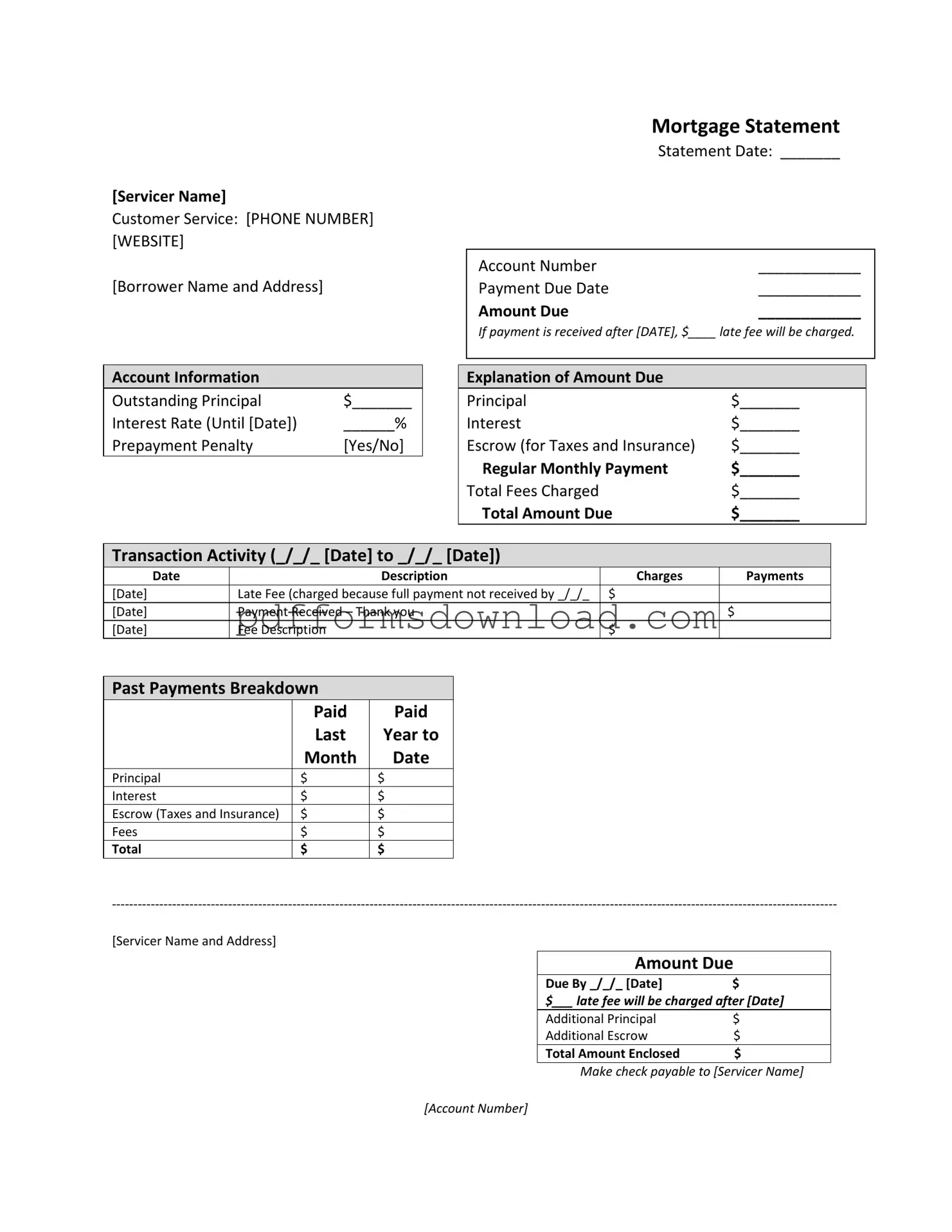

The Mortgage Statement form is a document that provides borrowers with essential information about their mortgage account, including payment details and outstanding balances. It outlines the amount due, payment history, and any applicable fees or penalties. Understanding this form is crucial for managing mortgage obligations effectively.

To fill out the Mortgage Statement form, please click the button below.

Make This Document Now

Download Mortgage Statement Template

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your Mortgage Statement online — edit, save, and download easily.