What is a Motor Vehicle Bill of Sale?

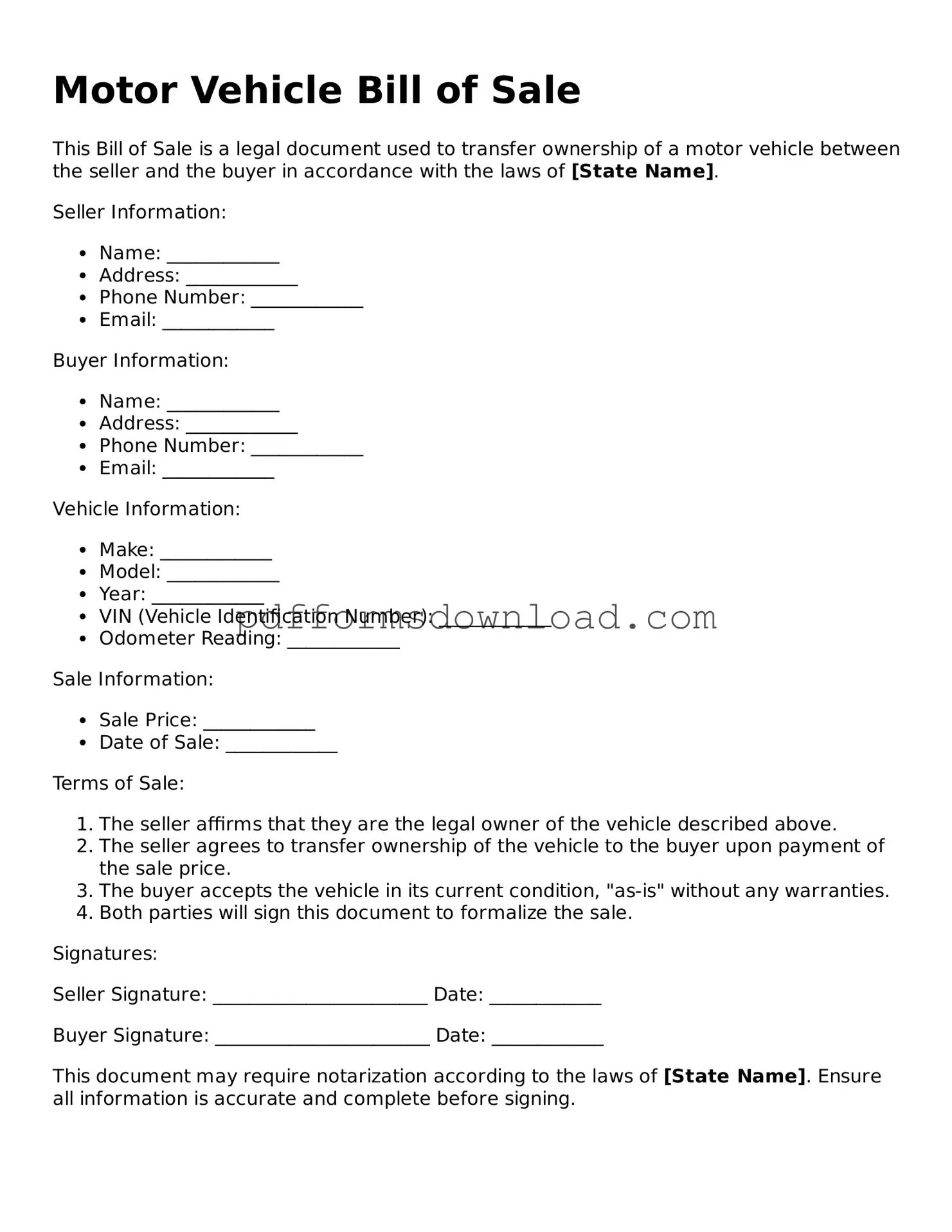

A Motor Vehicle Bill of Sale is a legal document that serves as proof of the sale and transfer of ownership of a motor vehicle from one party to another. This form includes essential details such as the vehicle's make, model, year, VIN (Vehicle Identification Number), and the names and addresses of both the seller and buyer. It is an important document for both parties, as it protects their rights and provides a record of the transaction.

Why do I need a Bill of Sale for a vehicle?

The Bill of Sale is crucial for several reasons. First, it acts as proof that the buyer has purchased the vehicle and that the seller has received payment. This document can be important for registration purposes, ensuring that the buyer can legally register the vehicle in their name. Additionally, it can help resolve any disputes regarding the sale in the future.

What information is typically included in a Motor Vehicle Bill of Sale?

Typically, a Motor Vehicle Bill of Sale includes the following information: the names and addresses of the seller and buyer, the vehicle's make, model, year, and VIN, the sale price, the date of the transaction, and any warranties or conditions of the sale. Some forms may also include space for the seller's signature and the buyer's signature, which can help validate the document.

Do I need to have the Bill of Sale notarized?

Notarization is not always required for a Bill of Sale, but it can add an extra layer of security and authenticity to the document. Some states may require notarization for certain transactions, especially if the vehicle is being registered in a different state. It is advisable to check the specific requirements of your state regarding notarization.

Can I create my own Bill of Sale, or do I need a specific form?

You can create your own Bill of Sale as long as it includes all the necessary information. However, using a pre-made form can simplify the process and ensure that you don't miss any important details. Many websites offer templates that you can fill out, or you can obtain a form from your local Department of Motor Vehicles (DMV).

Is a Bill of Sale the same as a title transfer?

No, a Bill of Sale is not the same as a title transfer. The Bill of Sale documents the sale of the vehicle, while the title is the official document that proves ownership. After completing the sale, the seller typically signs over the title to the buyer, who then must take it to the DMV to officially transfer the ownership and register the vehicle in their name.

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the seller and buyer should keep a copy for their records. The buyer should then take the Bill of Sale and the signed title to the DMV to complete the registration process. It is also a good idea for the seller to notify their local DMV of the sale to avoid any future liabilities related to the vehicle.