Download Netspend Dispute Template

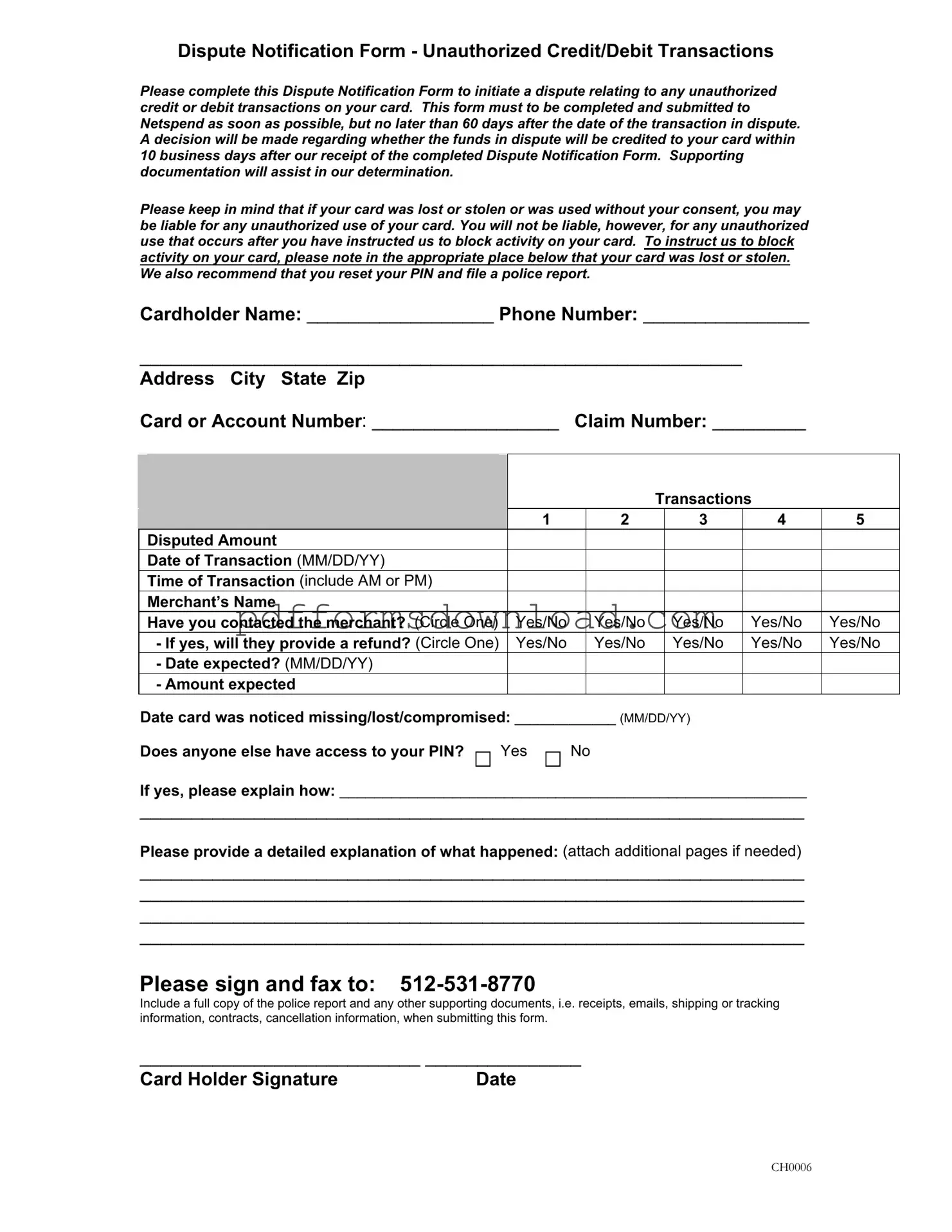

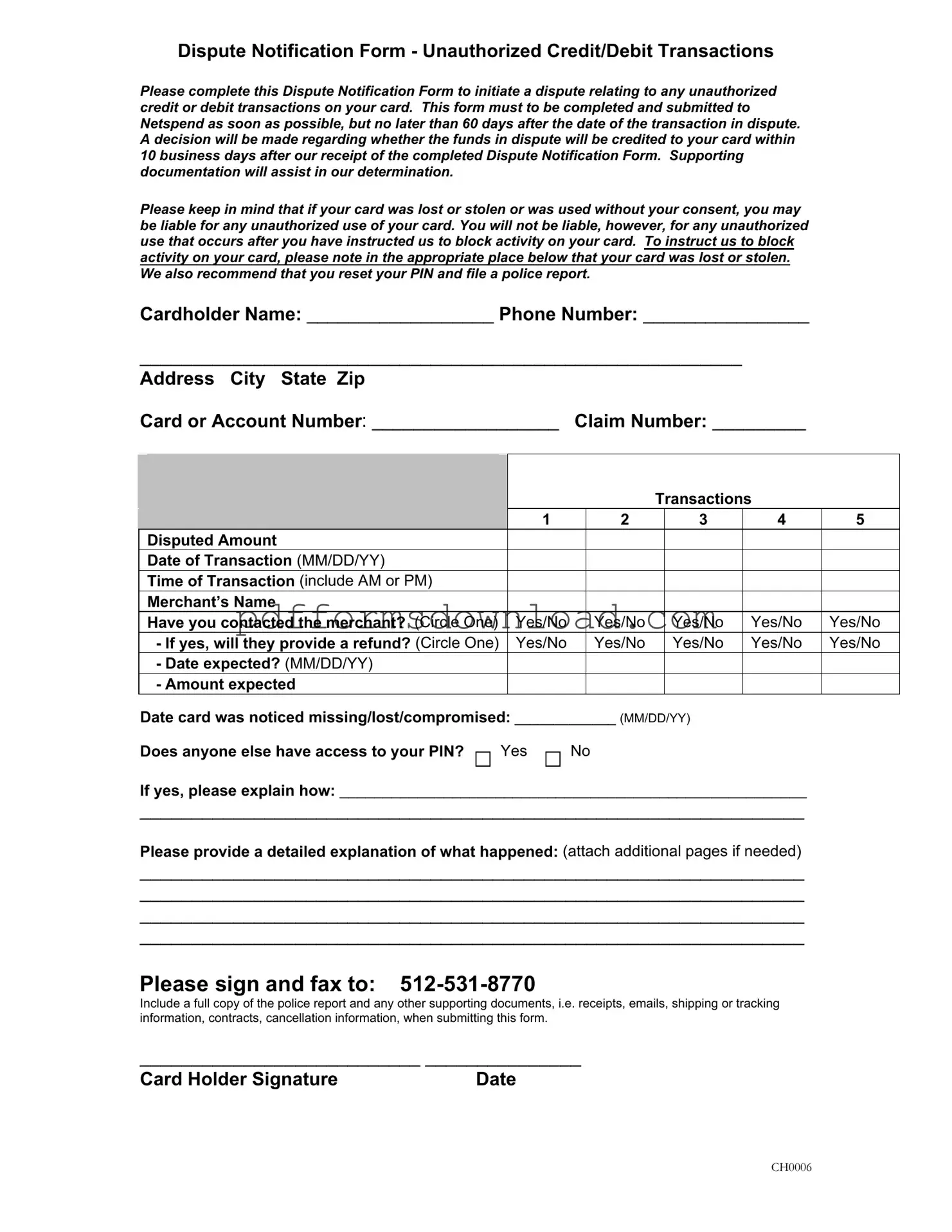

The Netspend Dispute Form is a crucial document designed to help cardholders report unauthorized credit or debit transactions. Completing this form promptly is essential, as it initiates the dispute process and allows Netspend to investigate the transactions in question. To ensure a smooth resolution, gather any supporting documentation and submit the form within 60 days of the disputed transaction.

Take action now by filling out the form below.

Make This Document Now

Download Netspend Dispute Template

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your Netspend Dispute online — edit, save, and download easily.