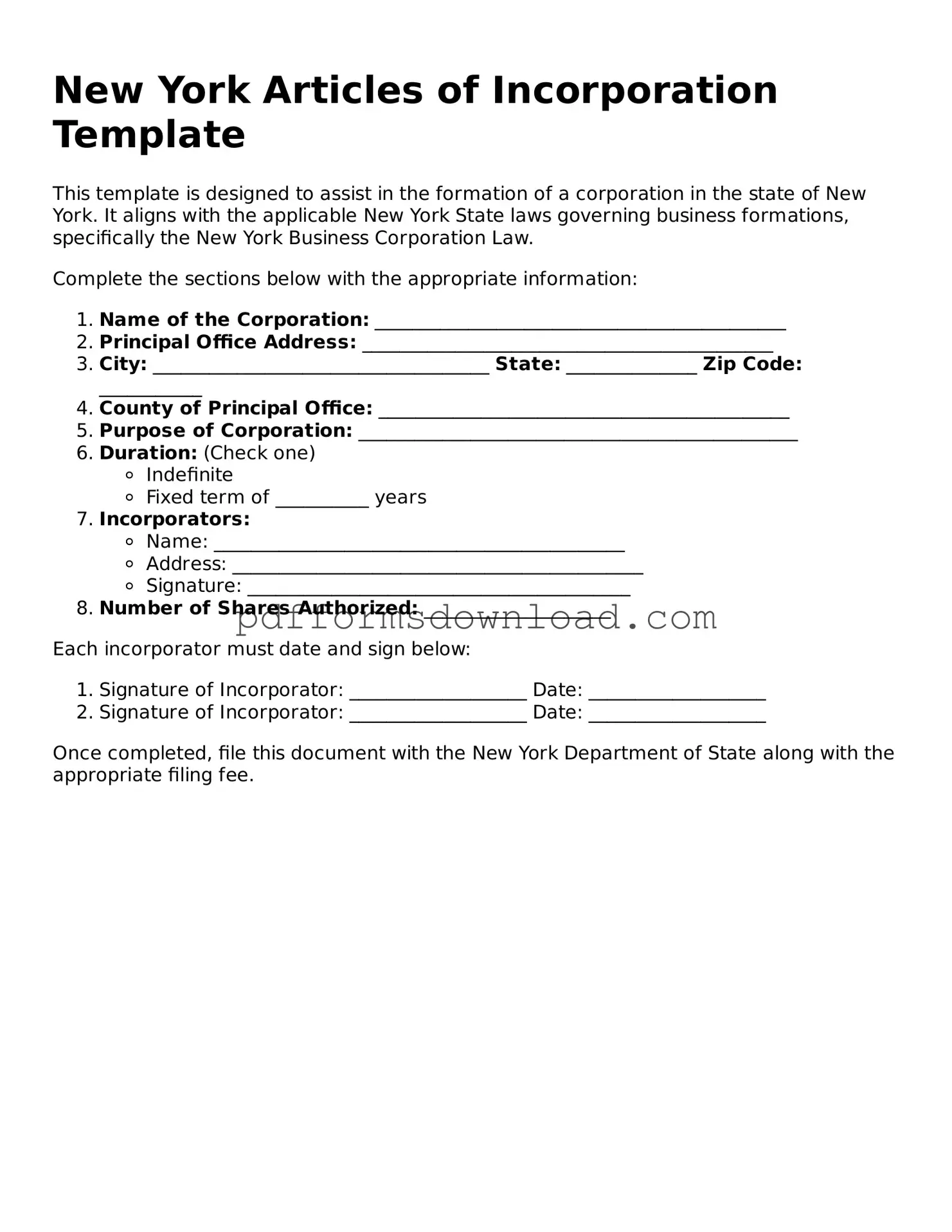

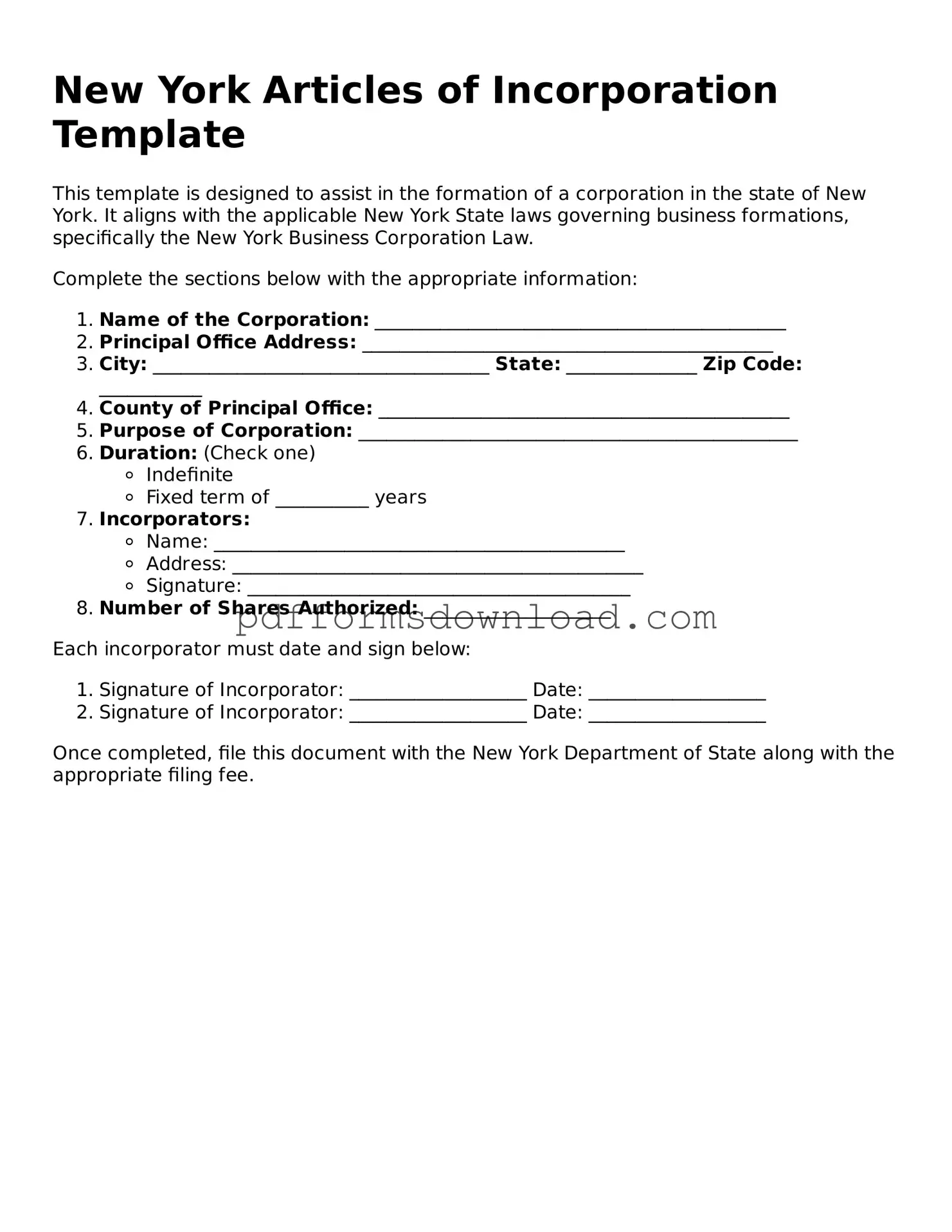

What is the New York Articles of Incorporation form?

The New York Articles of Incorporation form is a legal document that establishes a corporation in the state of New York. It outlines essential details about the corporation, including its name, purpose, and structure. Completing this form is a crucial first step in creating a corporation and ensuring compliance with state laws.

Who needs to file the Articles of Incorporation?

Any individual or group looking to form a corporation in New York must file the Articles of Incorporation. This includes businesses of all types, whether they are for-profit or non-profit. If you want to enjoy the benefits of limited liability and formal recognition as a corporation, this form is necessary.

What information is required on the form?

The form requires several key pieces of information. You will need to provide the corporation's name, the purpose of the business, the county where the corporation will be located, and the details of the registered agent. Additionally, information about the initial directors and the number of shares the corporation is authorized to issue is also required.

How do I submit the Articles of Incorporation?

You can submit the Articles of Incorporation either online or by mail. If you choose to file online, visit the New York Department of State's website. For mail submissions, print the completed form and send it to the appropriate office address listed on the form. Make sure to include the required filing fee with your submission.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation in New York varies based on the type of corporation you are forming. Generally, the fee is around $125 for a for-profit corporation. Non-profit corporations may have a different fee structure. Always check the latest fee schedule on the New York Department of State's website to ensure you have the correct amount.

How long does it take to process the Articles of Incorporation?

Processing times can vary. Typically, if you file online, you can expect a quicker turnaround, often within a few business days. Mail submissions may take longer, sometimes up to several weeks. If you need to expedite the process, consider using expedited services for an additional fee.

What happens after my Articles of Incorporation are approved?

Once your Articles of Incorporation are approved, your corporation is officially recognized by the state. You will receive a Certificate of Incorporation, which serves as proof of your corporation's existence. From this point, you can begin operating your business, but remember to comply with ongoing requirements, such as filing annual reports and maintaining proper records.