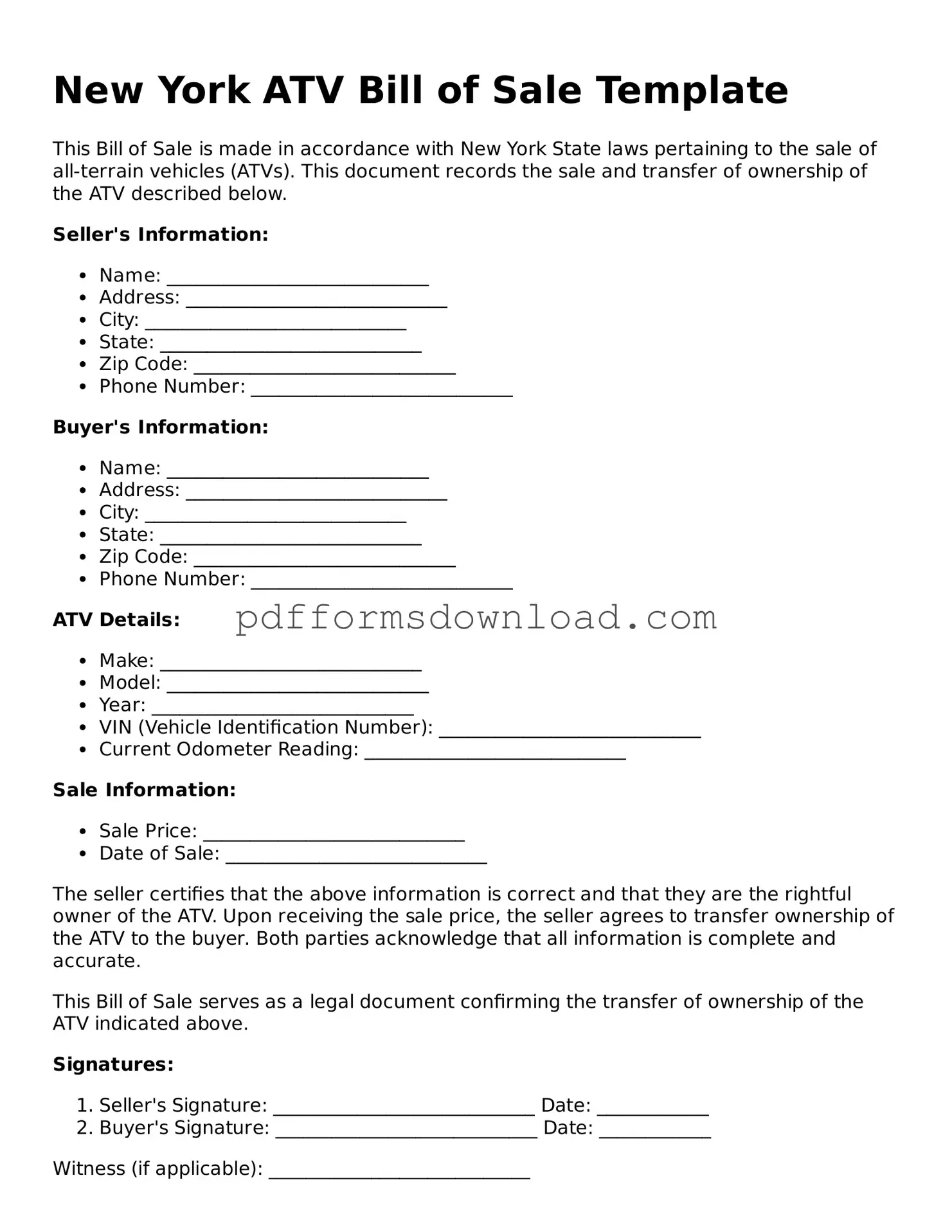

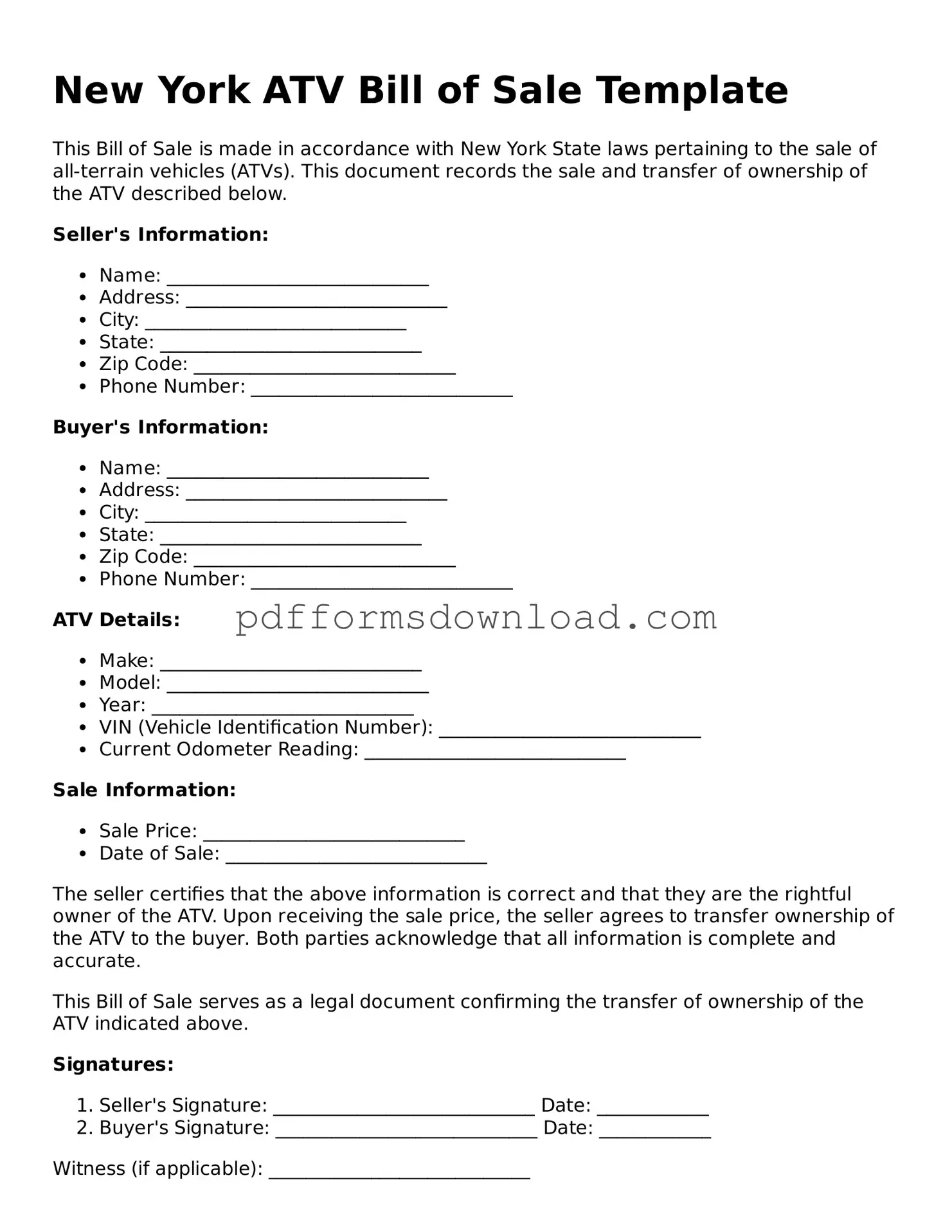

An ATV Bill of Sale is a legal document that records the transfer of ownership of an all-terrain vehicle (ATV) from one party to another in New York. This form serves as proof of the transaction and includes essential details such as the buyer's and seller's information, the vehicle's identification number (VIN), and the sale price. Having this document is important for both parties to ensure a smooth transfer of ownership and for future reference, especially when registering the vehicle with the Department of Motor Vehicles (DMV).

What information should be included in the ATV Bill of Sale?

The ATV Bill of Sale should include several key pieces of information. This includes the names and addresses of both the buyer and seller, the date of the sale, a detailed description of the ATV (including make, model, year, and VIN), the sale price, and any terms of the sale. Both parties should sign the document to validate the transaction. Including this information helps to ensure clarity and protects the interests of both parties involved.

Can I create my own ATV Bill of Sale?

Yes, you can create your own ATV Bill of Sale. However, it is crucial to ensure that it includes all necessary information and complies with New York state laws. Many templates are available online that can guide you in drafting a comprehensive Bill of Sale. If you feel uncertain about the legal aspects, consulting with a legal professional may be beneficial.

What should I do after completing the ATV Bill of Sale?

Once the ATV Bill of Sale is completed and signed by both parties, the seller should provide a copy to the buyer. The buyer will need this document for registering the ATV with the DMV. It is also wise for the seller to keep a copy for their records. If the ATV has a title, the seller should also transfer the title to the buyer at the same time.

How does the Bill of Sale affect registration and taxes?

The Bill of Sale is an important document when registering the ATV with the DMV. It serves as proof of ownership and is often required to complete the registration process. Additionally, the sale price listed on the Bill of Sale may be used to calculate sales tax, which the buyer must pay when registering the vehicle. Ensuring accuracy in the Bill of Sale can help avoid issues with registration and tax obligations.