What is a New York Deed form?

A New York Deed form is a legal document used to transfer ownership of real property from one party to another within the state of New York. This form is essential for ensuring that the transfer is recognized by the state and is typically recorded with the county clerk’s office where the property is located. Various types of deeds exist, including warranty deeds and quitclaim deeds, each serving different purposes in the transfer process.

What types of deeds are commonly used in New York?

In New York, the most commonly used deeds are the warranty deed and the quitclaim deed. A warranty deed provides a guarantee that the seller holds clear title to the property and has the right to sell it. This type of deed protects the buyer from any future claims against the property. In contrast, a quitclaim deed transfers whatever interest the seller has in the property, if any, without any guarantees. This is often used among family members or in situations where the seller cannot provide a clear title.

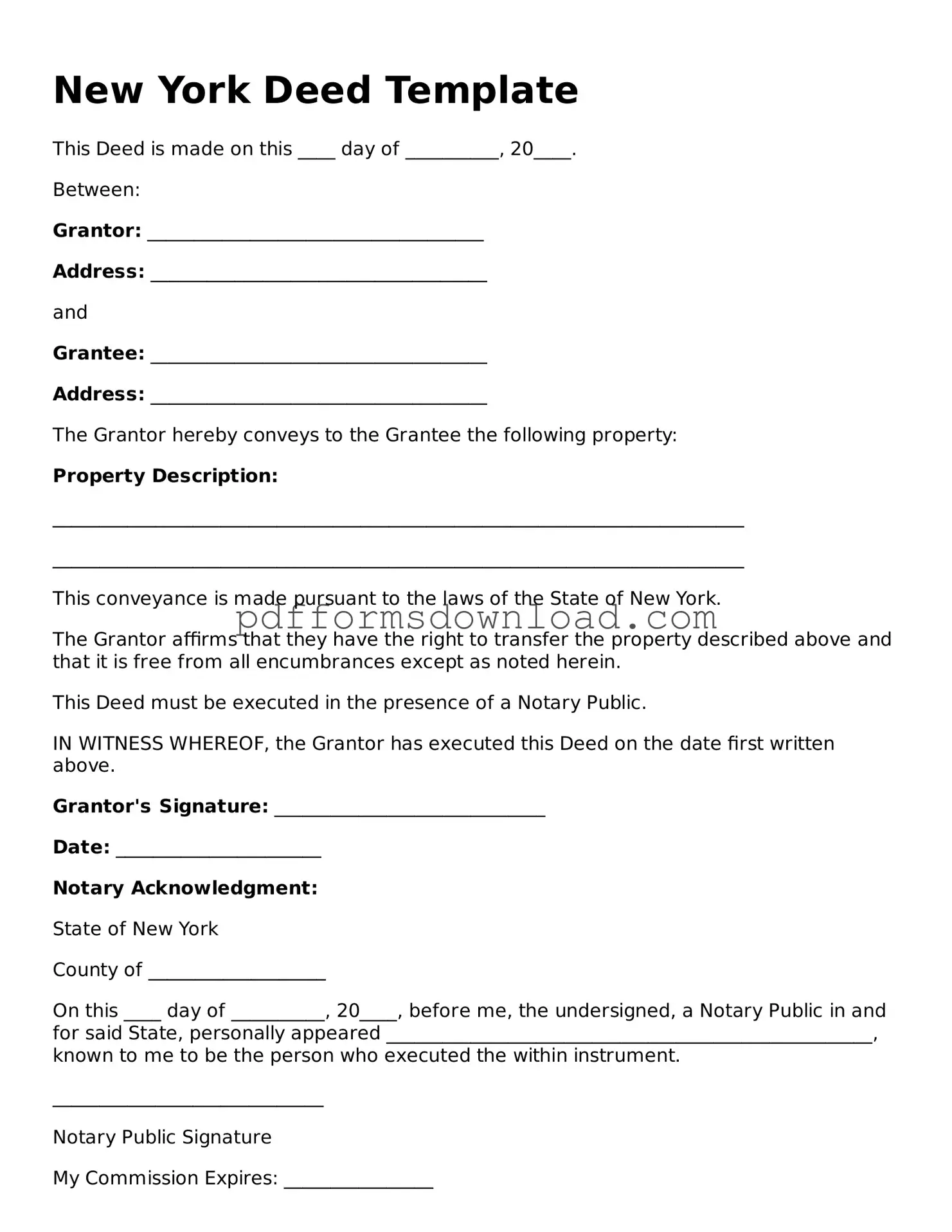

How do I complete a New York Deed form?

Completing a New York Deed form requires careful attention to detail. First, you must identify the parties involved, including the grantor (seller) and grantee (buyer). Next, provide a legal description of the property, which can typically be found in previous deeds or tax documents. Be sure to include the sale price and any relevant terms of the agreement. After filling out the form, both parties must sign it in the presence of a notary public to ensure its validity.

Is it necessary to have the deed notarized?

Yes, notarization is a crucial step in the process of executing a New York Deed form. The signatures of both the grantor and grantee must be witnessed by a notary public to verify their identities and ensure that they are signing voluntarily. This step adds an extra layer of protection and authenticity to the document, which is important for recording purposes.

How do I record a New York Deed?

To record a New York Deed, you must submit the completed and notarized deed to the county clerk’s office where the property is located. There may be a small fee for recording, and it’s advisable to check with the local office for specific requirements. Once recorded, the deed becomes part of the public record, providing legal notice of the change in ownership.

Are there any taxes associated with transferring property in New York?

Yes, transferring property in New York typically involves certain taxes. The most notable is the Real Estate Transfer Tax, which is imposed on the seller. The rate varies depending on the sale price of the property. Additionally, local municipalities may impose their own transfer taxes. It is essential to consult with a tax professional or real estate attorney to understand the full scope of any taxes that may apply to your specific situation.

What happens if I do not record the deed?

If a New York Deed is not recorded, the transfer of ownership may not be legally recognized. This can lead to complications, especially if disputes arise regarding the property in the future. Without recording, the seller may still be considered the legal owner, and the buyer may face challenges in asserting their rights. Recording the deed is a critical step in protecting the interests of the new owner and ensuring clarity in property ownership.