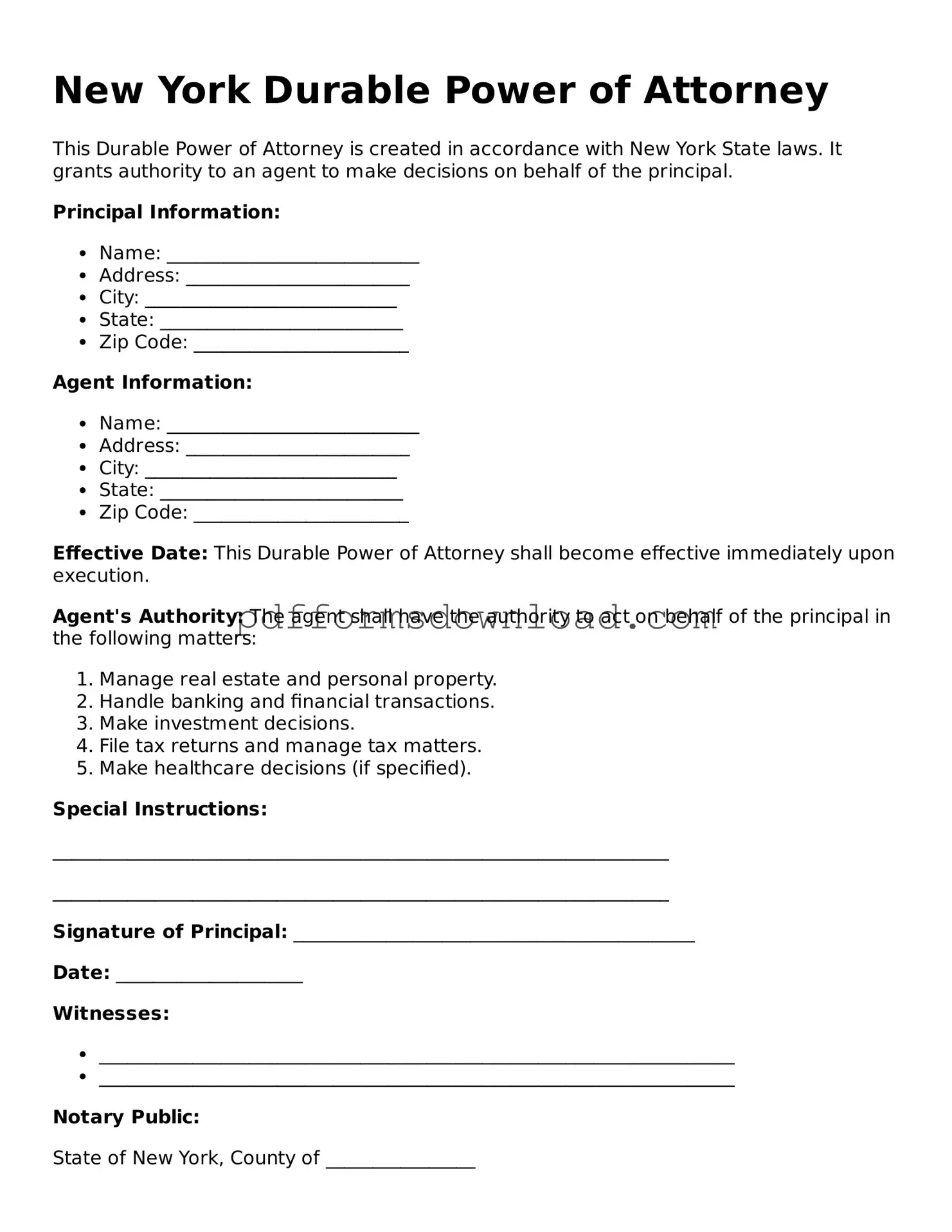

What is a Durable Power of Attorney in New York?

A Durable Power of Attorney is a legal document that allows an individual, known as the principal, to appoint someone else, called the agent or attorney-in-fact, to make decisions on their behalf. This document remains effective even if the principal becomes incapacitated. It is an important tool for managing financial and legal matters when the principal is unable to do so themselves.

Why should I consider creating a Durable Power of Attorney?

Creating a Durable Power of Attorney can provide peace of mind. It ensures that someone you trust can handle your financial affairs if you are unable to do so. This can include paying bills, managing investments, and making healthcare decisions. By having this document in place, you can avoid potential complications and delays in managing your affairs during a difficult time.

Who can be appointed as an agent in a Durable Power of Attorney?

You can choose anyone you trust to be your agent, such as a family member, friend, or professional advisor. It is crucial to select someone who understands your values and wishes. The agent should be responsible and capable of making decisions in your best interest. Keep in mind that the agent must be at least 18 years old and mentally competent.

Do I need a lawyer to create a Durable Power of Attorney?

While it is not legally required to have a lawyer to create a Durable Power of Attorney, it is often advisable. A lawyer can help ensure that the document meets all legal requirements and accurately reflects your wishes. They can also provide guidance on selecting an agent and understanding the implications of the powers granted.

Can I revoke a Durable Power of Attorney?

Yes, you can revoke a Durable Power of Attorney at any time, as long as you are mentally competent. To revoke it, you must create a written document stating your intention to do so and notify your agent and any institutions or individuals that were relying on the original document. It is a good practice to destroy any copies of the original Durable Power of Attorney to avoid confusion.

What happens if I do not have a Durable Power of Attorney?

If you do not have a Durable Power of Attorney and become incapacitated, a court may need to appoint a guardian to manage your affairs. This process can be lengthy, costly, and may not align with your wishes. Having a Durable Power of Attorney in place allows you to designate someone you trust to make decisions on your behalf without the need for court intervention.