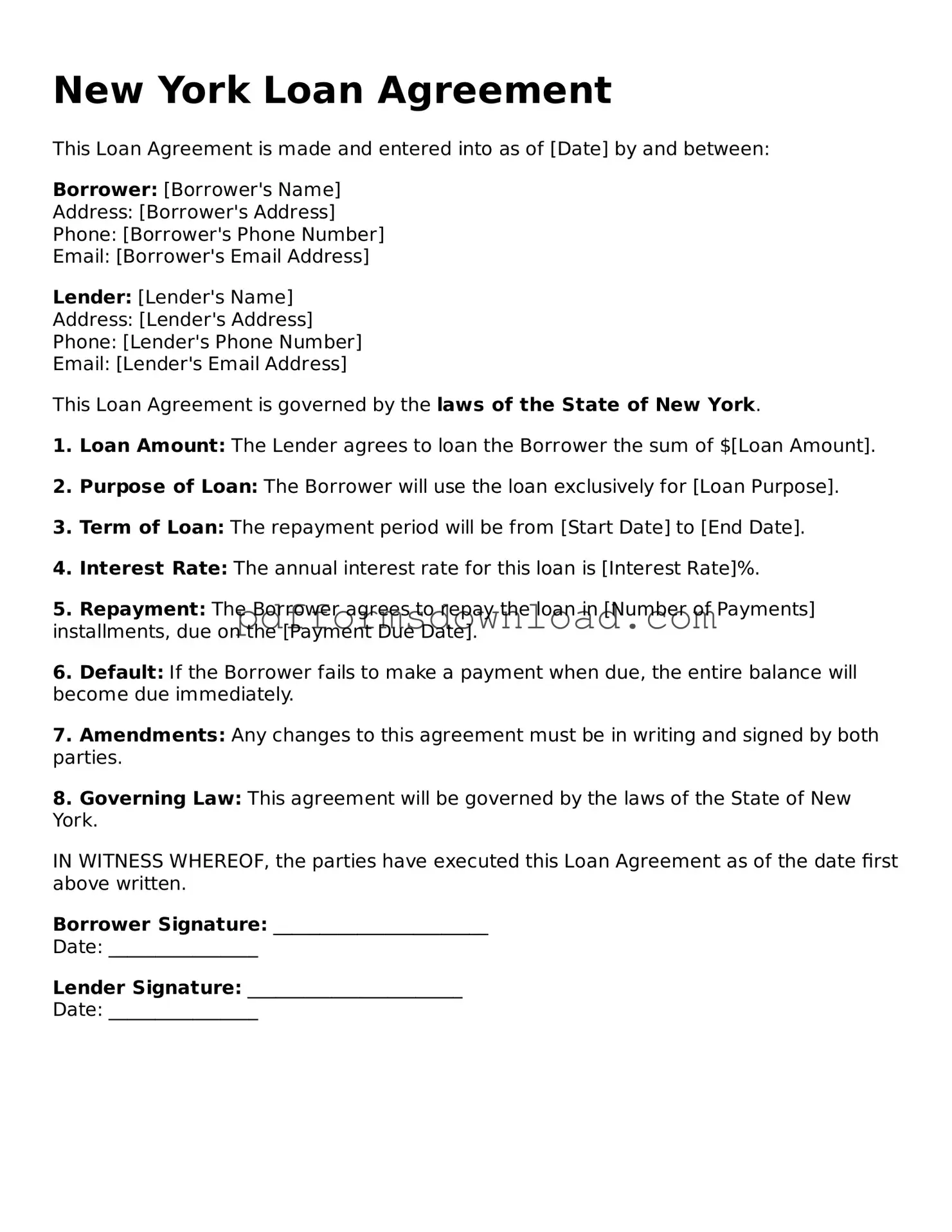

What is a New York Loan Agreement?

A New York Loan Agreement is a legal document outlining the terms and conditions under which a lender provides money to a borrower. This agreement specifies the amount borrowed, interest rates, repayment schedules, and any collateral involved. It serves to protect both parties by clearly defining their rights and responsibilities.

Who typically uses a Loan Agreement in New York?

Loan Agreements are commonly used by individuals, businesses, and financial institutions. For example, a person might use one when borrowing money from a friend or family member. Businesses often utilize these agreements for larger sums, especially when dealing with banks or private lenders. Having a formal agreement helps ensure that all parties are on the same page.

What are the key components of a New York Loan Agreement?

Several key components make up a Loan Agreement. These include the loan amount, interest rate, repayment schedule, and any fees associated with the loan. Additionally, the agreement may outline what happens if the borrower defaults on the loan, including any rights the lender has to collect the debt. It’s important for both parties to review these terms carefully.

Do I need a lawyer to draft a Loan Agreement?

While it’s not legally required to have a lawyer draft a Loan Agreement, it is often advisable. A lawyer can help ensure that the agreement complies with New York laws and adequately protects your interests. If the loan amount is significant or if there are complex terms, seeking legal assistance can be particularly beneficial.

What happens if the borrower cannot repay the loan?

If a borrower cannot repay the loan, the consequences will depend on the terms outlined in the Loan Agreement. Generally, the lender may have the right to charge late fees, report the default to credit agencies, or pursue legal action to recover the owed amount. It’s crucial for both parties to understand these implications before signing the agreement.

Can a Loan Agreement be modified after it is signed?

Yes, a Loan Agreement can be modified after it is signed, but both parties must agree to the changes. It’s best to document any modifications in writing to avoid misunderstandings in the future. This ensures that all parties have a clear record of the updated terms.

Is a Loan Agreement enforceable in New York?

Yes, a properly drafted and signed Loan Agreement is enforceable in New York. However, certain conditions must be met, such as the agreement being clear and not violating any laws. If disputes arise, having a well-structured agreement can significantly aid in resolving issues effectively.