What is a Power of Attorney in New York?

A Power of Attorney (POA) in New York is a legal document that allows an individual, known as the principal, to designate another person, called the agent or attorney-in-fact, to make decisions on their behalf. This can include financial matters, legal decisions, and health care choices, depending on how the document is structured.

Why might I need a Power of Attorney?

A Power of Attorney is crucial for anyone who wants to ensure their affairs are managed according to their wishes in case they become incapacitated or unable to make decisions. It is particularly important for those with chronic illnesses, aging individuals, or anyone planning for future uncertainties.

What types of Power of Attorney are available in New York?

New York offers several types of Power of Attorney forms, including a general Power of Attorney, which grants broad powers, and a limited Power of Attorney, which restricts the agent's authority to specific tasks. There is also a durable Power of Attorney, which remains effective even if the principal becomes incapacitated.

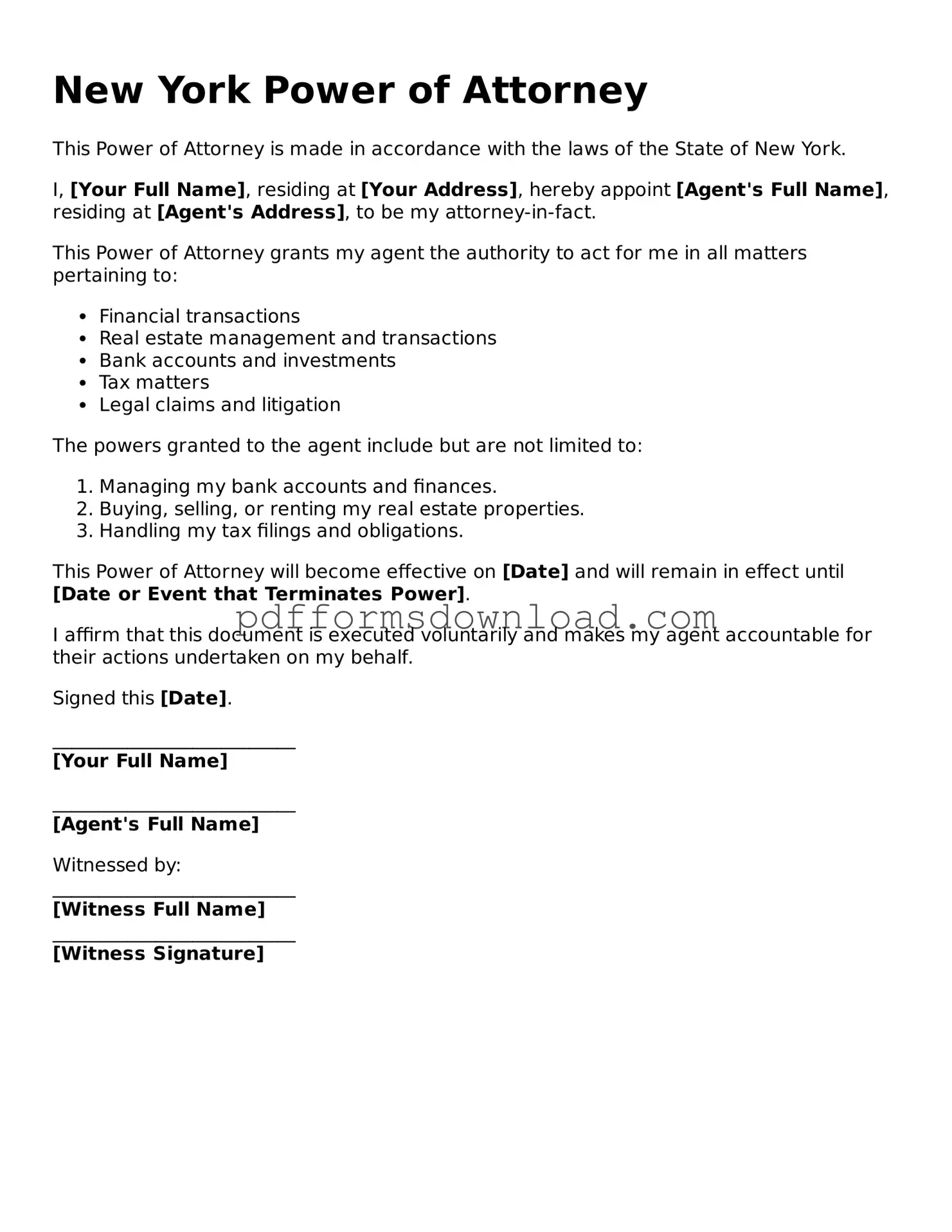

How do I create a Power of Attorney in New York?

To create a Power of Attorney in New York, you must complete a specific form that complies with state laws. The form must be signed by the principal in the presence of a notary public and, in some cases, two witnesses. It's important to ensure that the document is filled out correctly to avoid any legal complications.

Can I revoke a Power of Attorney in New York?

Yes, you can revoke a Power of Attorney at any time, as long as you are mentally competent. To revoke it, you should create a written revocation document and notify the agent and any relevant institutions or individuals who may rely on the original Power of Attorney.

What happens if I don’t have a Power of Attorney?

If you do not have a Power of Attorney and become incapacitated, your loved ones may need to go through a lengthy court process to obtain guardianship. This can be costly, time-consuming, and may not align with your wishes, making it essential to have a POA in place.

Can an agent under a Power of Attorney make health care decisions?

Yes, if the Power of Attorney includes health care decision-making authority. However, New York also allows for a separate Health Care Proxy, which specifically designates someone to make medical decisions for you if you are unable to do so.

Are there any restrictions on who can be an agent?

In New York, anyone over the age of 18 can serve as an agent, provided they are not the principal's health care provider or an employee of the health care provider, unless they are related to the principal. It's crucial to choose someone trustworthy and reliable.

Is a Power of Attorney valid if I move to another state?

A Power of Attorney executed in New York is generally valid in other states, but laws can vary. It is advisable to check the specific requirements of the state you are moving to, as some may have different rules regarding the acceptance of out-of-state POA forms.

Can I use a Power of Attorney for business purposes?

Yes, a Power of Attorney can be used for business purposes, allowing an agent to handle business transactions, sign contracts, or manage financial affairs on behalf of the principal. It's important to specify these powers clearly in the document to avoid confusion.