What is a New York Promissory Note?

A New York Promissory Note is a written agreement where one party promises to pay a specific amount of money to another party. It outlines the terms of the loan, including the repayment schedule, interest rate, and any penalties for late payments. This document serves as a legal record of the debt and the obligations of both parties involved.

Who needs a Promissory Note?

Anyone who is lending or borrowing money can benefit from a Promissory Note. This includes individuals, businesses, and organizations. It is especially important when the loan amount is significant or when the repayment terms are complex. Having a written note helps protect both parties by clearly stating the expectations and responsibilities.

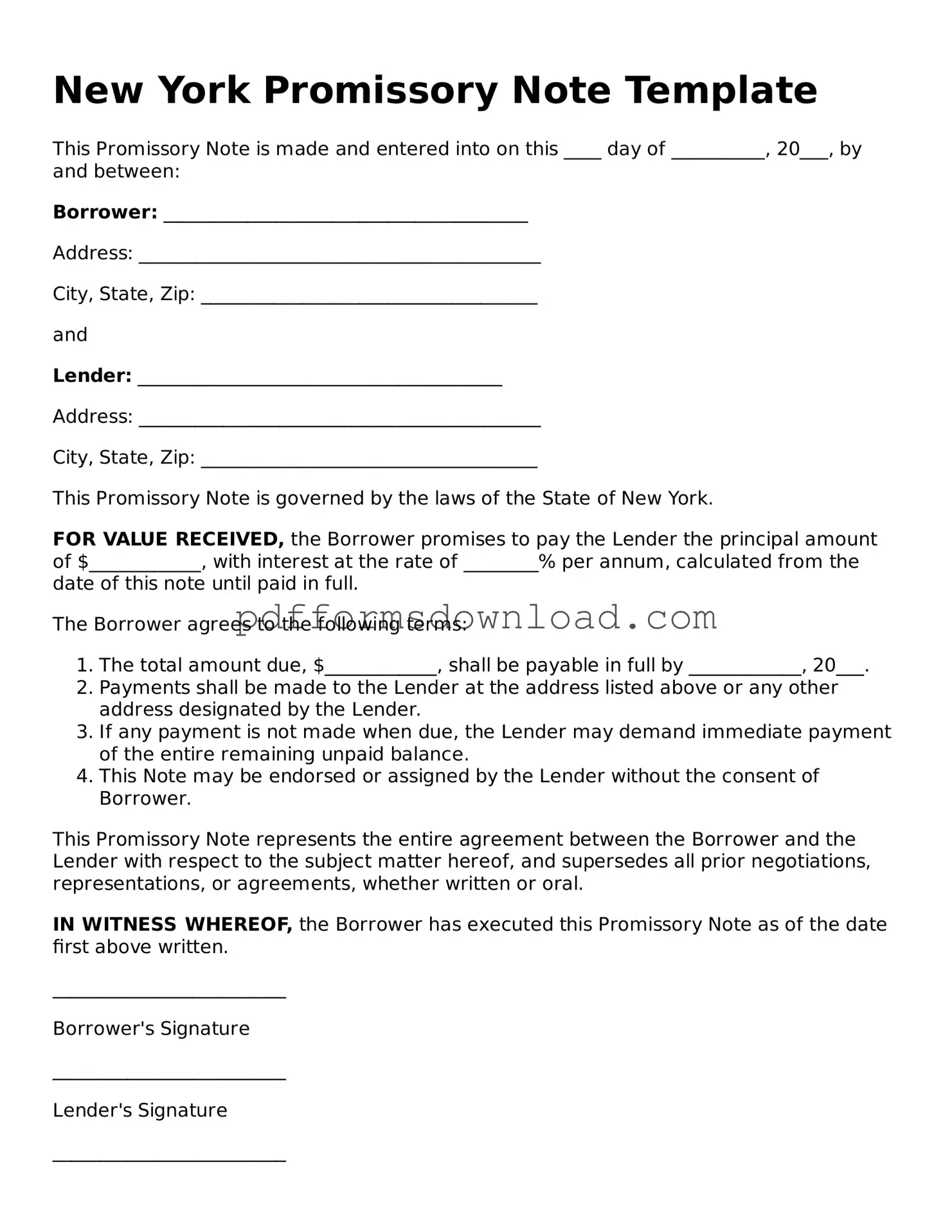

What should be included in a New York Promissory Note?

A New York Promissory Note should include the following key elements: the names and addresses of both the borrower and the lender, the principal amount of the loan, the interest rate, the repayment schedule, any late fees or penalties, and the date when the note is signed. It may also include provisions for default and what happens in that case.

Is a Promissory Note legally binding?

Yes, a Promissory Note is legally binding in New York as long as it meets certain requirements. Both parties must agree to the terms, and the document must be signed. If either party fails to fulfill their obligations, the other party can take legal action to enforce the terms of the note.

Can a Promissory Note be modified?

Yes, a Promissory Note can be modified if both parties agree to the changes. It is advisable to document any modifications in writing and have both parties sign the updated agreement. This ensures that everyone is on the same page regarding the new terms.

How do I enforce a Promissory Note?

If the borrower does not repay the loan as agreed, the lender can take steps to enforce the Promissory Note. This may involve sending a demand letter for payment or pursuing legal action in court. It is recommended to consult with a legal professional for guidance on the best course of action.

Do I need a lawyer to create a Promissory Note?

While it is not legally required to have a lawyer draft a Promissory Note, it can be helpful, especially for complex agreements. Many templates are available online, but having a legal professional review the document can ensure that it meets all legal requirements and adequately protects your interests.