What is a Quitclaim Deed?

A Quitclaim Deed is a legal document that allows a property owner to transfer their interest in a property to another person. Unlike other types of deeds, a Quitclaim Deed does not guarantee that the property title is clear or that the seller has any ownership rights. It simply conveys whatever interest the seller has in the property, if any.

When should I use a Quitclaim Deed?

This type of deed is commonly used in situations where the property is being transferred between family members, such as in divorce settlements or when adding or removing a spouse from the title. It is also used in cases where the grantor does not want to deal with the complexities of a warranty deed, which provides more assurances about the title.

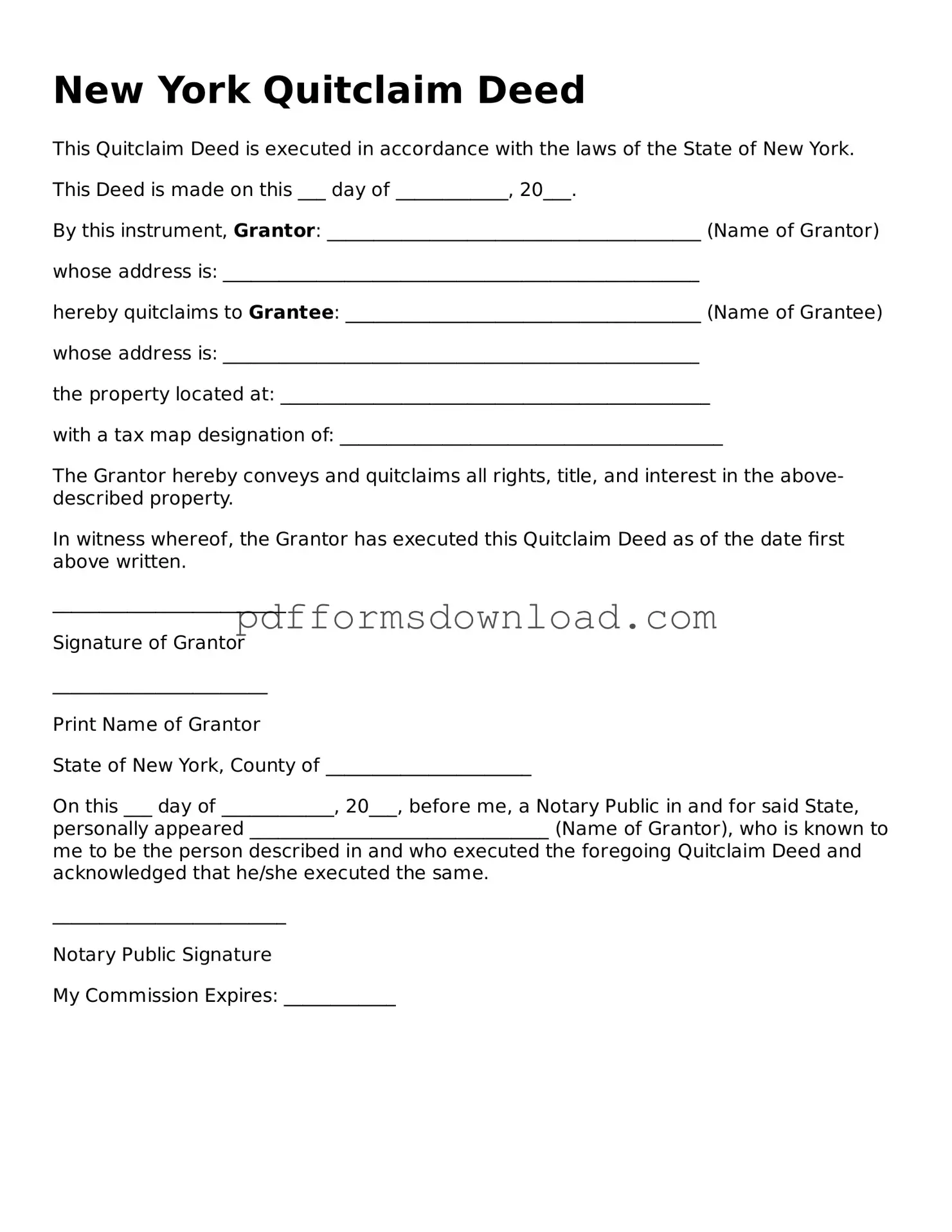

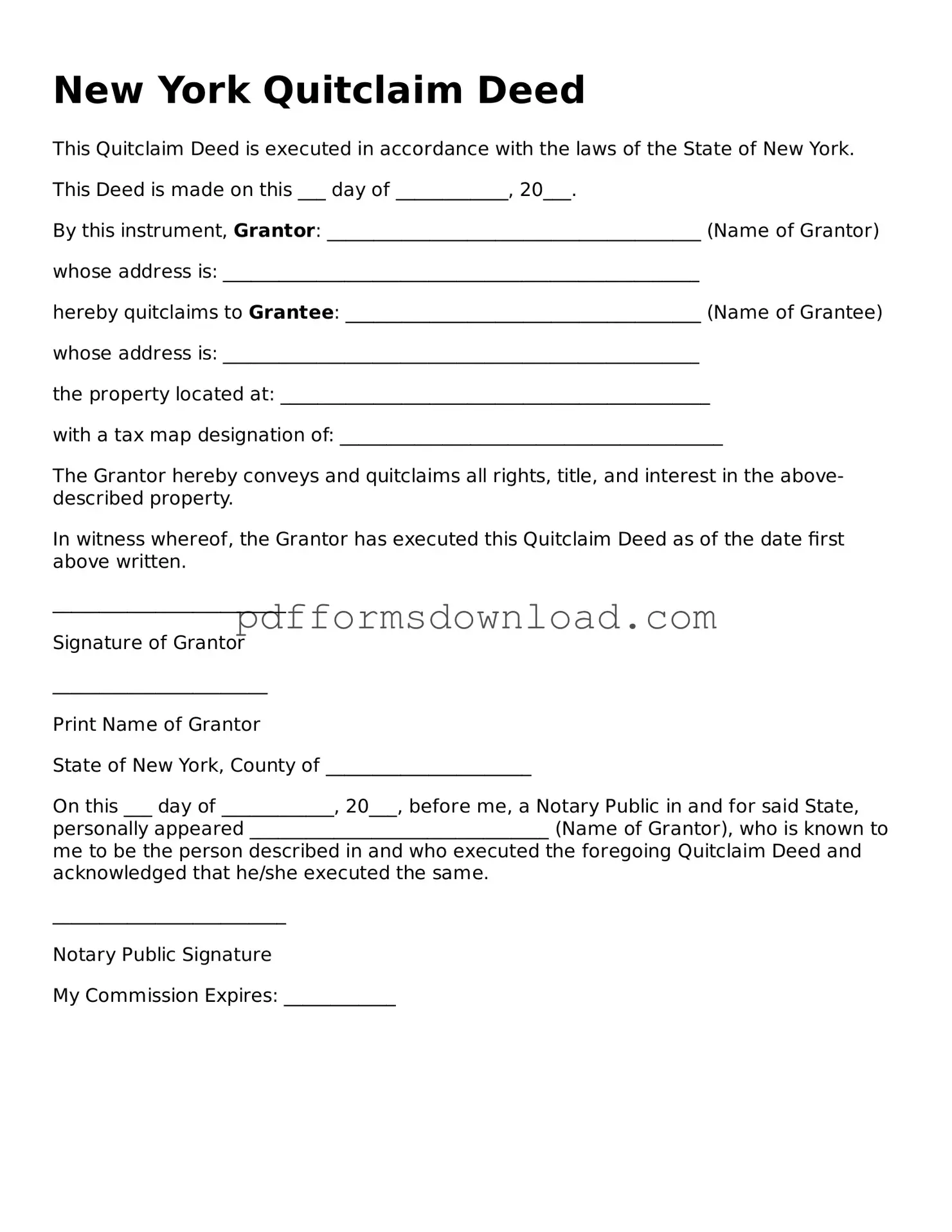

How do I fill out a Quitclaim Deed?

To fill out a Quitclaim Deed, you will need to include the names of the grantor (the person transferring the property) and the grantee (the person receiving the property), a description of the property, and the date of the transfer. It is essential to ensure that all information is accurate and complete to avoid potential issues in the future.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed and a Warranty Deed are not the same. A Warranty Deed offers guarantees that the grantor holds clear title to the property and will defend against any claims. In contrast, a Quitclaim Deed offers no such assurances and simply transfers the interest without any warranties.

Do I need to have the Quitclaim Deed notarized?

Yes, in New York, a Quitclaim Deed must be notarized to be legally valid. This means that the grantor must sign the deed in the presence of a notary public, who will then affix their seal to the document. This step helps to ensure the authenticity of the signatures.

How do I record a Quitclaim Deed in New York?

To record a Quitclaim Deed in New York, you must submit the notarized deed to the county clerk’s office where the property is located. There may be a recording fee, and it is advisable to check with the county clerk for specific requirements and procedures.

Are there any tax implications when using a Quitclaim Deed?

Yes, transferring property through a Quitclaim Deed may have tax implications. While the transfer itself may not incur a tax, it is important to consider potential gift tax or other tax liabilities, especially if the property has significant value. Consulting a tax professional is recommended to understand any financial consequences.

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed has been executed and recorded, it cannot be revoked unilaterally. However, the parties involved can agree to reverse the transaction and create a new deed to transfer the property back. Legal advice may be necessary to navigate this process effectively.

What happens if the grantor has no ownership interest?

If the grantor has no ownership interest in the property, a Quitclaim Deed will still be valid but will not transfer any actual ownership. The grantee will receive no rights or claims to the property. It is crucial to verify ownership before proceeding with this type of deed.

Can I use a Quitclaim Deed for commercial properties?

Yes, a Quitclaim Deed can be used for both residential and commercial properties. However, it is essential to ensure that all parties understand the implications of the deed and that the transfer is appropriate for the type of property involved.