What is a Transfer-on-Death Deed in New York?

A Transfer-on-Death Deed (TOD Deed) is a legal document that allows an individual to transfer real estate property to a designated beneficiary upon the individual's death. This deed enables the property owner to retain full control of the property during their lifetime, while ensuring that the property automatically passes to the beneficiary without going through probate after the owner's death.

Who can use a Transfer-on-Death Deed in New York?

Any individual who owns real estate in New York can utilize a Transfer-on-Death Deed. This includes homeowners, property investors, and individuals holding property in their name. However, certain restrictions may apply, such as if the property is subject to a mortgage or is part of a trust.

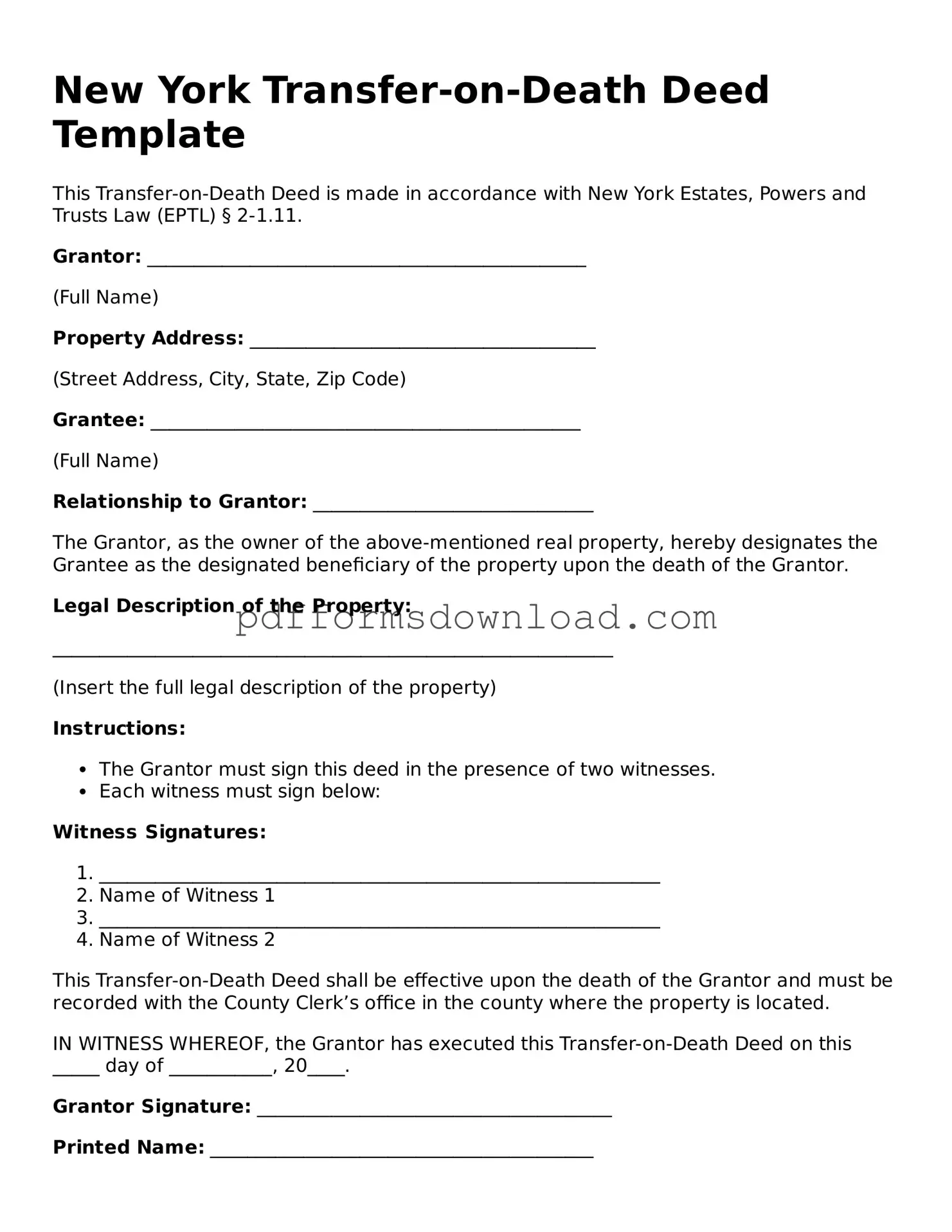

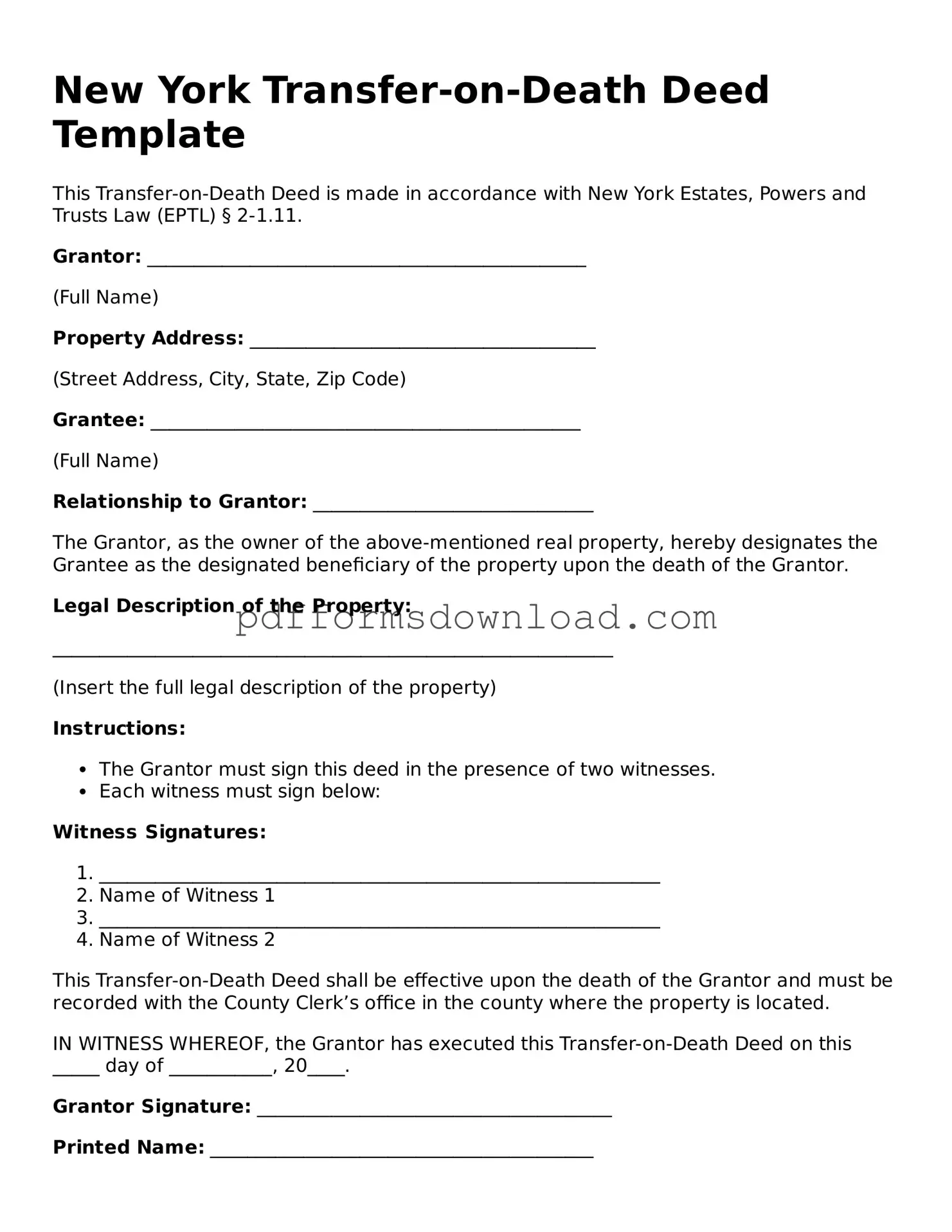

How do I create a Transfer-on-Death Deed?

To create a Transfer-on-Death Deed, you must complete the appropriate form, which is available through New York state resources or legal websites. The form requires details such as the property description, the owner's information, and the beneficiary's name. After filling out the form, it must be signed in the presence of a notary public and then filed with the county clerk's office where the property is located.

Is a Transfer-on-Death Deed revocable?

Yes, a Transfer-on-Death Deed is revocable. The property owner can change the beneficiary or revoke the deed entirely at any time before their death. To do this, the owner must complete a revocation form and file it with the county clerk's office. This flexibility allows property owners to adapt their estate plans as circumstances change.

Are there any tax implications associated with a Transfer-on-Death Deed?

Generally, a Transfer-on-Death Deed does not trigger immediate tax consequences for the property owner or the beneficiary. However, once the property is transferred upon the owner's death, the beneficiary may be responsible for property taxes and potential capital gains taxes if they decide to sell the property. It is advisable to consult with a tax professional to understand the specific implications based on individual circumstances.

Can I use a Transfer-on-Death Deed for multiple beneficiaries?

Yes, a Transfer-on-Death Deed can designate multiple beneficiaries. The form allows for the naming of more than one person to receive the property upon the owner's death. It is important to specify how the property will be divided among the beneficiaries, whether equally or in specific shares, to avoid any confusion or disputes later on.

What happens if the beneficiary predeceases the property owner?

If the designated beneficiary passes away before the property owner, the Transfer-on-Death Deed may become void unless there are alternative provisions made in the deed itself. Property owners can include contingent beneficiaries to ensure that the property still transfers to another individual in the event of the primary beneficiary's death. This can help to maintain the intended distribution of the property.