Download P 45 It Template

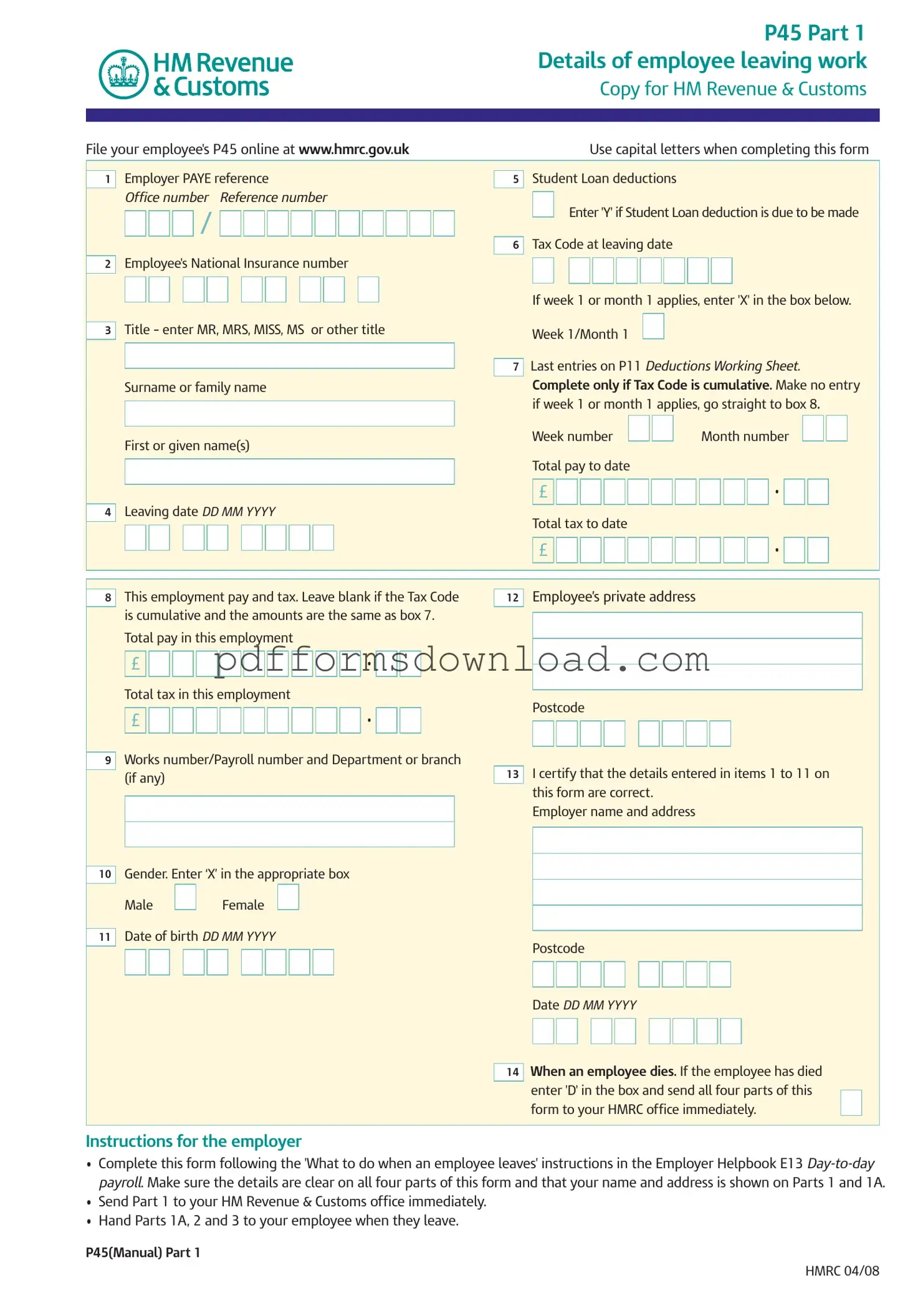

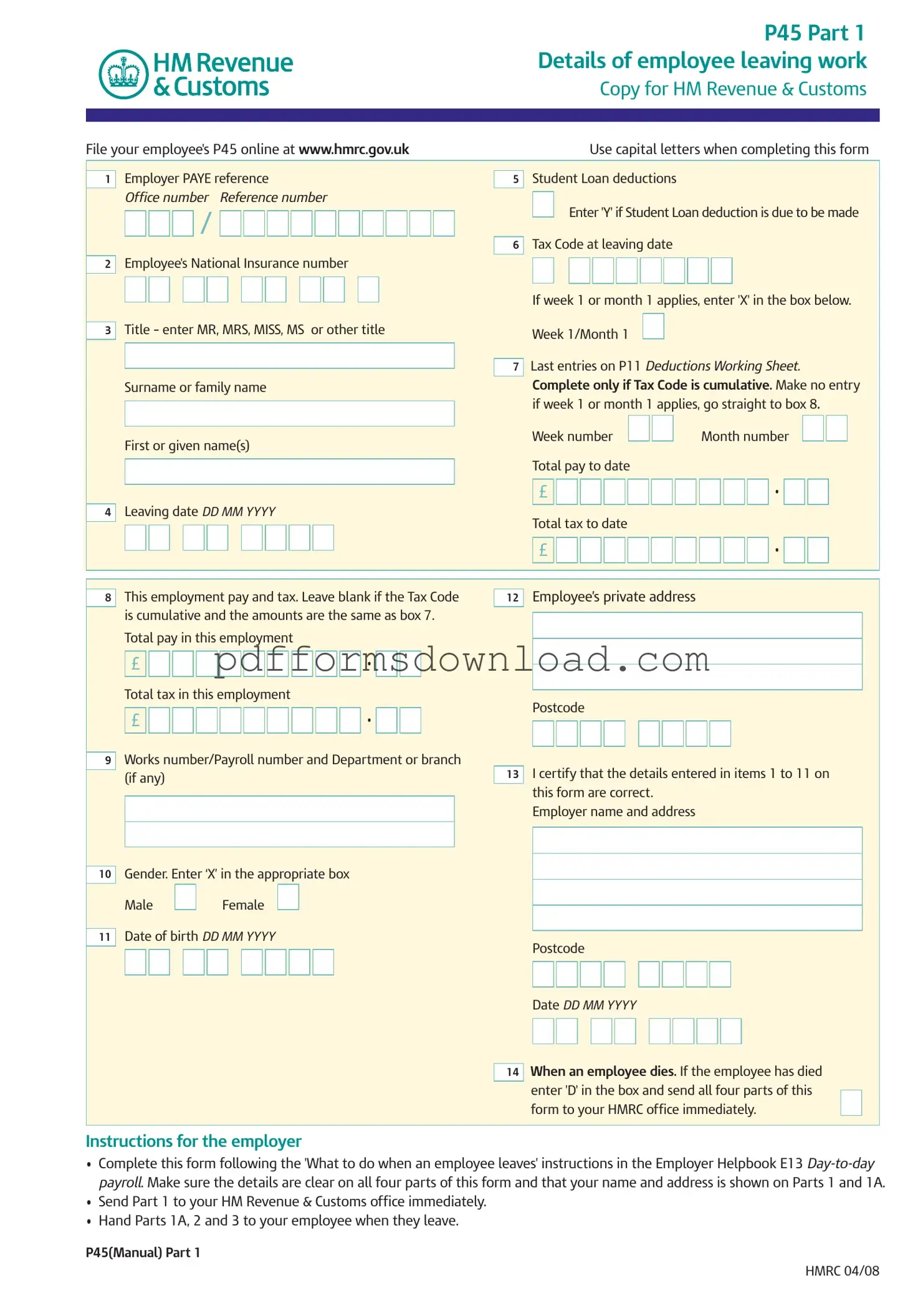

The P45 It form is a crucial document used in the UK to record details when an employee leaves a job. It provides essential information about their earnings and tax deductions, helping both the employee and their new employer manage tax responsibilities effectively. If you need to fill out this form, click the button below to get started.

Make This Document Now

Download P 45 It Template

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your P 45 It online — edit, save, and download easily.