What is a Profit and Loss form?

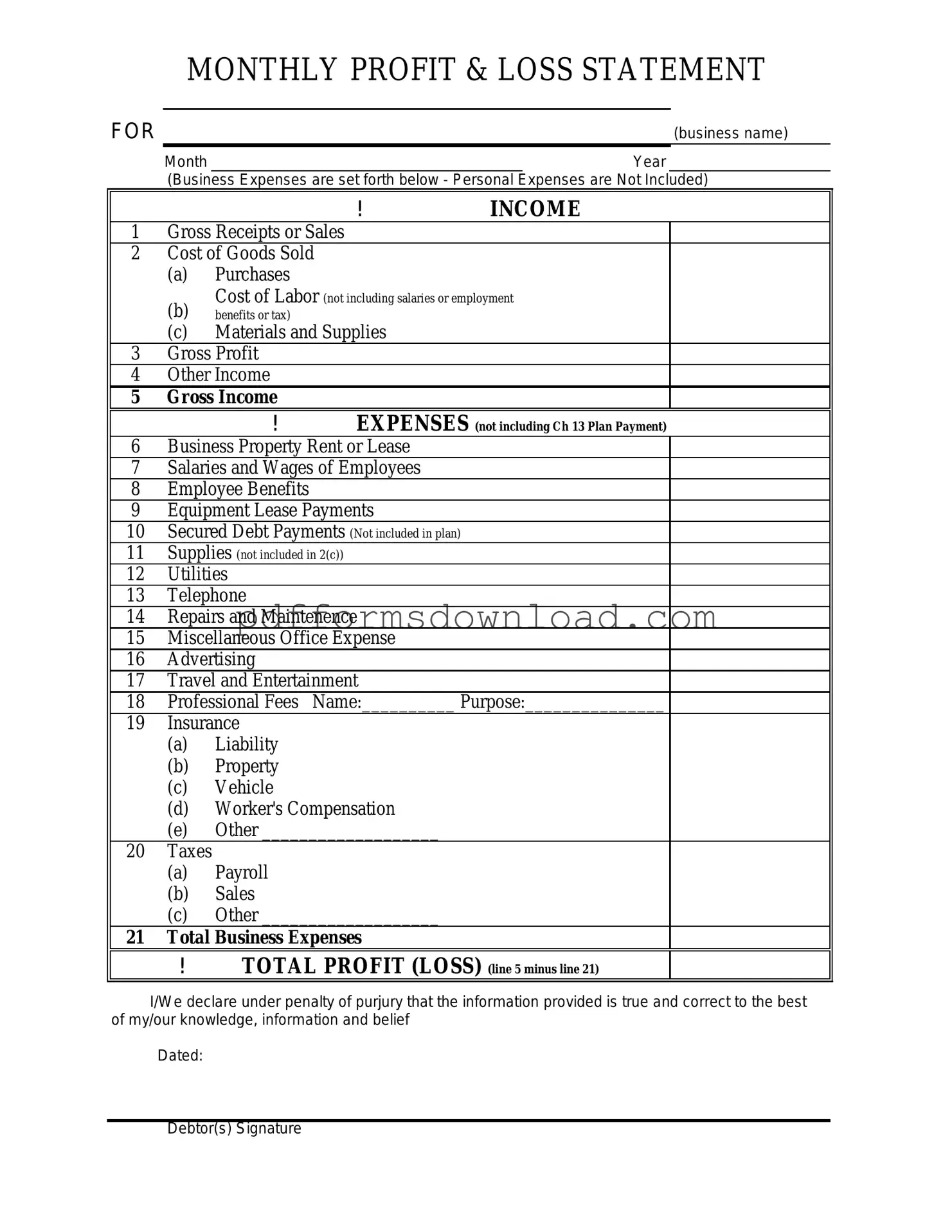

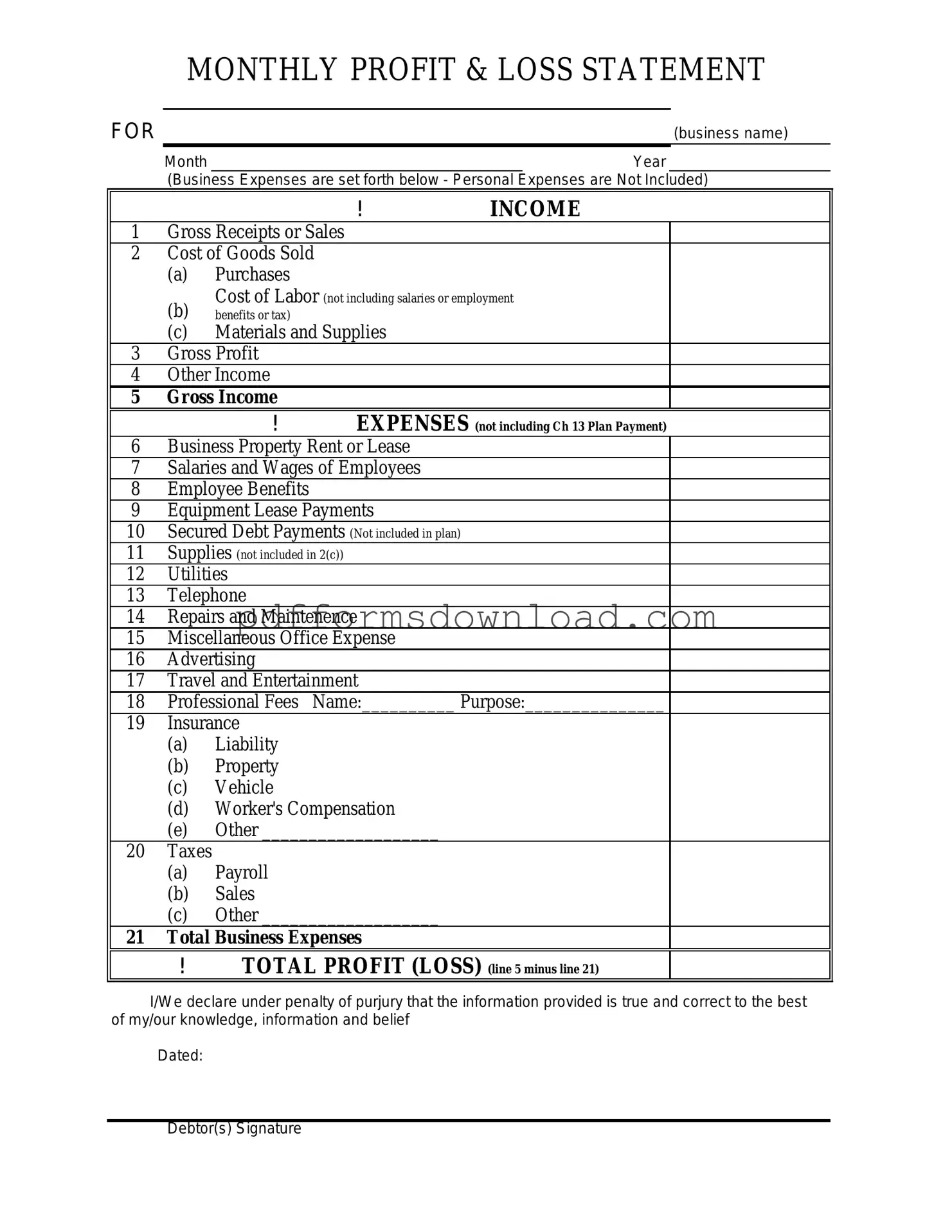

A Profit and Loss form, also known as an income statement, summarizes a company's revenues, costs, and expenses over a specific period. It provides a clear picture of the company's financial performance, showing whether it made a profit or incurred a loss during that time frame.

Why is a Profit and Loss form important?

This form is crucial for business owners and stakeholders. It helps in assessing the company's profitability, making informed decisions, and planning for future financial strategies. Investors and creditors also rely on this document to evaluate the company’s financial health.

What information is included in a Profit and Loss form?

The form typically includes total revenues, cost of goods sold, gross profit, operating expenses, and net profit or loss. Each section provides insights into different aspects of the company's financial activities.

How often should a Profit and Loss form be prepared?

Companies usually prepare this form monthly, quarterly, or annually. The frequency depends on the size of the business and its specific needs. Regular updates help track performance and make timely adjustments.

Who uses the Profit and Loss form?

Various stakeholders utilize the Profit and Loss form. Business owners, investors, creditors, and financial analysts rely on it to gauge profitability and assess financial stability. Additionally, tax authorities may require it for compliance purposes.

How does a Profit and Loss form differ from a balance sheet?

The Profit and Loss form focuses on income and expenses over a period, while a balance sheet provides a snapshot of a company's assets, liabilities, and equity at a specific point in time. Both documents are essential for a complete financial overview.

Can a Profit and Loss form show non-cash expenses?

Yes, the form can include non-cash expenses such as depreciation and amortization. These expenses impact net income but do not involve actual cash transactions during the reporting period.

How can I improve my Profit and Loss results?

Improving results can involve increasing sales, reducing costs, or optimizing expenses. Regularly reviewing the form allows businesses to identify trends and areas for improvement, leading to better financial outcomes.

What is the difference between gross profit and net profit?

Gross profit is calculated by subtracting the cost of goods sold from total revenue. Net profit, on the other hand, is the amount remaining after all expenses, including operating expenses and taxes, have been deducted from total revenue. This distinction is vital for understanding overall profitability.

Where can I find templates for a Profit and Loss form?

Templates for Profit and Loss forms are widely available online. Many accounting software programs also offer built-in templates. These resources can simplify the process of creating and maintaining accurate financial records.