What is a Quitclaim Deed?

A Quitclaim Deed is a legal document used to transfer ownership of real property from one party to another. Unlike other types of deeds, it does not guarantee that the property title is clear or free from liens. Instead, it simply conveys whatever interest the grantor has in the property, if any. This type of deed is often used among family members or in situations where the parties know each other well.

When should I use a Quitclaim Deed?

You might consider using a Quitclaim Deed in several situations. Common scenarios include transferring property between family members, adding or removing a spouse from the title after marriage or divorce, or clearing up title issues. It is important to understand that this deed does not provide any warranty regarding the property’s title.

What are the risks associated with a Quitclaim Deed?

The primary risk is that a Quitclaim Deed does not guarantee the validity of the title. If there are existing liens or other claims against the property, the new owner may assume these risks. Additionally, if the grantor does not actually own the property, the recipient may end up with nothing. Therefore, it’s advisable to conduct a title search before proceeding with a Quitclaim Deed.

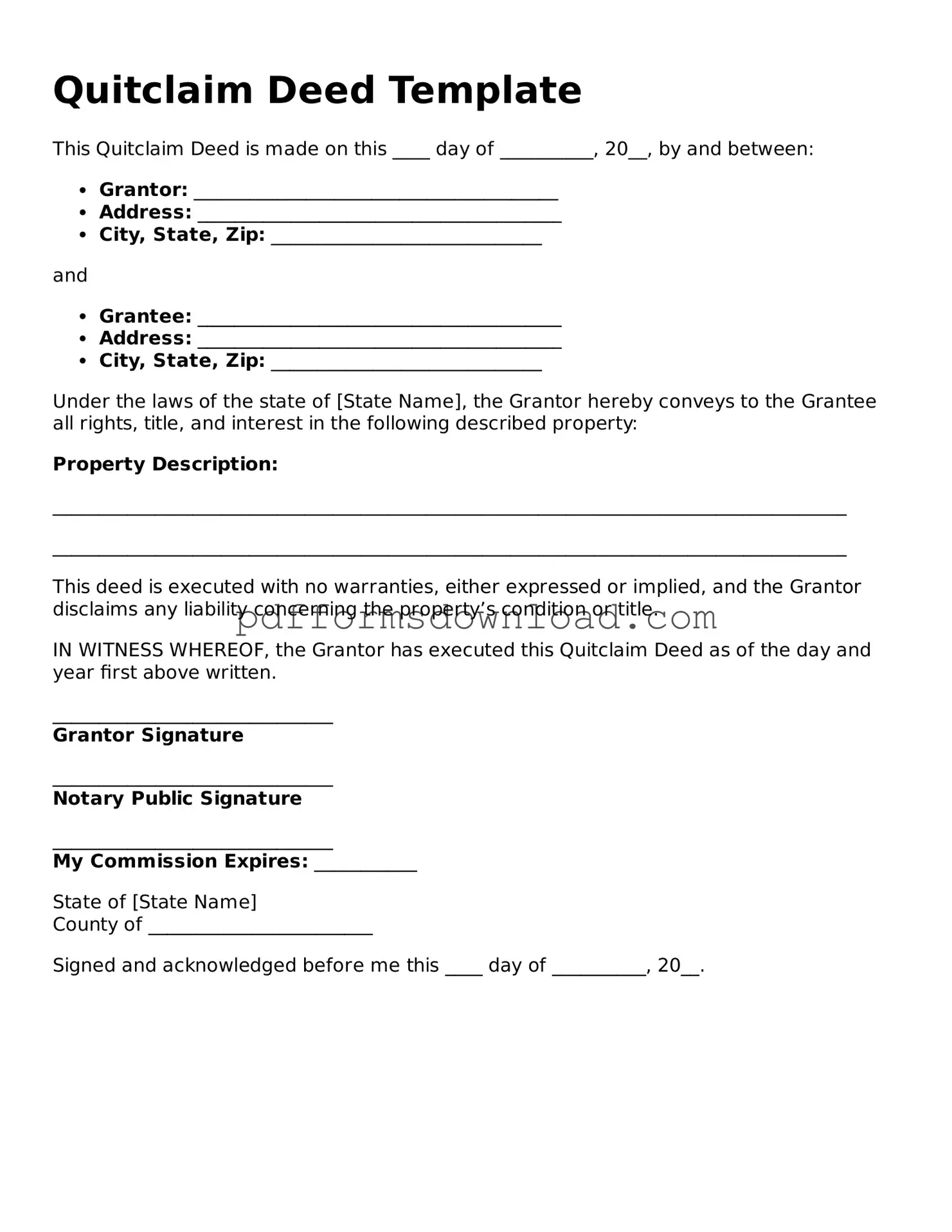

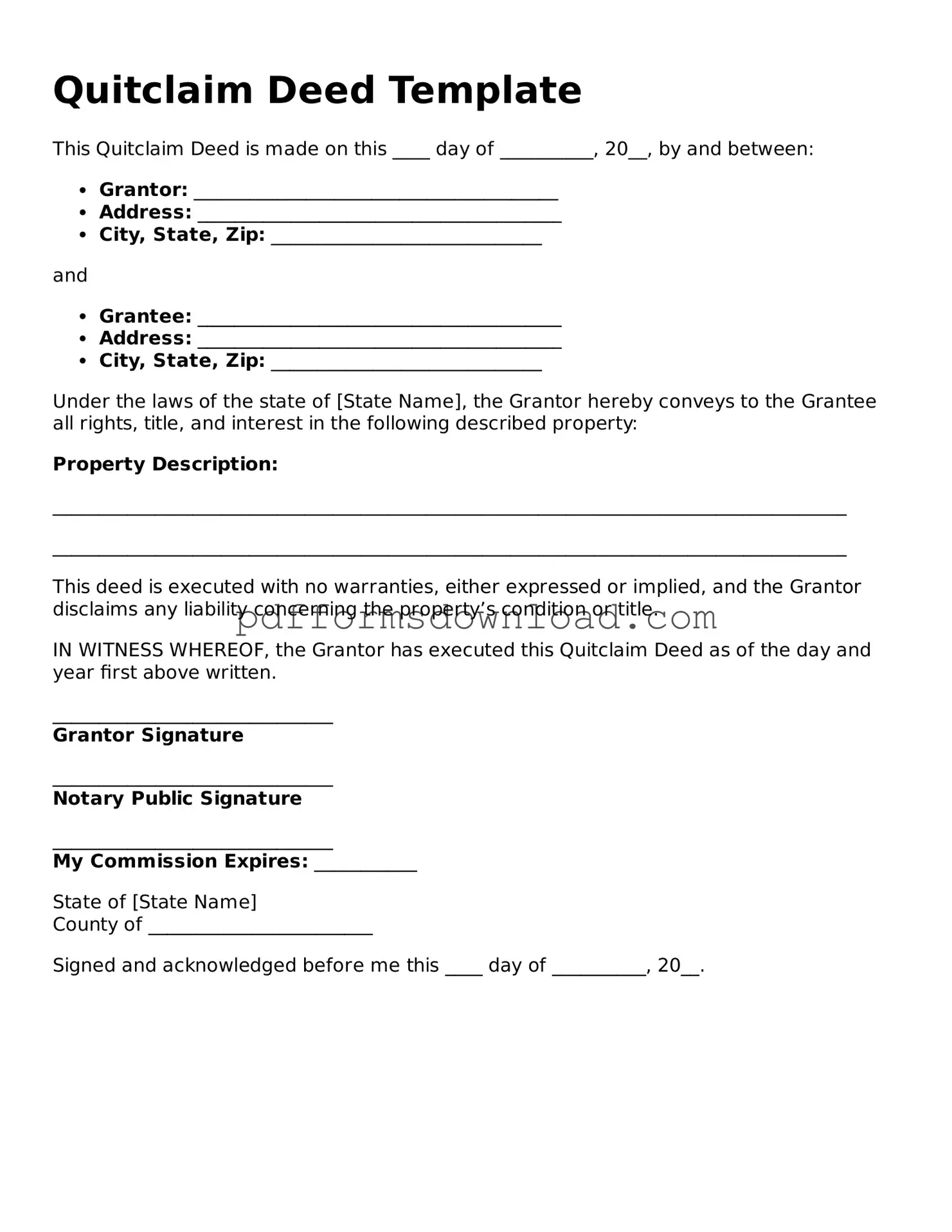

How do I prepare a Quitclaim Deed?

Preparing a Quitclaim Deed involves several steps. First, you need to gather the necessary information, including the names of the parties involved, a legal description of the property, and the date of transfer. You can find templates online or consult a legal professional to ensure that the document meets your state’s requirements. After drafting, both parties should sign the deed, and it may need to be notarized.

Do I need to file the Quitclaim Deed with the county?

Yes, after completing the Quitclaim Deed, it is typically necessary to file it with the county recorder’s office where the property is located. Filing the deed ensures that the transfer of ownership is officially recorded and can help prevent future disputes regarding property ownership.

Is there a fee for filing a Quitclaim Deed?

Most counties charge a fee for filing a Quitclaim Deed. The amount varies depending on the jurisdiction. It is advisable to check with the local county recorder’s office for specific fees and any additional requirements that may apply.

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and recorded, it cannot be revoked unilaterally. However, the parties involved can create a new legal document to reverse the transaction if both agree. This process often requires a new deed, such as a Warranty Deed or another Quitclaim Deed, depending on the circumstances.

Do I need an attorney to execute a Quitclaim Deed?

While it is not legally required to have an attorney to execute a Quitclaim Deed, seeking legal advice can be beneficial. An attorney can help ensure that the deed is properly prepared, that all necessary information is included, and that your interests are protected throughout the process.