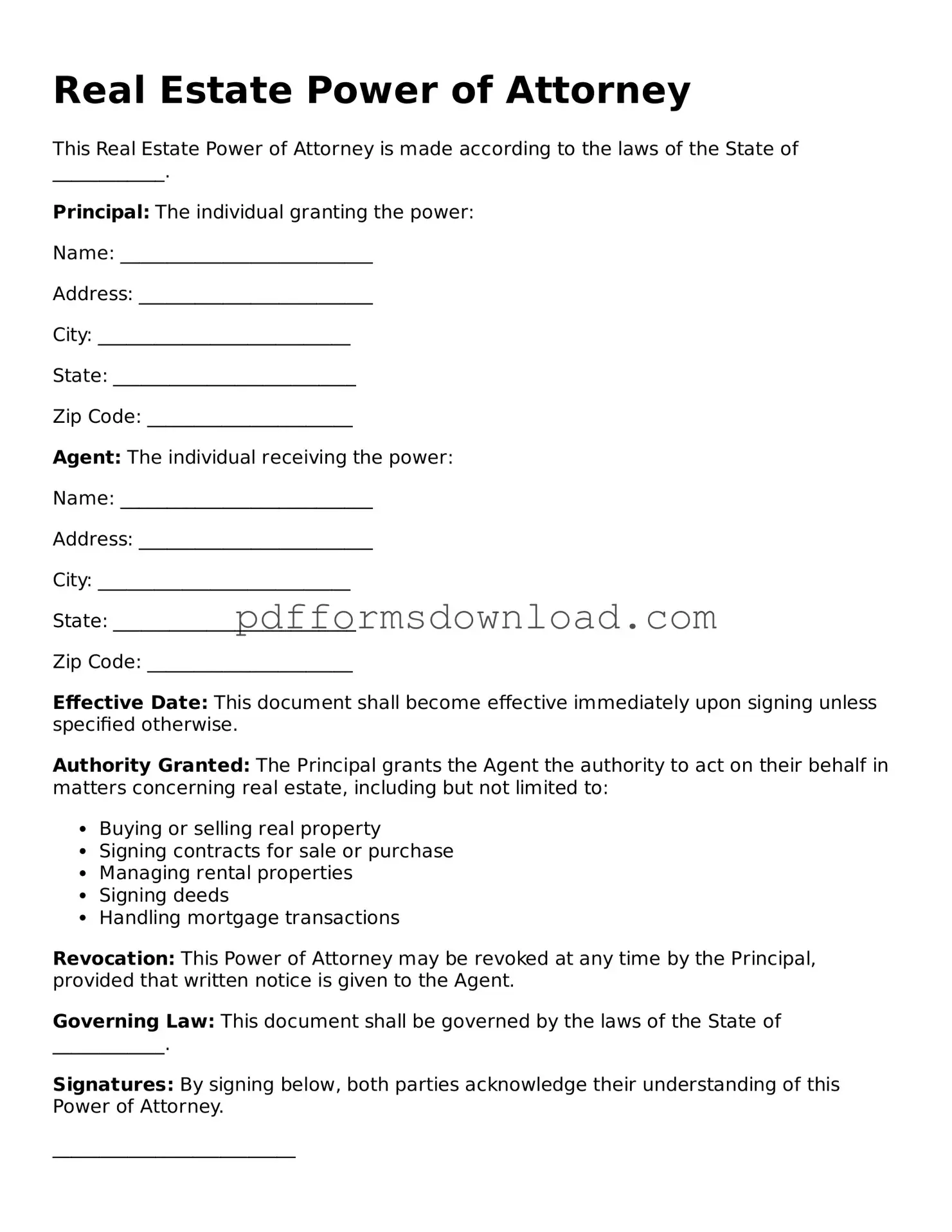

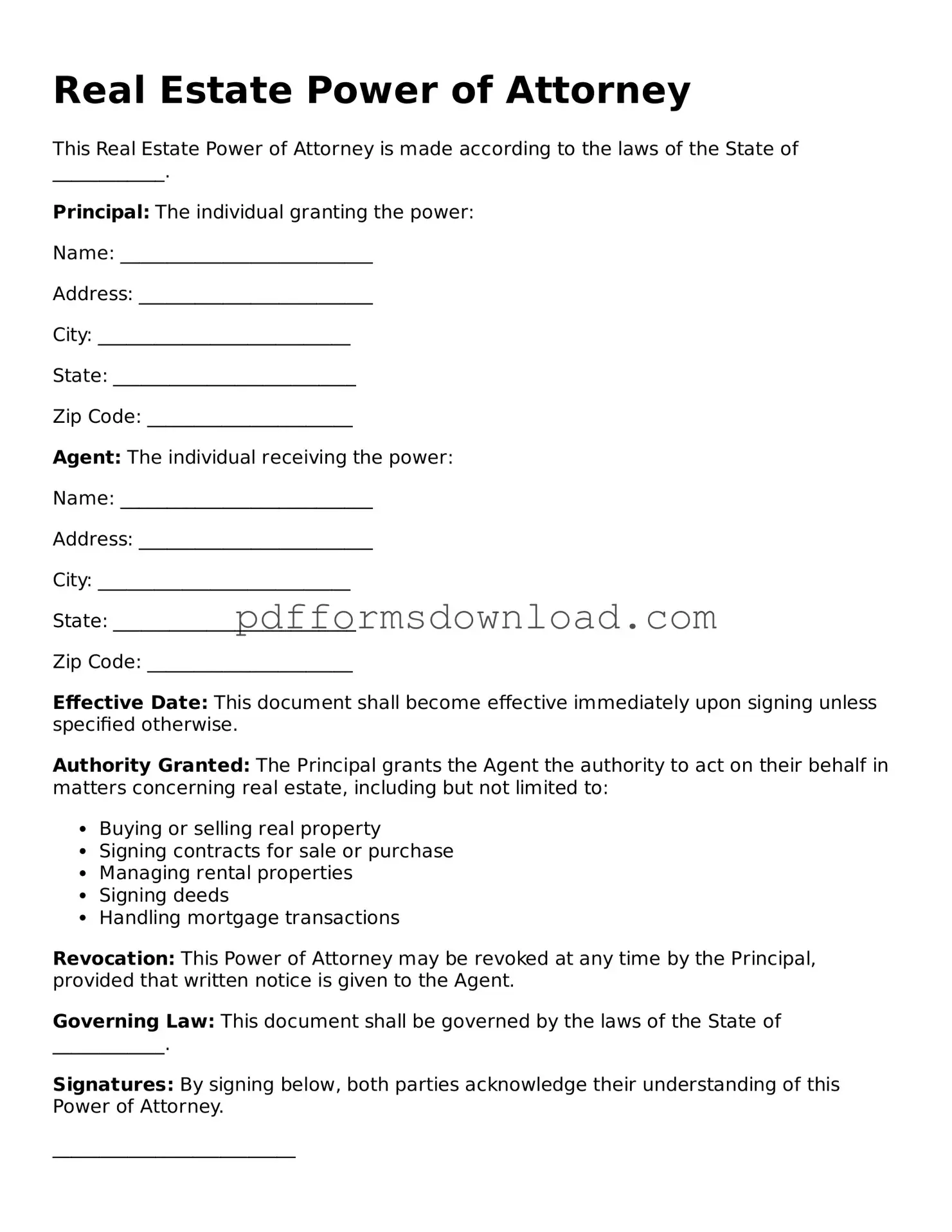

What is a Real Estate Power of Attorney?

A Real Estate Power of Attorney is a legal document that allows one person, known as the principal, to appoint another person, referred to as the agent or attorney-in-fact, to handle real estate transactions on their behalf. This can include buying, selling, or managing property. The document grants the agent specific powers, which can be broad or limited based on the principal’s wishes.

Why would someone need a Real Estate Power of Attorney?

Individuals may need a Real Estate Power of Attorney for various reasons. For example, if a person is unable to be present for a real estate transaction due to travel, health issues, or other commitments, appointing an agent can ensure that the transaction proceeds smoothly. Additionally, it can be useful for individuals who may not have the expertise to navigate real estate dealings themselves.

What powers can be granted through this document?

The powers granted in a Real Estate Power of Attorney can vary significantly. They can include the ability to buy or sell property, sign contracts, manage rental properties, and make decisions regarding property maintenance. The principal can specify which powers are granted and can limit the authority to specific transactions or time periods.

How is a Real Estate Power of Attorney executed?

To execute a Real Estate Power of Attorney, the principal must sign the document in the presence of a notary public. Some states may also require witnesses to be present during the signing. It is essential to follow the specific legal requirements of the state where the property is located to ensure the document is valid.

Can a Real Estate Power of Attorney be revoked?

Yes, a Real Estate Power of Attorney can be revoked at any time by the principal, as long as they are mentally competent. To revoke the document, the principal should create a written notice of revocation and inform the agent and any relevant parties, such as real estate professionals or financial institutions, that the authority has been terminated.

What happens if the principal becomes incapacitated?

If the principal becomes incapacitated, the Real Estate Power of Attorney can still remain in effect, depending on the type of power of attorney established. A durable power of attorney is designed to remain valid even if the principal loses mental capacity. This is particularly important for ongoing real estate management or transactions that may need to be addressed during such circumstances.

Are there any risks associated with granting a Real Estate Power of Attorney?

Yes, there are potential risks involved. The principal must choose a trustworthy agent, as they will have significant control over the principal’s property and financial matters. Misuse of power or conflicts of interest can occur if the agent does not act in the principal's best interests. Therefore, careful consideration should be given to selecting the right person for this role and clearly outlining the scope of authority in the document.