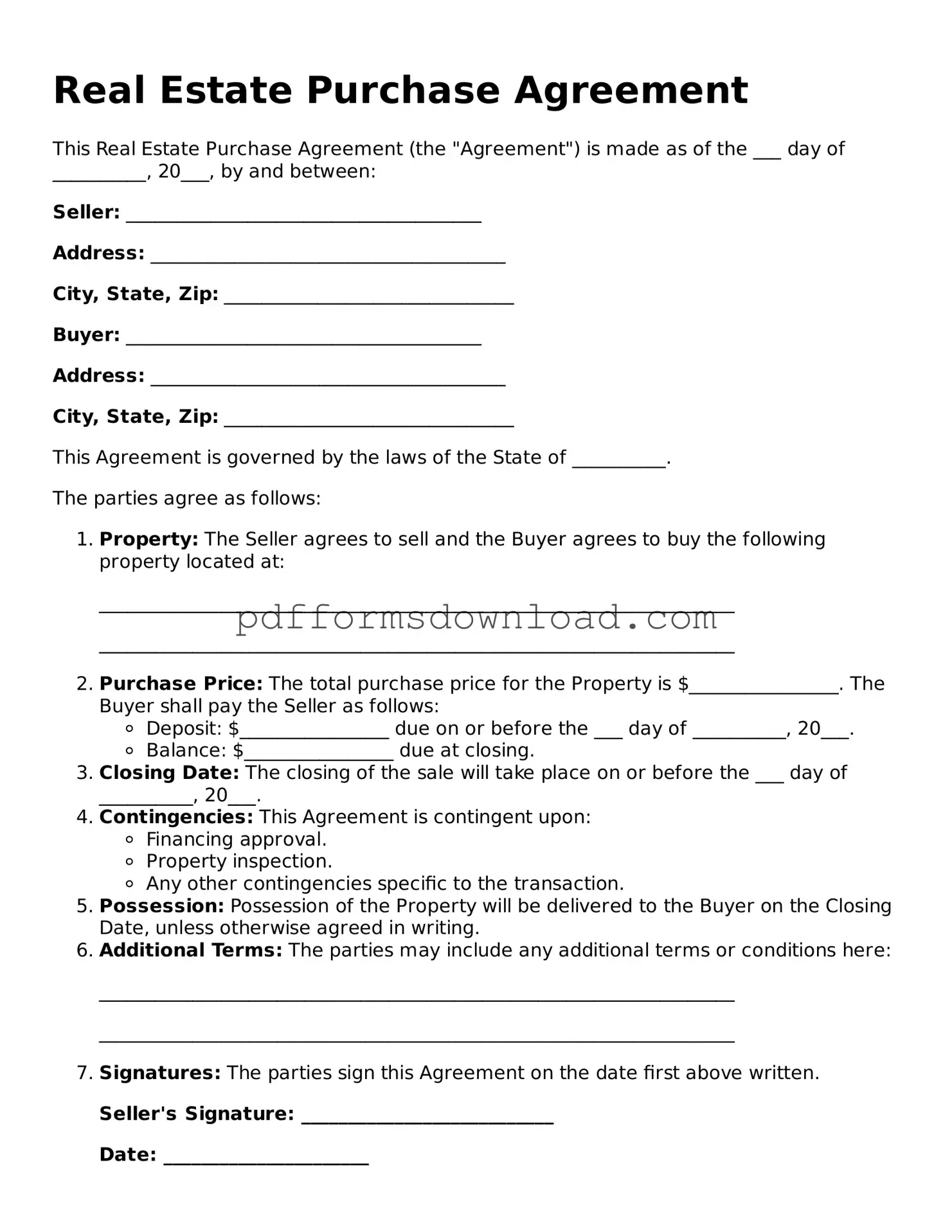

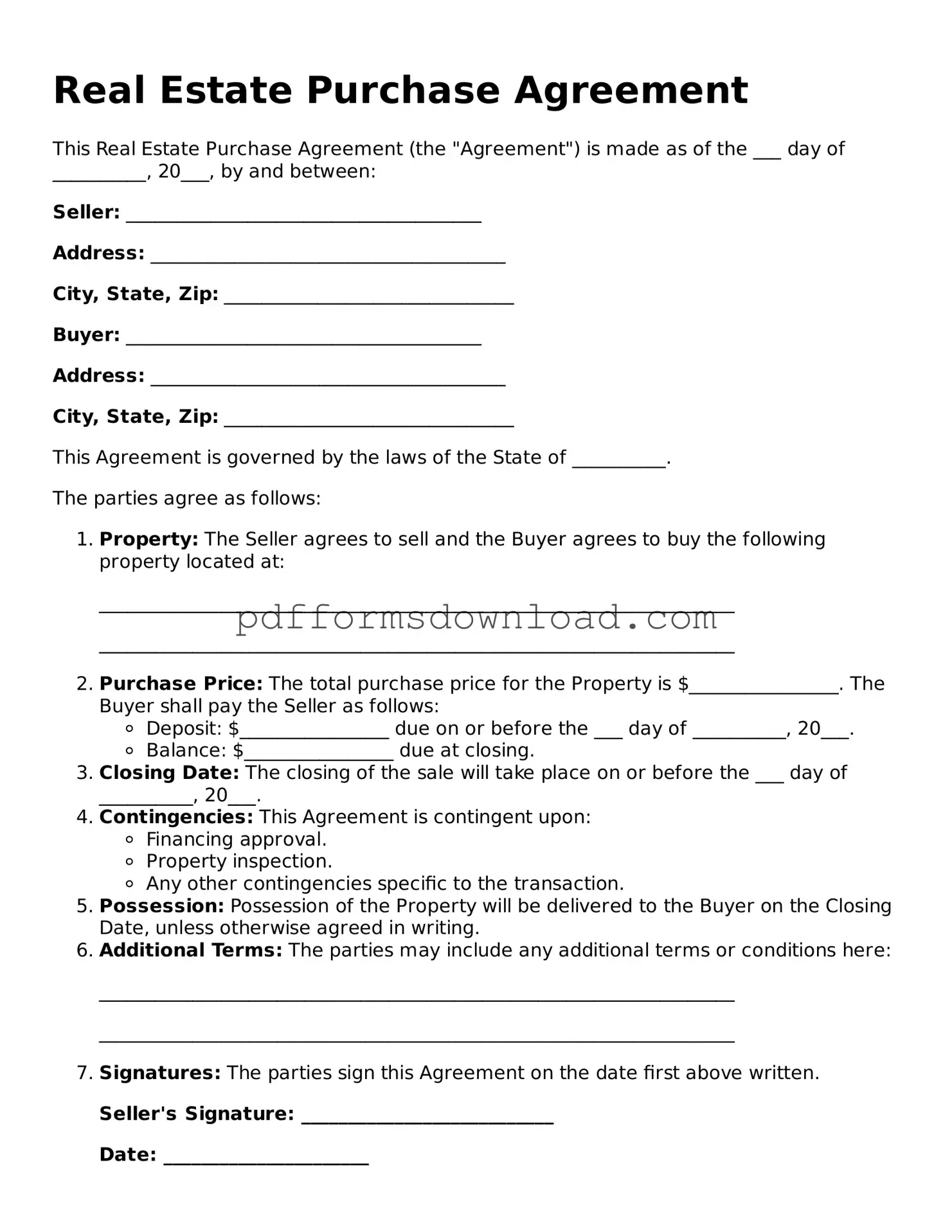

What is a Real Estate Purchase Agreement?

A Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a property will be sold. It serves as a binding contract between the buyer and the seller, detailing important information such as the purchase price, property description, and the closing date. This agreement protects both parties by clearly stating their rights and obligations throughout the transaction process.

What key elements should be included in the agreement?

Several essential components should be included in a Real Estate Purchase Agreement. First, the names and contact information of both the buyer and seller must be clearly stated. Next, a detailed description of the property, including its address and legal description, is crucial. The purchase price, any earnest money deposits, and financing details should also be outlined. Additionally, the agreement should specify any contingencies, such as inspections or financing approvals, and the timeline for closing the sale.

How does the negotiation process work?

Negotiation is a vital part of the Real Estate Purchase Agreement process. Once the buyer expresses interest in a property, they typically submit an initial offer. The seller can accept, reject, or counter the offer. This back-and-forth may involve adjustments to the price, closing date, or contingencies. Open communication is key, and both parties should feel comfortable discussing their needs and expectations. Once an agreement is reached, the finalized terms are documented in the purchase agreement.

What happens after the agreement is signed?

After both parties sign the Real Estate Purchase Agreement, the next steps involve fulfilling the terms outlined in the document. This may include completing any required inspections, securing financing, and addressing contingencies. The closing process begins once all conditions are met. During closing, ownership of the property is officially transferred from the seller to the buyer, and necessary documents are signed. It's crucial for both parties to remain engaged throughout this process to ensure a smooth transaction.

Can the agreement be modified after signing?

Yes, the Real Estate Purchase Agreement can be modified after signing, but both parties must agree to any changes. If modifications are necessary, they should be documented in writing and signed by both the buyer and seller. Common reasons for amendments include changes in closing dates, adjustments to the purchase price, or updates to contingencies. Clear communication and mutual consent are essential to ensure that all parties are on the same page.