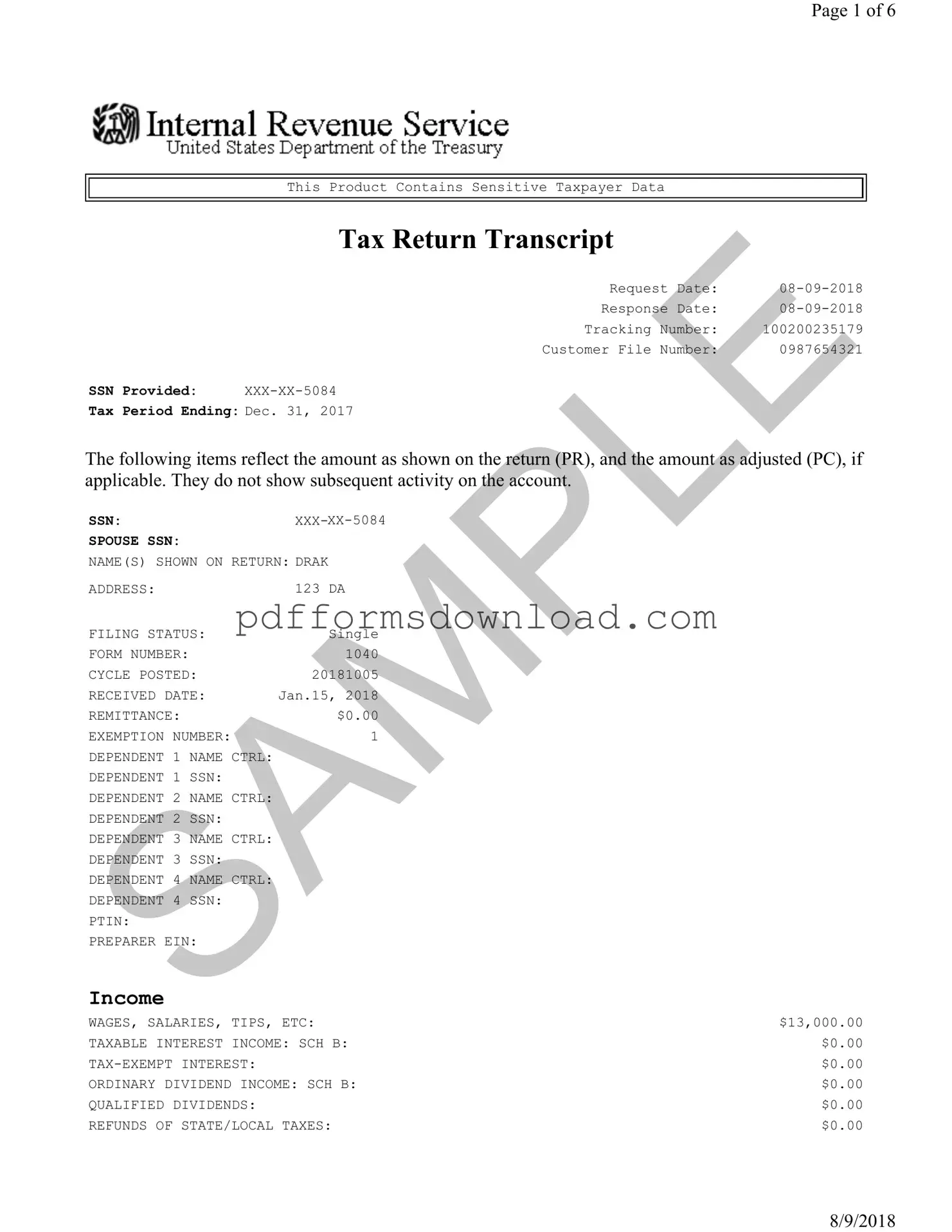

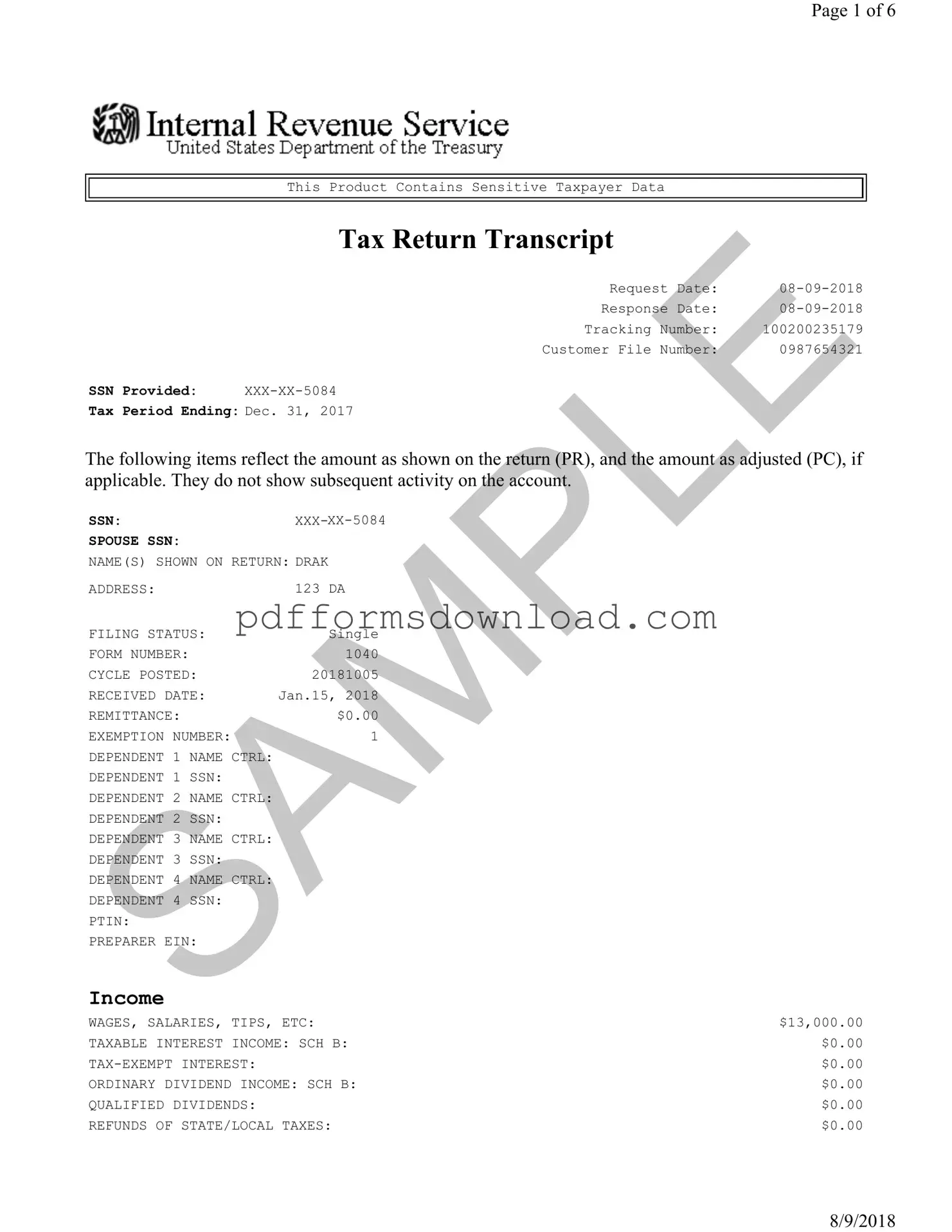

Download Sample Tax Return Transcript Template

The Sample Tax Return Transcript is a document that summarizes a taxpayer's income, deductions, and tax liabilities as reported on their tax return. It provides essential information for various purposes, including loan applications and verifying income. Understanding this form can help taxpayers ensure they have accurate records for their financial needs.

To fill out the form, please click the button below.

Make This Document Now

Download Sample Tax Return Transcript Template

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your Sample Tax Return Transcript online — edit, save, and download easily.