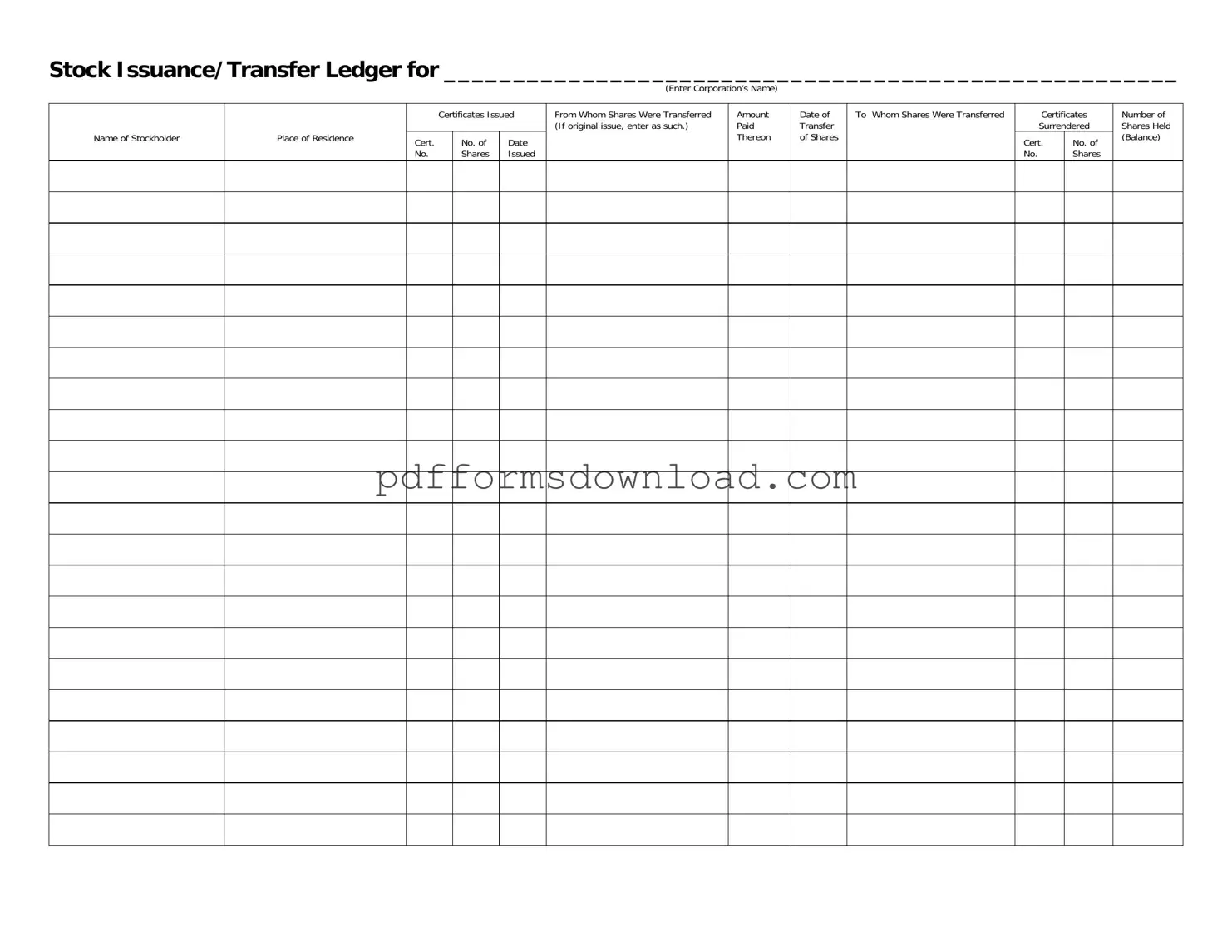

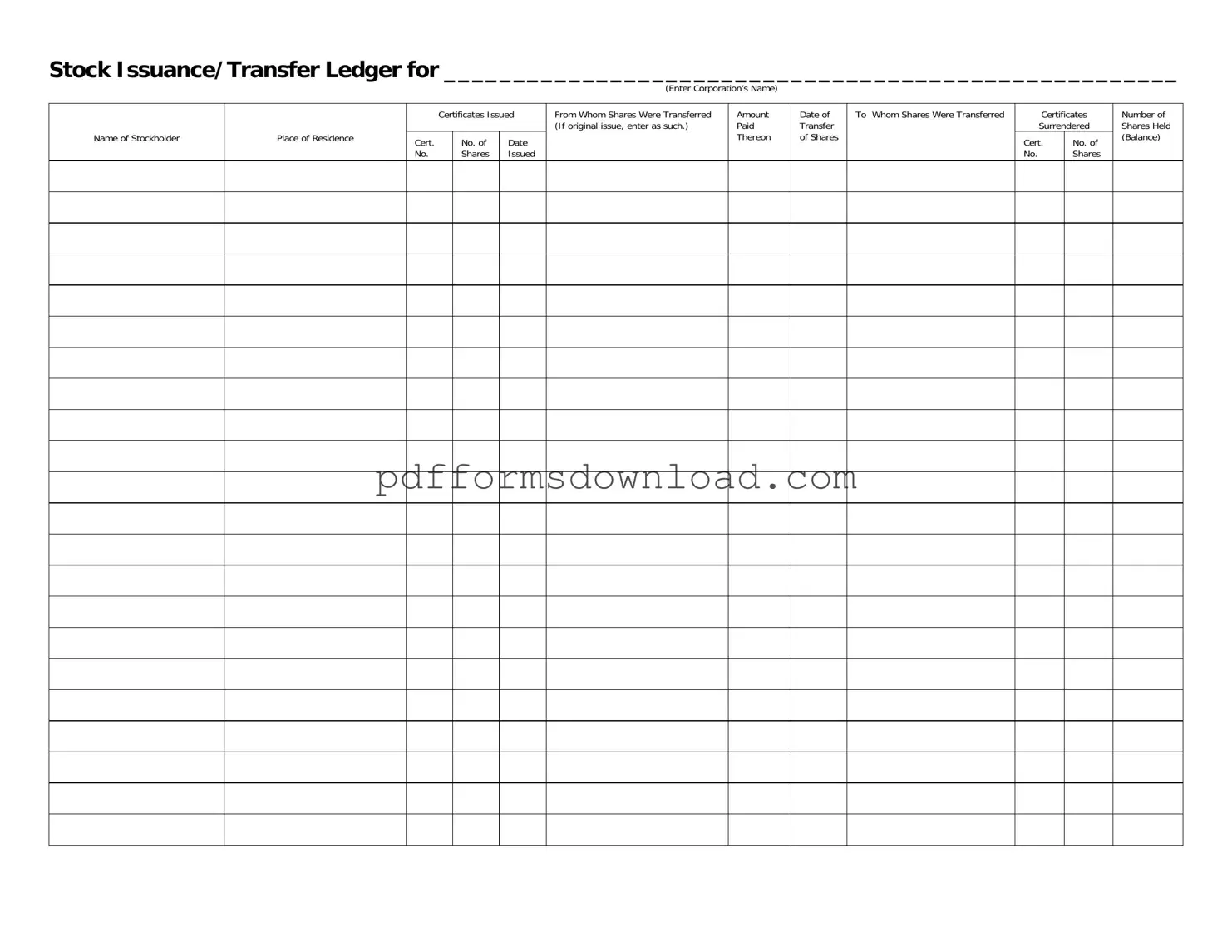

What is a Stock Transfer Ledger form?

The Stock Transfer Ledger form is a document used by corporations to keep track of the issuance and transfer of stock shares. It records important details such as the stockholder's name, place of residence, certificate numbers, and the number of shares issued or transferred. This form is essential for maintaining accurate records of ownership and ensuring compliance with corporate regulations.

Why is it important to maintain a Stock Transfer Ledger?

Maintaining a Stock Transfer Ledger is crucial for several reasons. It provides a clear record of who owns shares in the corporation, which is vital for voting rights and dividend distribution. Additionally, it helps prevent disputes over ownership and ensures that the corporation remains compliant with state and federal regulations regarding stock transfers.

Who should fill out the Stock Transfer Ledger form?

The Stock Transfer Ledger form should be filled out by the corporation's secretary or another authorized officer. This individual is responsible for accurately recording all stock issuances and transfers, ensuring that the information is up-to-date and reflects the current ownership structure of the corporation.

What information is required on the Stock Transfer Ledger form?

The form requires several key pieces of information, including the corporation's name, the name of the stockholder, their place of residence, the certificate numbers, the number of shares issued, and details about the transfer, such as the date and parties involved. This comprehensive information helps maintain an accurate record of stock ownership.

How do I determine the number of shares to record?

The number of shares to record depends on the specific transaction. If shares are being issued for the first time, the form should reflect the total number of shares issued. For transfers, record the number of shares being transferred from one stockholder to another. Always ensure that the total number of shares held is accurately updated after each transaction.

What should I do if a stock certificate is lost?

If a stock certificate is lost, the stockholder should notify the corporation immediately. The corporation may require the stockholder to complete a lost certificate affidavit and may issue a replacement certificate. It is essential to document this process in the Stock Transfer Ledger to maintain accurate records.

Can the Stock Transfer Ledger be maintained electronically?

Yes, the Stock Transfer Ledger can be maintained electronically. Many corporations use software solutions to track stock issuances and transfers. However, it's important to ensure that electronic records are secure and backed up regularly. They should also comply with any applicable regulations regarding record-keeping.

What happens if there is a discrepancy in the Stock Transfer Ledger?

If a discrepancy arises in the Stock Transfer Ledger, it is important to investigate promptly. Review the records for accuracy and consult with the parties involved to clarify any misunderstandings. Keeping thorough documentation can help resolve issues and prevent future discrepancies.

How often should the Stock Transfer Ledger be updated?

The Stock Transfer Ledger should be updated immediately after any stock issuance or transfer occurs. Regular updates ensure that the records reflect the most current ownership and help avoid confusion during corporate actions such as shareholder meetings or dividend distributions.

Is there a specific format for the Stock Transfer Ledger form?

While there is no universally mandated format for the Stock Transfer Ledger form, it should include all necessary fields for recording stock transactions. The form provided includes sections for the corporation's name, stockholder details, certificate numbers, and transaction specifics, which are essential for maintaining accurate records.