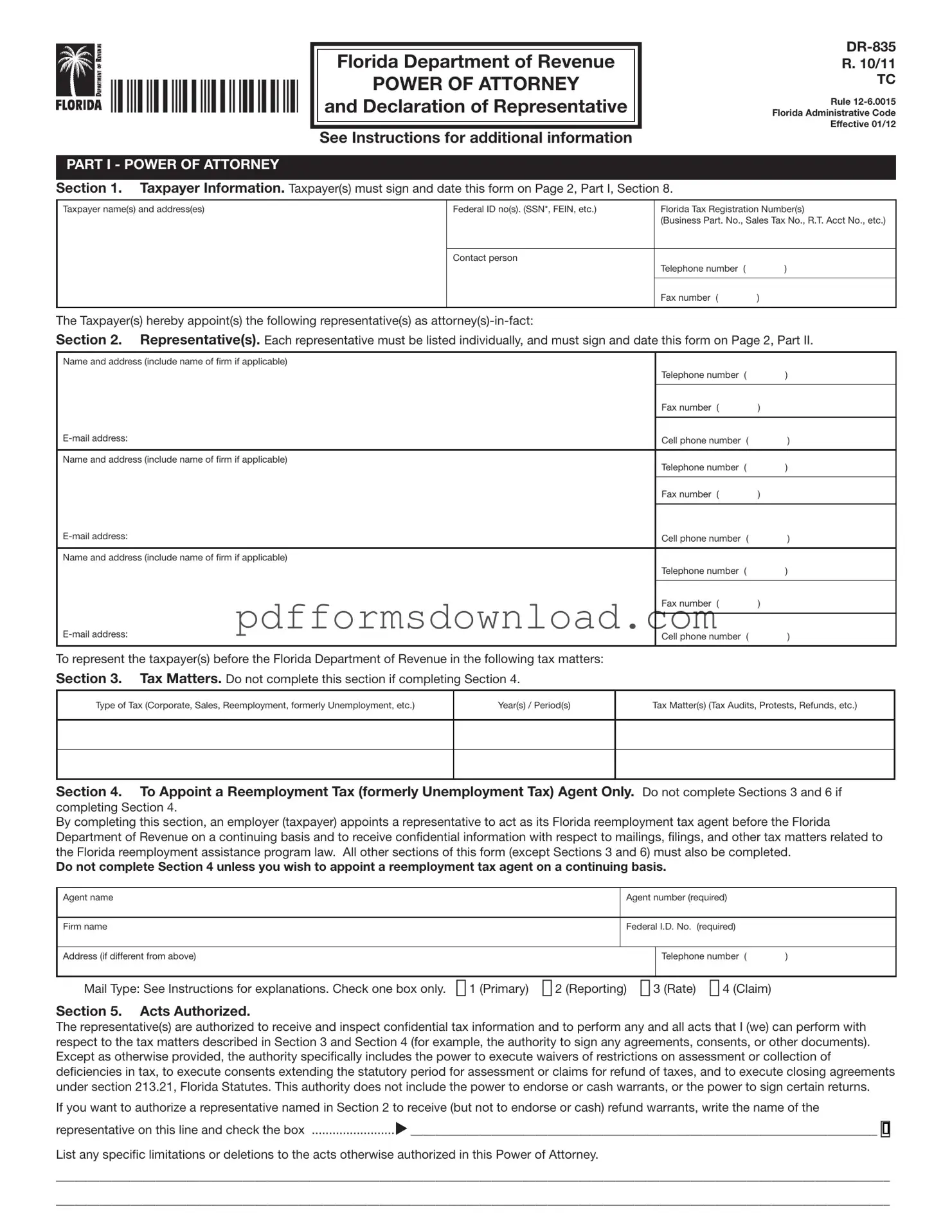

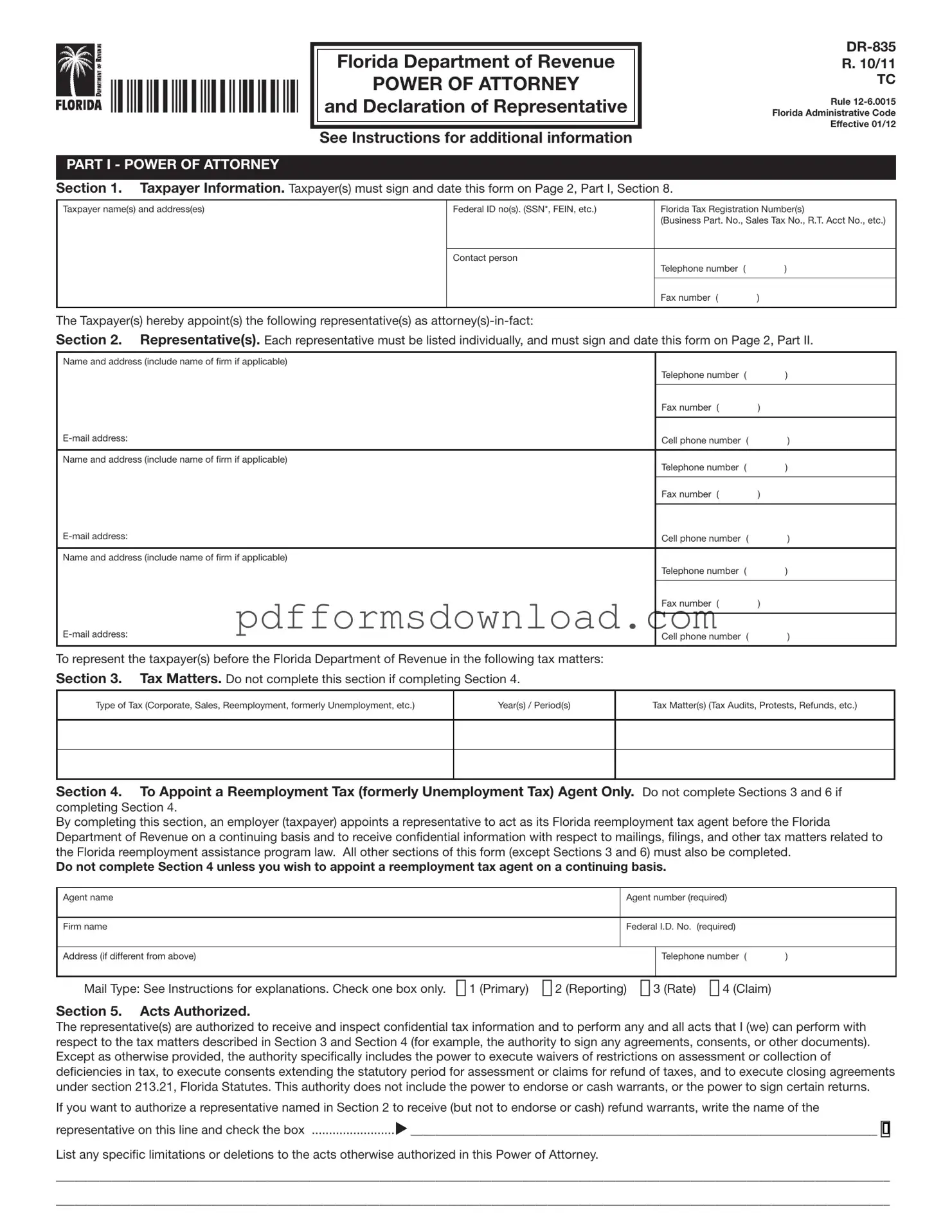

What is the Tax POA DR 835 form?

The Tax POA DR 835 form is a Power of Attorney document specifically designed for individuals or entities to authorize someone else to represent them in tax matters before the Colorado Department of Revenue. This form allows the designated representative to access tax information and communicate with the tax authority on behalf of the taxpayer.

Who can be designated as a representative on the Tax POA DR 835 form?

A representative can be anyone the taxpayer trusts to handle their tax affairs. This may include attorneys, accountants, or other tax professionals. It is important that the designated person is capable and willing to manage the responsibilities associated with representing the taxpayer.

How does one complete the Tax POA DR 835 form?

To complete the Tax POA DR 835 form, the taxpayer must fill out their personal information, including their name, address, and taxpayer identification number. The representative's information must also be included. After providing the necessary details, the taxpayer must sign and date the form to validate it.

Is there a fee associated with submitting the Tax POA DR 835 form?

There is no fee required for submitting the Tax POA DR 835 form to the Colorado Department of Revenue. However, any fees associated with the services provided by the designated representative are separate and should be discussed directly with them.

How long is the Tax POA DR 835 form valid?

The Tax POA DR 835 form remains in effect until the taxpayer revokes it, the representative is no longer able to act on behalf of the taxpayer, or until the specific tax matters indicated on the form are resolved. It is advisable to review the form periodically to ensure it still meets the taxpayer's needs.

Can the Tax POA DR 835 form be revoked?

Yes, the taxpayer can revoke the Tax POA DR 835 form at any time. To do so, a written notice of revocation must be submitted to the Colorado Department of Revenue. It is also recommended to inform the designated representative of the revocation to avoid any confusion.

What should be done if the Tax POA DR 835 form is lost?

If the Tax POA DR 835 form is lost, the taxpayer should complete a new form to ensure that their representation is properly documented. It is crucial to keep a copy of the new form for personal records and to provide it to the designated representative.

Can multiple representatives be designated on the Tax POA DR 835 form?

The Tax POA DR 835 form allows for the designation of one primary representative. However, if the taxpayer wishes to appoint multiple representatives, separate forms must be completed for each individual. This ensures clarity and proper representation for each designated person.

What types of tax matters can be handled with the Tax POA DR 835 form?

The Tax POA DR 835 form allows the designated representative to handle a variety of tax matters, including but not limited to tax return preparation, audits, and negotiations with the Colorado Department of Revenue. The form provides the representative with the authority to discuss and resolve issues related to the taxpayer's tax account.

Where should the completed Tax POA DR 835 form be submitted?

The completed Tax POA DR 835 form should be submitted directly to the Colorado Department of Revenue. It can be mailed or delivered in person to the appropriate office. For the most efficient processing, it is recommended to check the Department's website for specific submission guidelines.