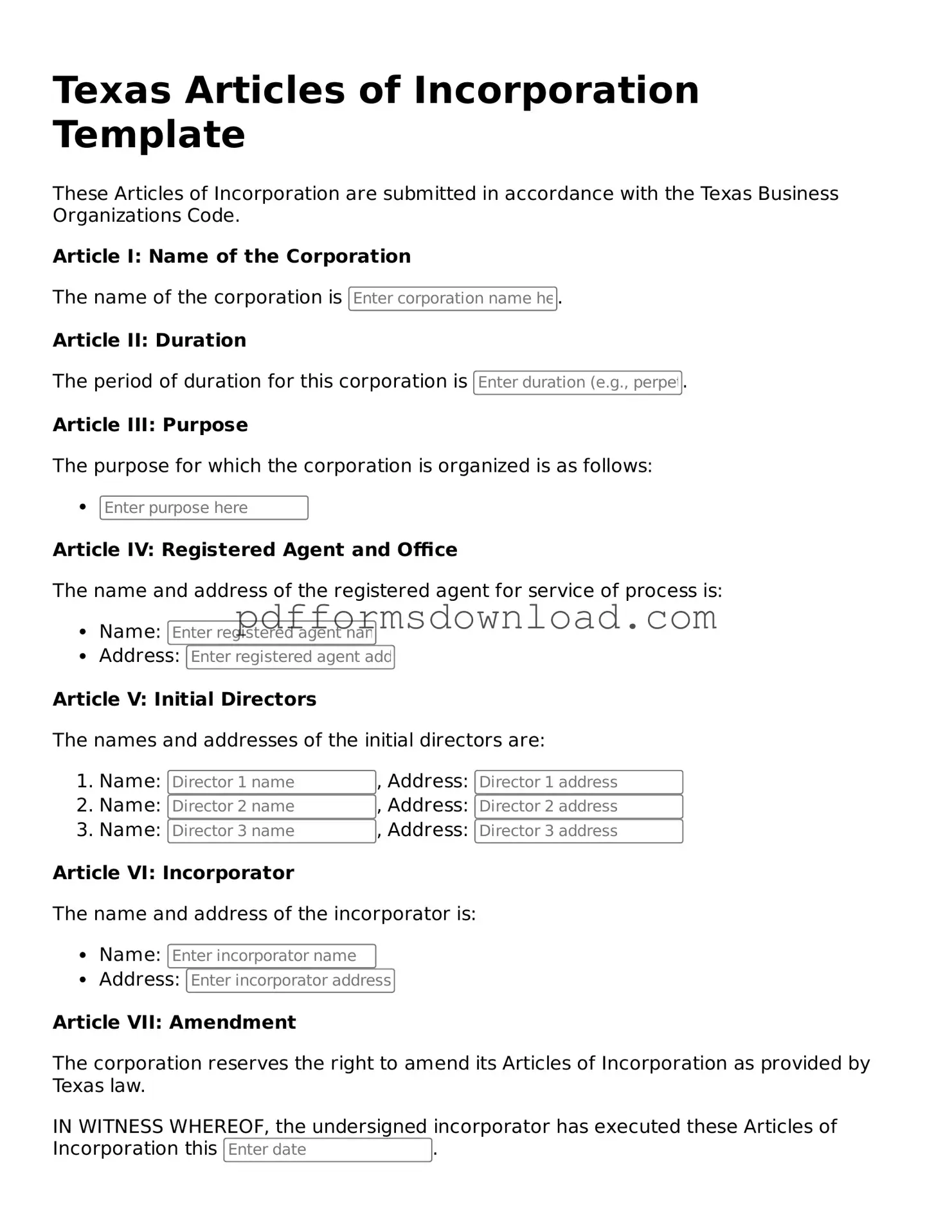

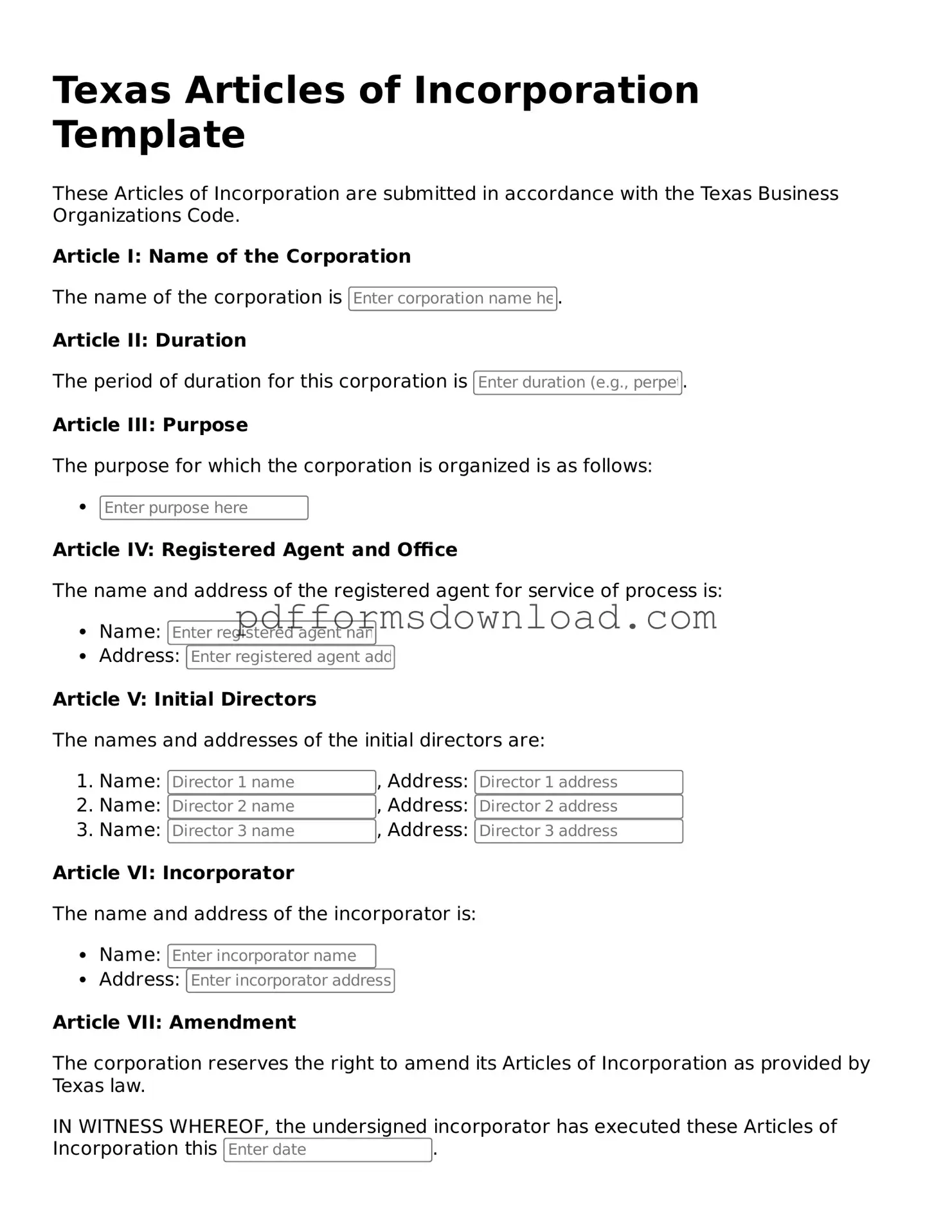

What are the Texas Articles of Incorporation?

The Texas Articles of Incorporation are a legal document that establishes a corporation in the state of Texas. This document outlines essential information about the corporation, including its name, purpose, registered agent, and the number of shares it is authorized to issue. Filing this form with the Texas Secretary of State is a crucial step in the process of forming a corporation, as it officially creates the business entity under Texas law.

Who needs to file the Articles of Incorporation?

Any individual or group looking to create a corporation in Texas must file the Articles of Incorporation. This includes startups, small businesses, and larger enterprises. It is important for anyone considering incorporating to understand that this document is necessary for legal recognition and protection of the business as a separate entity from its owners.

What information is required in the Articles of Incorporation?

The Articles of Incorporation require several key pieces of information. This includes the corporation's name, which must be unique and not already in use by another entity in Texas. Additionally, the document should specify the corporation's purpose, the registered agent's name and address, and the number of shares the corporation is authorized to issue. Some corporations may also include information about the initial directors and their addresses.

How do I file the Articles of Incorporation?

Filing the Articles of Incorporation can be done online or by mail. For online filing, you can visit the Texas Secretary of State's website, where you will find a user-friendly portal for submitting the form. If you prefer to file by mail, you can download the form, complete it, and send it to the appropriate address along with the required filing fee. Ensure that you keep a copy for your records.

What is the filing fee for the Articles of Incorporation?

The filing fee for the Articles of Incorporation varies depending on the type of corporation being formed. As of October 2023, the standard fee for filing a for-profit corporation is $300, while a non-profit corporation may have a reduced fee. It is advisable to check the Texas Secretary of State's website for the most current fee schedule, as these amounts can change.

How long does it take for the Articles of Incorporation to be processed?

The processing time for the Articles of Incorporation can vary. Generally, online submissions are processed more quickly, often within a few business days. Mail submissions may take longer, sometimes up to several weeks, depending on the volume of filings. If expedited processing is necessary, there may be an option available for an additional fee.

Can I amend the Articles of Incorporation after filing?

Yes, it is possible to amend the Articles of Incorporation after they have been filed. If changes are needed, such as altering the corporation's name or changing the number of authorized shares, you must file an amendment with the Texas Secretary of State. This process requires a separate form and may involve additional fees. It is essential to keep the Articles of Incorporation current to reflect the corporation's operations accurately.

What are the consequences of not filing the Articles of Incorporation?

Failing to file the Articles of Incorporation can have significant consequences. Without this filing, the business does not have legal recognition as a corporation, which means it does not enjoy the benefits of limited liability. This lack of protection exposes the owners to personal liability for the corporation's debts and obligations. Additionally, operating without proper incorporation can lead to penalties and challenges in securing funding or contracts.