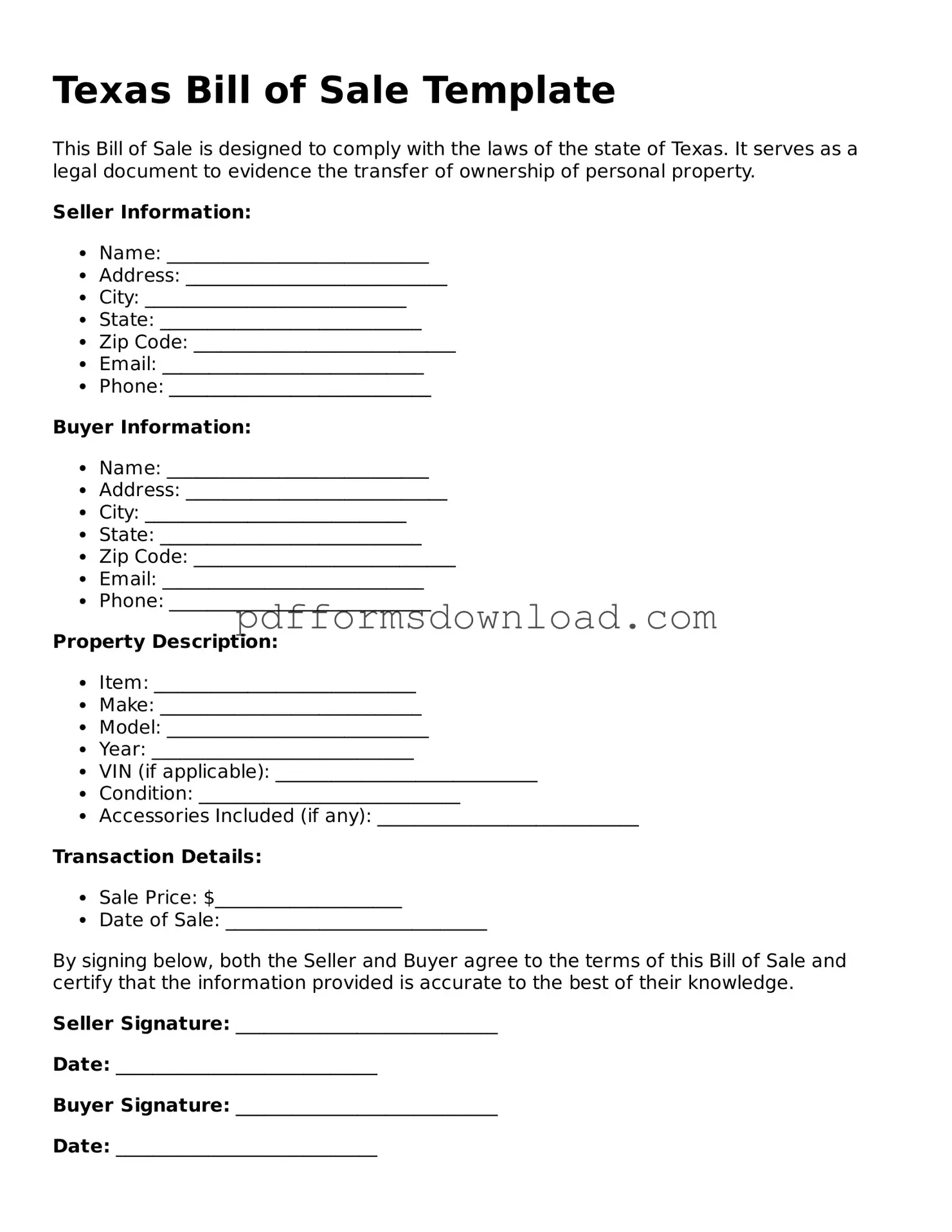

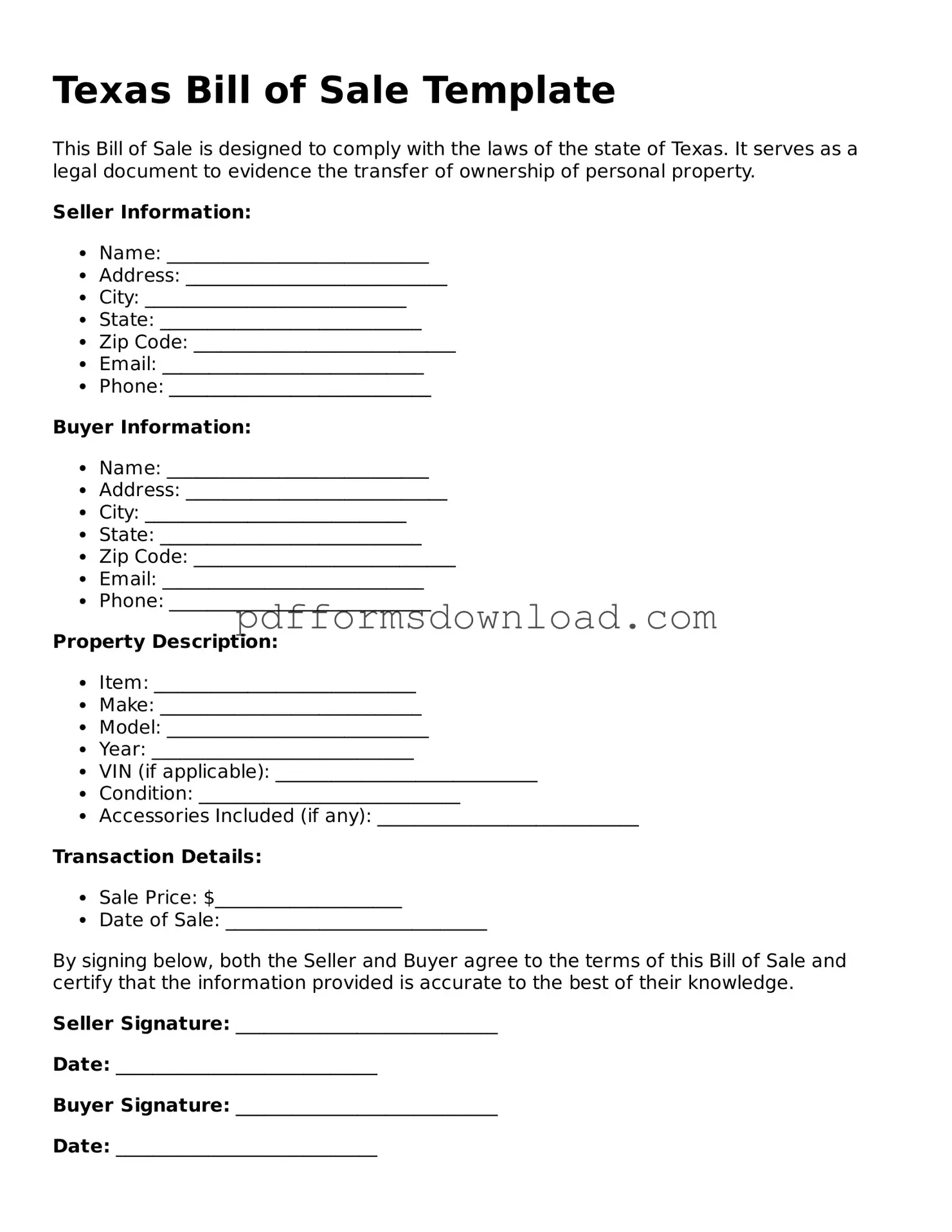

What is a Texas Bill of Sale?

A Texas Bill of Sale is a legal document that records the transfer of ownership of personal property from one party to another. It provides proof of the transaction and can be used for various types of property, including vehicles, boats, and equipment.

Is a Bill of Sale required in Texas?

While a Bill of Sale is not legally required for every transaction in Texas, it is highly recommended. It serves as a record of the sale and can protect both the buyer and seller in case of disputes or misunderstandings in the future.

What information should be included in a Texas Bill of Sale?

A Texas Bill of Sale should include the names and addresses of both the buyer and seller, a description of the item being sold, the sale price, the date of the transaction, and the signatures of both parties. Additional details, like vehicle identification numbers (VIN) for cars, can enhance the document's clarity.

Do I need a notary for a Bill of Sale in Texas?

A notary is not required for a Bill of Sale in Texas. However, having the document notarized can add an extra layer of verification and may be beneficial if the transaction involves a significant amount of money or valuable items.

Can I use a generic Bill of Sale template?

Yes, you can use a generic Bill of Sale template as long as it includes all necessary information specific to your transaction. Ensure that the template complies with Texas laws and accurately reflects the details of the sale.

What if the item being sold is a vehicle?

If the item is a vehicle, the Bill of Sale should include the vehicle's make, model, year, and VIN. Additionally, the seller should provide the buyer with the vehicle's title, which must be signed over to the buyer at the time of sale.

How does a Bill of Sale affect taxes?

A Bill of Sale can have tax implications. In Texas, the buyer is typically responsible for paying sales tax on the purchase price of the item. The seller may need to report the sale on their tax returns, depending on the circumstances.

What should I do if I lose my Bill of Sale?

If you lose your Bill of Sale, it is advisable to recreate the document if possible. Both parties should sign a new Bill of Sale that reflects the original transaction details. Keeping a copy of the document is essential for future reference.

Can a Bill of Sale be used in court?

Yes, a Bill of Sale can be used in court as evidence of the transaction. It can help establish ownership and the terms of the sale if a dispute arises between the buyer and seller.

How long should I keep a Bill of Sale?

It is wise to keep a Bill of Sale for several years, especially for significant transactions. Retaining it can help resolve any future issues related to ownership or warranty claims.