What is a Texas Deed form?

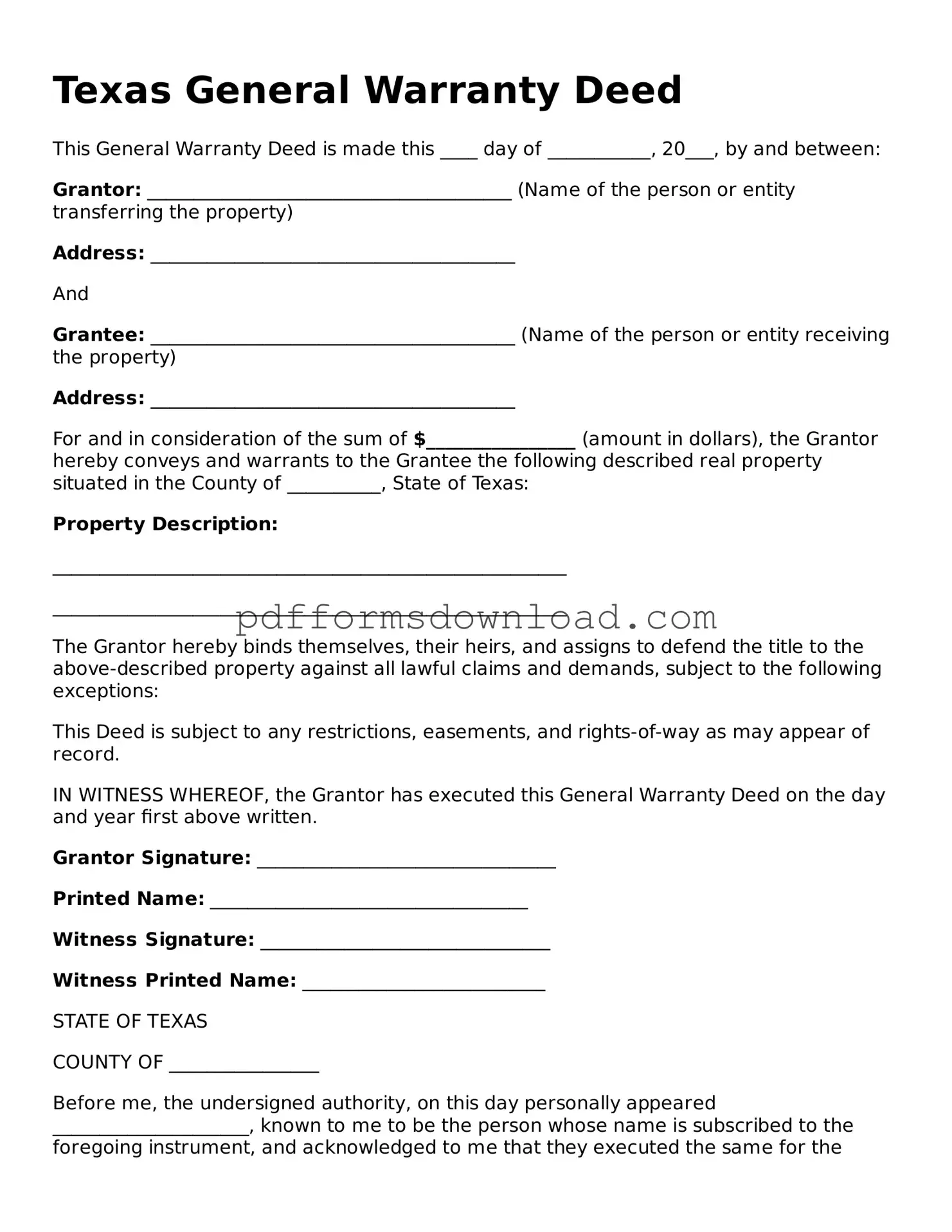

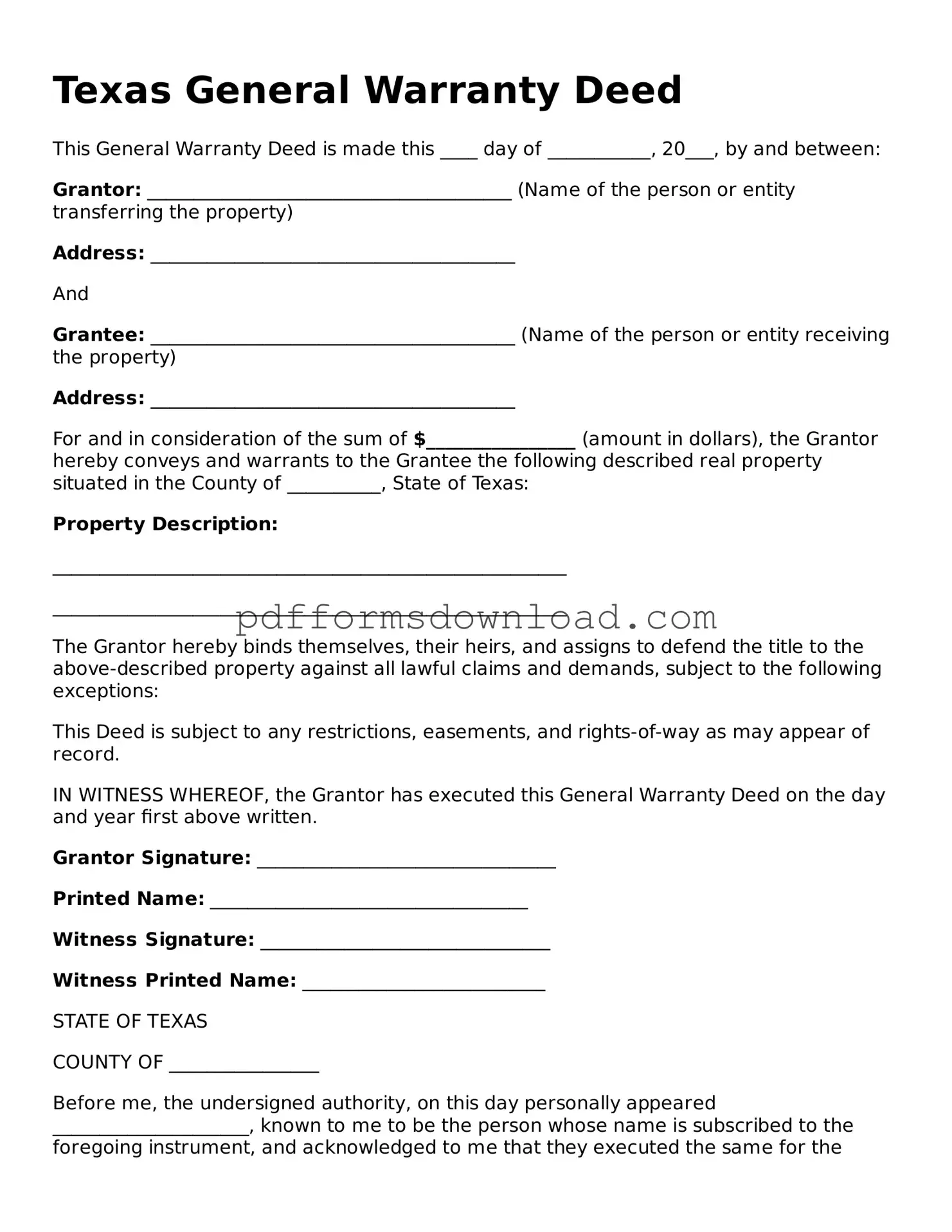

A Texas Deed form is a legal document used to transfer ownership of real property in Texas. This form serves as proof of the transaction and outlines the details of the property being transferred, including its legal description. It also includes information about the parties involved in the transaction, such as the grantor (the person transferring the property) and the grantee (the person receiving the property). The deed must be signed and notarized to be valid and is typically filed with the county clerk's office where the property is located.

What types of Texas Deeds are there?

There are several types of deeds used in Texas, each serving a different purpose. The most common types include the Warranty Deed, which provides a guarantee that the grantor holds clear title to the property and has the right to sell it. The Special Warranty Deed offers a limited guarantee, covering only the period during which the grantor owned the property. A Quitclaim Deed transfers whatever interest the grantor has in the property without any warranties. Understanding the differences between these deeds is crucial for making informed decisions during a property transaction.

Do I need an attorney to prepare a Texas Deed form?

While it is not legally required to have an attorney prepare a Texas Deed form, consulting one is often a wise choice. An attorney can ensure that the deed is correctly drafted, meets all legal requirements, and protects your interests. They can also help clarify any complex issues related to the property, such as liens or encumbrances. If you are unsure about the process or the implications of the deed, seeking legal advice can provide peace of mind.

How do I record a Texas Deed?

To record a Texas Deed, you must first ensure it is properly executed, meaning it has been signed by the grantor and notarized. Once this is complete, you can take the deed to the county clerk’s office in the county where the property is located. There, you will need to pay a recording fee, which varies by county. Recording the deed is essential as it provides public notice of the transfer and protects the grantee's rights to the property. Keep a copy of the recorded deed for your records, as it serves as proof of ownership.