What is a Deed in Lieu of Foreclosure?

A Deed in Lieu of Foreclosure is a legal document that allows a homeowner to voluntarily transfer the title of their property to the lender. This process typically occurs when the homeowner is unable to continue making mortgage payments and wants to avoid the lengthy and costly foreclosure process. By opting for a deed in lieu, the homeowner can settle their mortgage obligation and potentially mitigate damage to their credit score.

How does a Deed in Lieu of Foreclosure work?

In a Deed in Lieu of Foreclosure, the homeowner approaches the lender to discuss their financial situation. If both parties agree, the homeowner signs over the property title to the lender. In return, the lender may agree to forgive the remaining mortgage balance. This arrangement can be beneficial for both sides, as it allows the lender to take possession of the property without going through foreclosure, while the homeowner can avoid the stress and stigma associated with foreclosure.

What are the benefits of a Deed in Lieu of Foreclosure?

One significant benefit is the potential to minimize damage to the homeowner's credit score compared to a foreclosure. Additionally, the process is often quicker and less expensive than a traditional foreclosure. Homeowners may also be able to negotiate terms that allow them to remain in the home for a short period after the deed is signed, providing a smoother transition to new living arrangements.

Are there any drawbacks to a Deed in Lieu of Foreclosure?

Yes, there can be drawbacks. For instance, not all lenders accept a Deed in Lieu of Foreclosure, so homeowners may find themselves limited in their options. Additionally, homeowners may still face tax implications on any forgiven debt, as the IRS may consider it taxable income. It's essential to consult with a tax advisor to understand the full financial impact.

Who qualifies for a Deed in Lieu of Foreclosure?

Generally, homeowners who are struggling to make mortgage payments and are facing financial hardship may qualify. However, each lender has its own criteria, which can include the homeowner's payment history, the property's condition, and the overall market value. It's crucial for homeowners to communicate openly with their lender to determine eligibility.

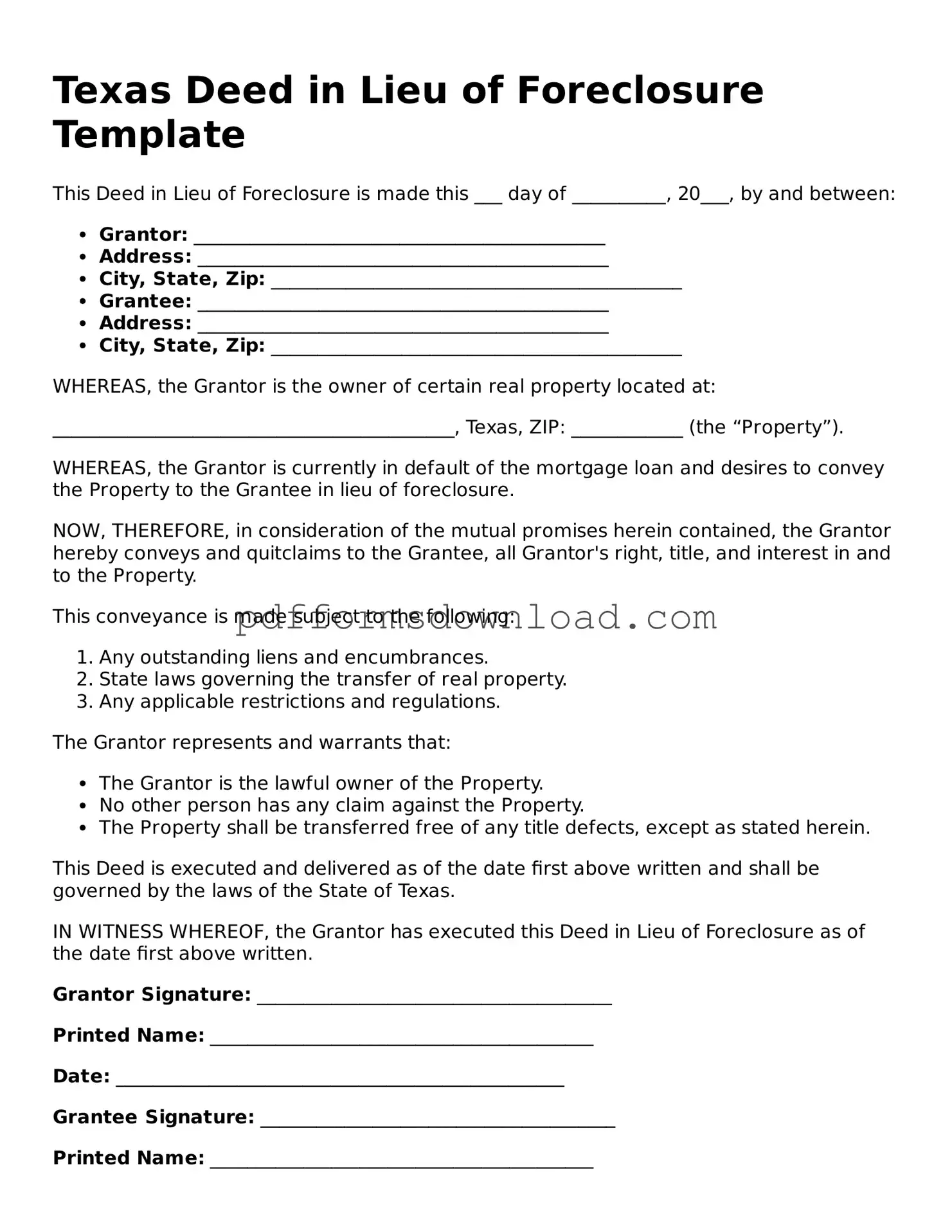

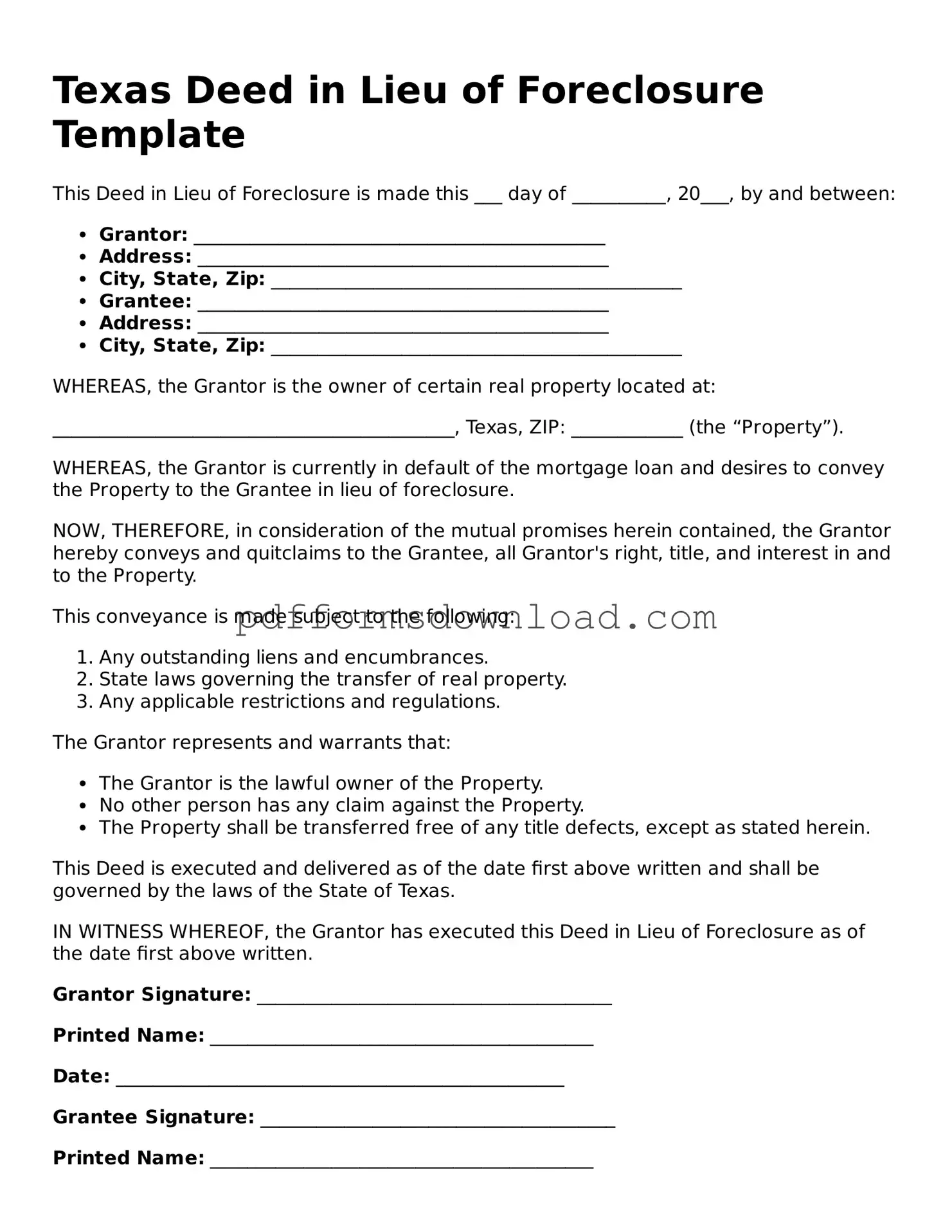

What steps should a homeowner take to initiate a Deed in Lieu of Foreclosure?

First, the homeowner should gather all relevant financial documents, including mortgage statements and proof of income. Next, they should reach out to their lender to discuss their situation. If the lender is open to the idea, the homeowner will need to fill out the necessary paperwork and may have to provide additional documentation to complete the process.

Can a homeowner remain in their home after signing a Deed in Lieu of Foreclosure?

In some cases, homeowners may be allowed to stay in their home for a short period after signing the deed. This arrangement, often referred to as a "leaseback," can provide the homeowner with time to find alternative housing. However, this is not guaranteed and depends on the lender's policies and the specific circumstances of the situation.

How does a Deed in Lieu of Foreclosure affect credit scores?

While a Deed in Lieu of Foreclosure can be less damaging than a foreclosure, it will still impact the homeowner's credit score. The extent of the impact can vary based on the homeowner's credit history and the lender's reporting practices. Typically, homeowners can expect a drop in their score, but it may be less severe than what they would experience with a foreclosure.

Is legal assistance recommended for a Deed in Lieu of Foreclosure?

Yes, seeking legal assistance can be beneficial. An attorney can help homeowners navigate the complexities of the process, ensuring that their rights are protected and that they fully understand the implications of the deed. Legal counsel can also assist in negotiating terms with the lender, potentially leading to a more favorable outcome for the homeowner.