What is the Texas Employment Verification form?

The Texas Employment Verification form is a document used to confirm an individual's employment status in Texas. Employers complete this form to provide proof of employment for various purposes, such as loan applications, background checks, or government assistance programs.

Who needs to fill out the Texas Employment Verification form?

Typically, the employer fills out this form at the request of an employee. Employees may need it for job applications, financial transactions, or other situations requiring proof of their employment status.

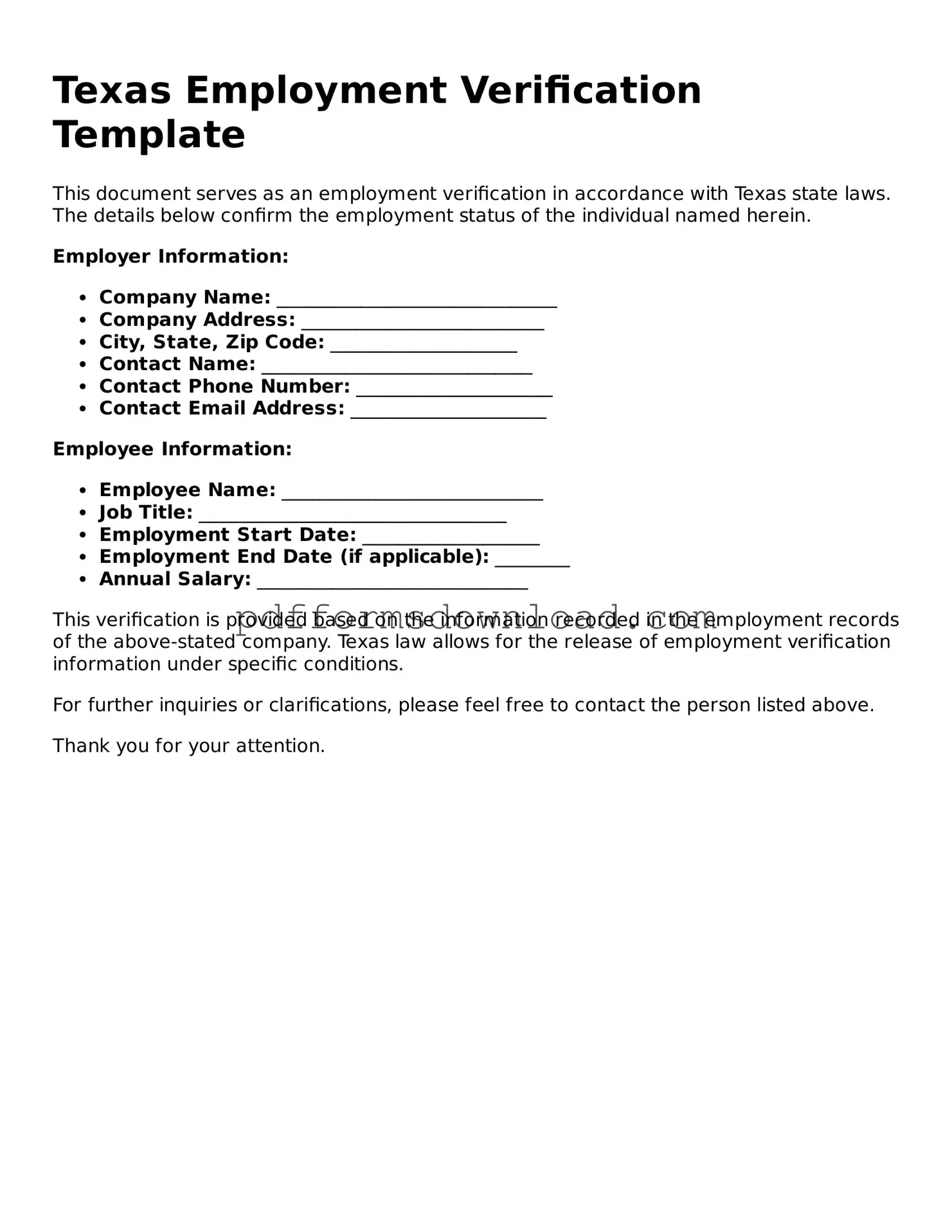

What information is required on the form?

The form usually requires basic information such as the employee's name, job title, dates of employment, and salary details. Employers may also need to include their contact information and the company’s name.

How do I request an Employment Verification form?

Can I complete the form myself?

No, the Texas Employment Verification form must be completed by the employer. The employer's signature is essential for the document to be valid. Employees can provide necessary details, but the final verification must come from the employer.

Is there a fee for obtaining the Employment Verification form?

Generally, there should not be a fee for obtaining this form. Employers typically provide it as part of their standard employment practices. However, some companies may have specific policies regarding requests, so it’s best to check with your HR department.

How long does it take to receive the completed form?

The time it takes to receive the completed Employment Verification form can vary. It usually depends on the employer's policies and workload. It’s reasonable to expect it within a few business days, but you should follow up if you haven’t received it in a timely manner.

What should I do if my employer refuses to complete the form?

If your employer refuses to complete the form, first ask for the reason. They may have specific policies or concerns. If you believe you have a right to the verification, consider discussing the issue with HR or seeking advice from a legal consultant.

Can the form be used for purposes outside of employment verification?

The Texas Employment Verification form is specifically designed for employment verification. Using it for other purposes may not be appropriate. If you need verification for a different reason, you should consult your employer for guidance on the proper documentation to use.