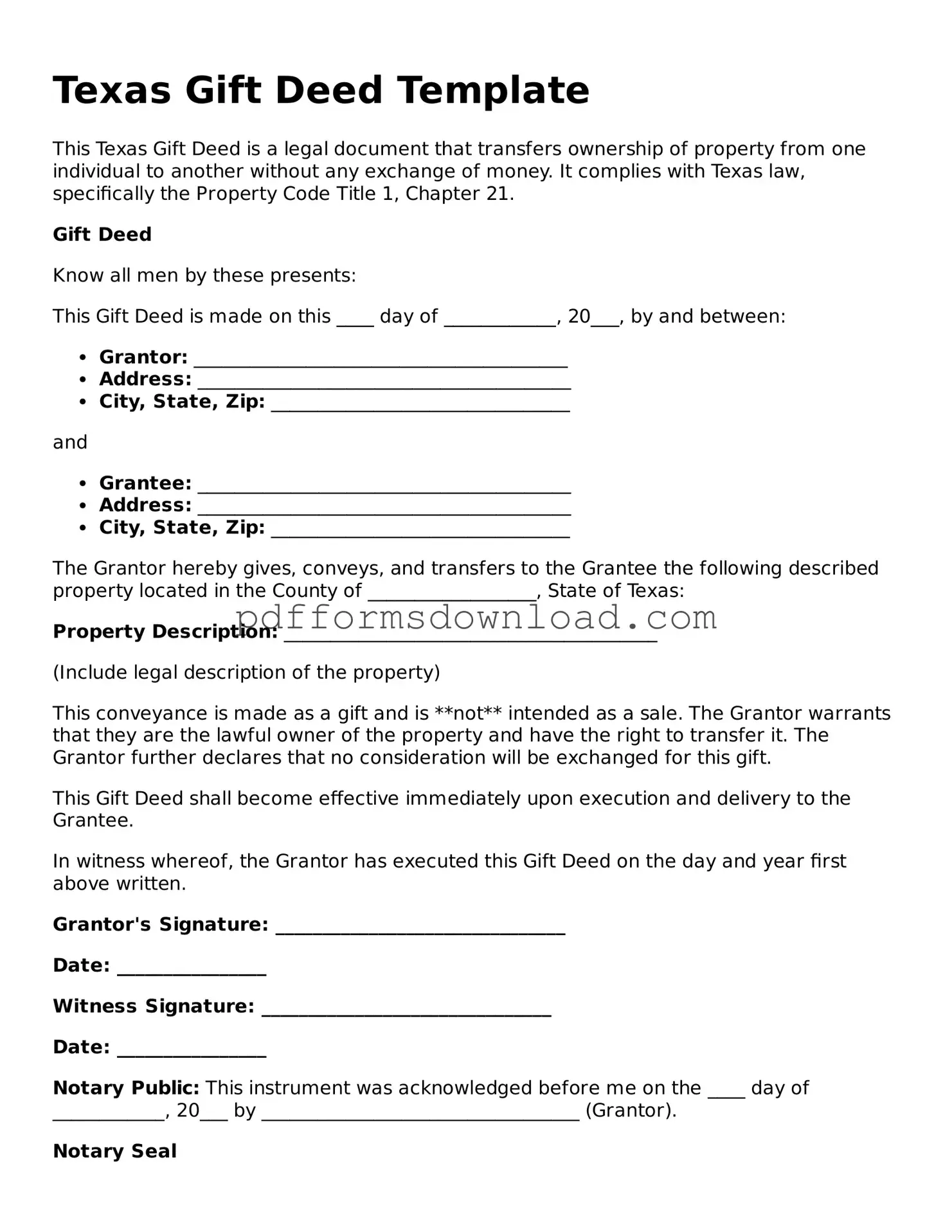

What is a Texas Gift Deed?

A Texas Gift Deed is a legal document used to transfer ownership of real property from one person to another without any exchange of money. This type of deed is commonly utilized when a property owner wishes to give their property as a gift to a family member or friend. The deed must be executed properly to ensure that the transfer is legally recognized.

Who can create a Gift Deed in Texas?

Any property owner in Texas can create a Gift Deed, provided they have the legal capacity to do so. This typically means that the person must be at least 18 years old and mentally competent. The donor, or the person giving the gift, must also be the legal owner of the property being transferred.

What information is required in a Texas Gift Deed?

A Texas Gift Deed should include several key pieces of information. This includes the names and addresses of both the donor and the recipient, a legal description of the property being gifted, and a statement indicating that the property is being given as a gift. Additionally, the deed must be signed by the donor and acknowledged by a notary public.

Is consideration necessary for a Gift Deed?

No, consideration is not necessary for a Gift Deed. Unlike a sale, where money is exchanged, a gift is given voluntarily without any expectation of receiving something in return. This is one of the defining characteristics of a gift, and it is important to clearly state that the transfer is a gift in the deed itself.

Do I need to file the Gift Deed with the county?

Yes, it is advisable to file the Gift Deed with the county clerk’s office where the property is located. Filing the deed provides public notice of the transfer and helps to establish the new owner’s legal rights to the property. It is important to keep a copy of the filed deed for personal records as well.

Are there any tax implications when gifting property in Texas?

Gifting property can have tax implications, particularly regarding gift taxes. The IRS allows individuals to gift a certain amount each year without incurring gift taxes. As of 2023, this limit is $17,000 per recipient. If the value of the property exceeds this amount, the donor may need to file a gift tax return. It is wise to consult with a tax professional for specific guidance.

Can a Gift Deed be revoked?

Once a Gift Deed is executed and delivered, it generally cannot be revoked. The transfer of ownership is considered complete. However, if the donor retains certain rights or interests in the property, such as a life estate, it may be possible to challenge the gift under specific circumstances. Legal advice may be necessary to navigate these situations.

What happens if the donor dies after executing a Gift Deed?

If the donor passes away after executing a Gift Deed, the property typically remains with the recipient, as ownership has already transferred. However, if the donor had outstanding debts or if the property was part of a larger estate plan, it may be subject to probate. Consulting with an estate attorney can provide clarity on the implications of the donor’s death on the gifted property.

Can I use a Gift Deed to transfer property to a trust?

Yes, a Gift Deed can be used to transfer property to a trust. This is often done for estate planning purposes. When transferring property to a trust, it is crucial to ensure that the trust is properly established and that the deed reflects the trust's name as the recipient. Legal assistance can help navigate the complexities of this process.