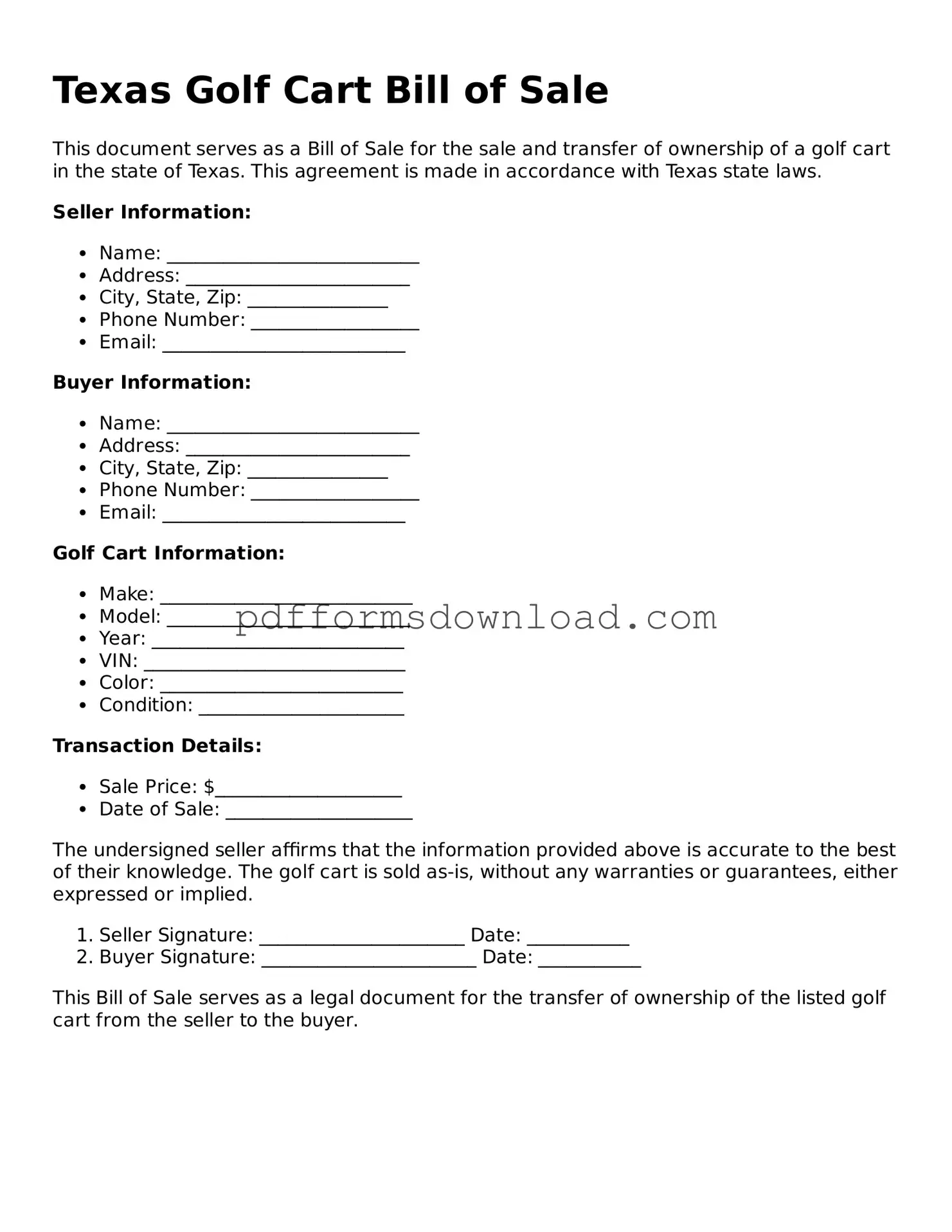

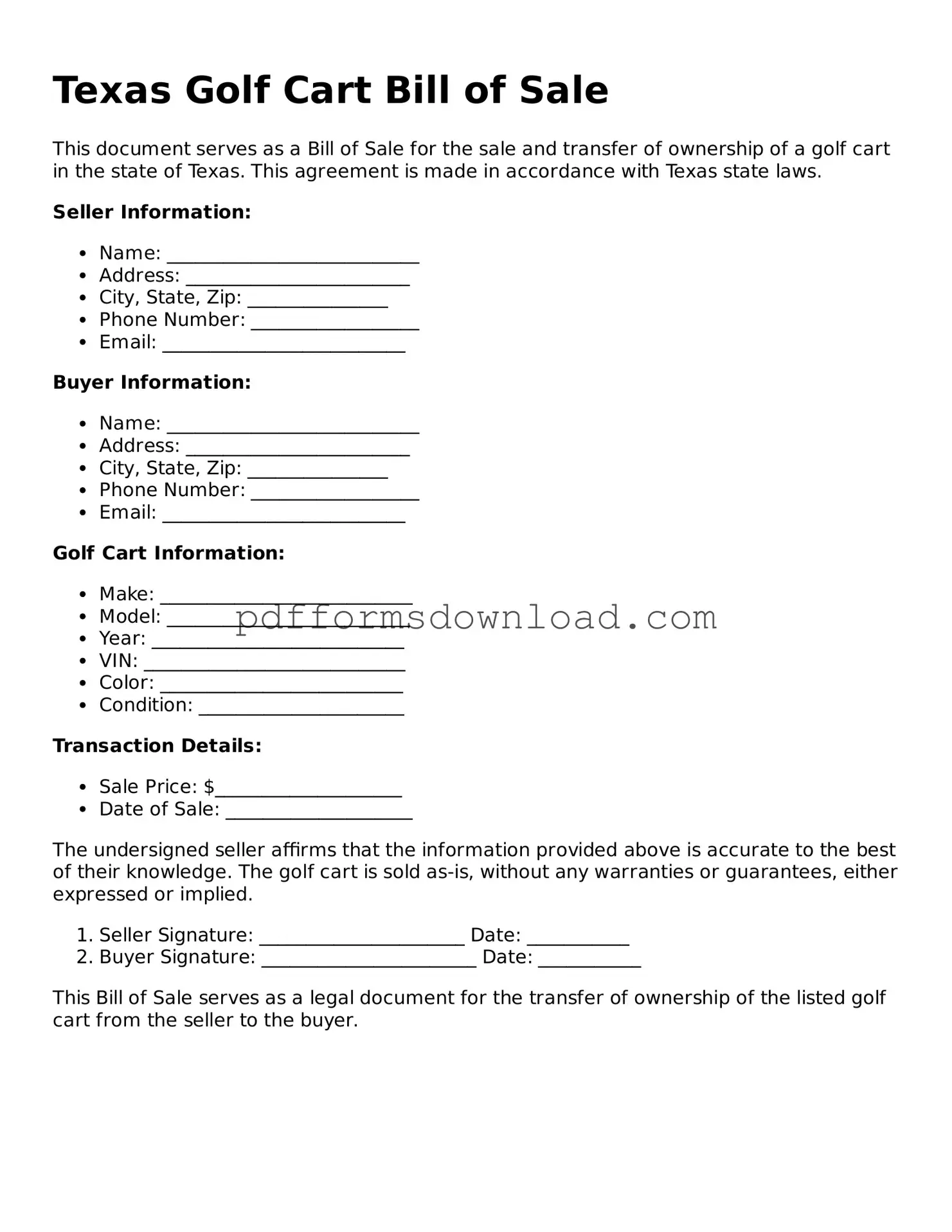

Printable Texas Golf Cart Bill of Sale Form

The Texas Golf Cart Bill of Sale form is a legal document used to record the sale and transfer of ownership of a golf cart in Texas. This form helps both buyers and sellers ensure that the transaction is clear and documented properly. To make the process easier, consider filling out the form by clicking the button below.

Make This Document Now

Printable Texas Golf Cart Bill of Sale Form

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your Golf Cart Bill of Sale online — edit, save, and download easily.