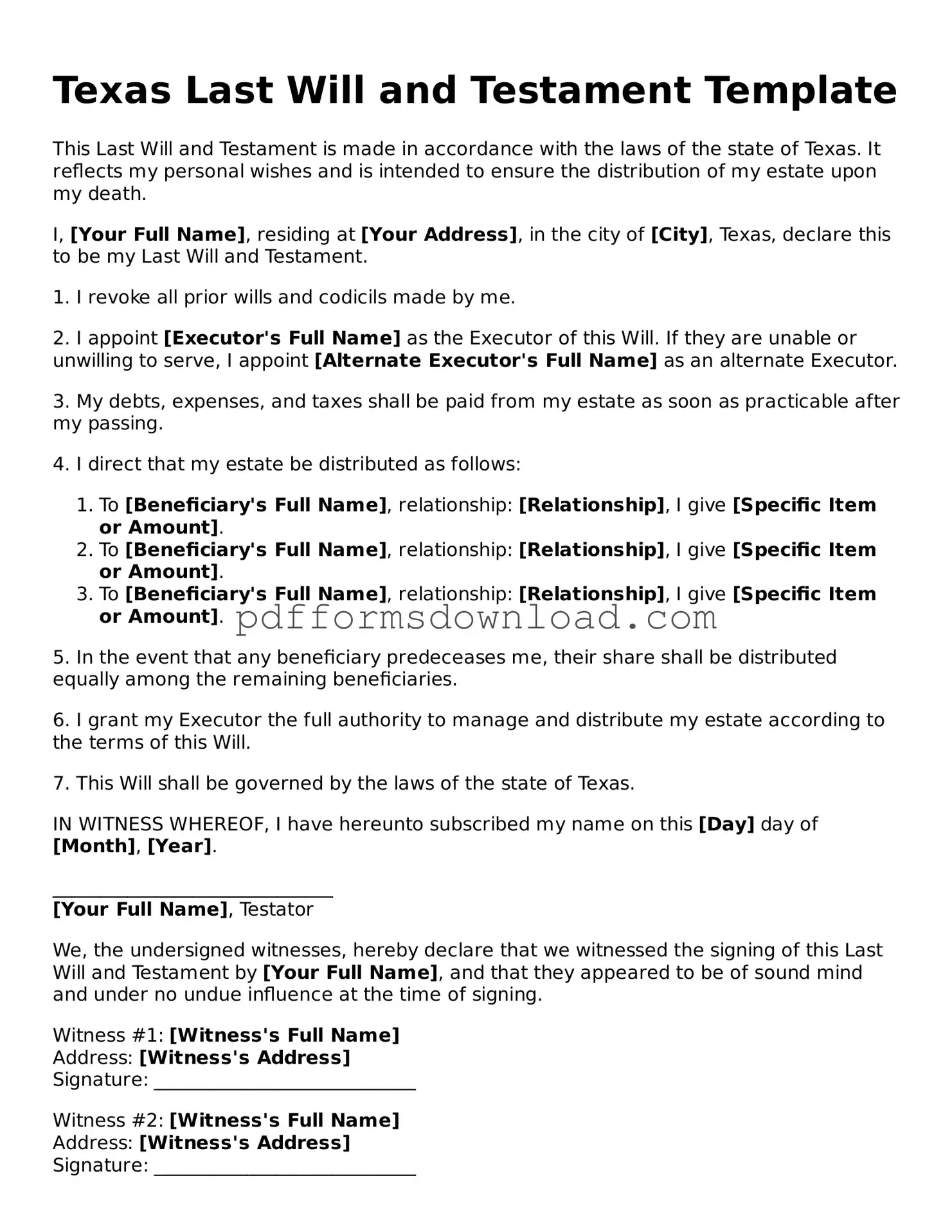

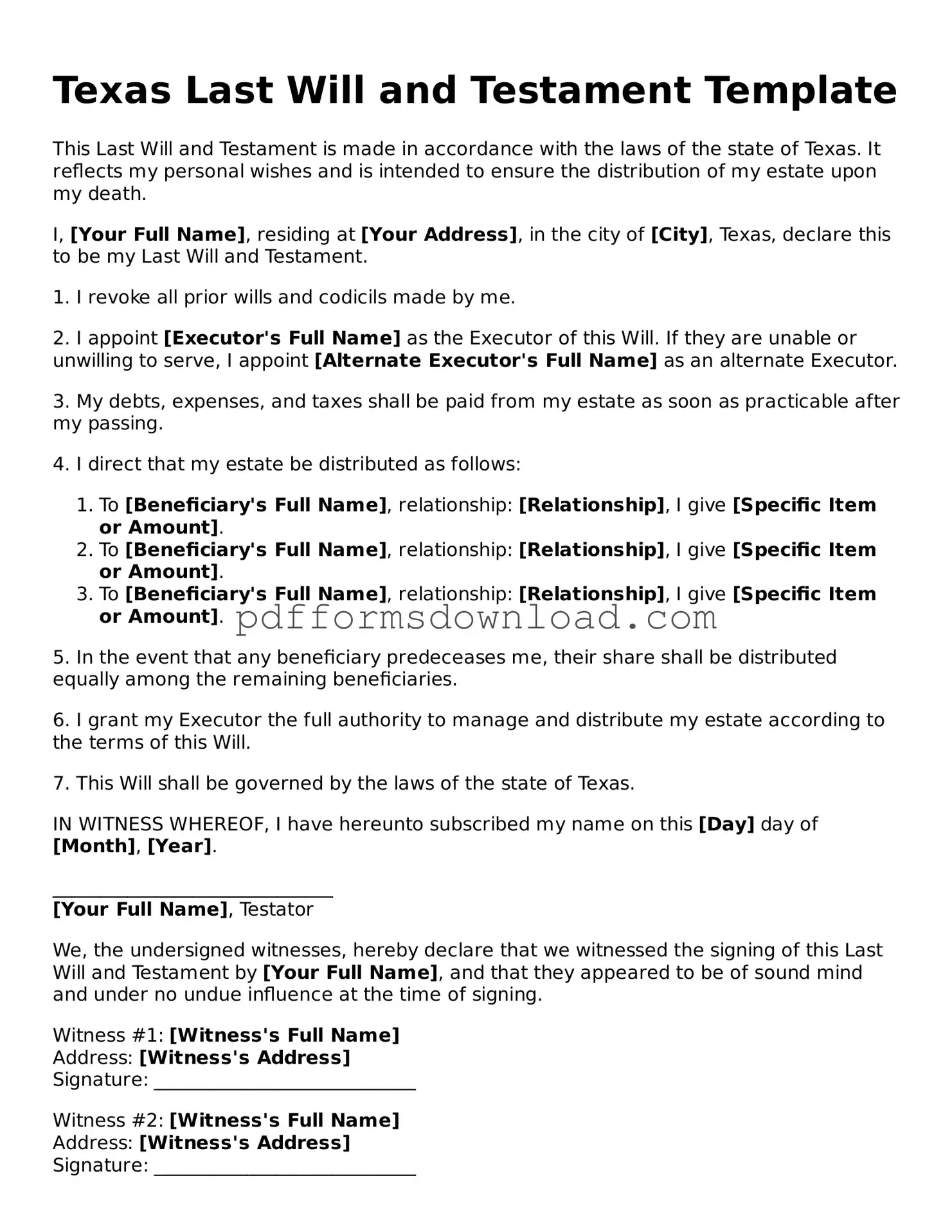

What is a Last Will and Testament in Texas?

A Last Will and Testament is a legal document that outlines how a person's assets and property should be distributed after their death. In Texas, this document also allows you to appoint guardians for minor children and name an executor to manage the estate. It ensures that your wishes are respected and can help avoid disputes among family members.

Who can create a Last Will and Testament in Texas?

Any adult who is at least 18 years old and of sound mind can create a Last Will and Testament in Texas. This means you must understand what you are doing and the consequences of your decisions. If you are married, you may also want to consider how your will interacts with your spouse's will.

What are the requirements for a valid will in Texas?

To be valid in Texas, a will must be in writing, signed by the person creating it (the testator), and witnessed by at least two people. These witnesses should not be beneficiaries of the will to avoid conflicts of interest. If these requirements are met, the will is generally considered valid.

Can I change my Last Will and Testament after it is created?

Yes, you can change your will at any time while you are alive and of sound mind. This is often done through a codicil, which is an amendment to the original will. Alternatively, you can create an entirely new will, which should explicitly revoke the previous one. Always ensure that any changes comply with Texas law.

What happens if I die without a will in Texas?

If you die without a will, your estate will be distributed according to Texas intestacy laws. This means the state will decide how your assets are divided, which may not align with your wishes. Generally, your property will go to your closest relatives, but the distribution may vary based on your family situation.

Can I write my own will in Texas?

Yes, you can write your own will in Texas, as long as it meets the legal requirements. However, doing so can be risky if you are not familiar with the laws. Mistakes can lead to confusion or disputes after your death. It is often advisable to consult with an attorney to ensure your will is properly drafted and executed.

What is the role of an executor in a will?

The executor is the person responsible for managing your estate after your death. This includes paying debts, distributing assets according to your will, and handling any legal matters. Choosing a trustworthy and organized person as your executor is crucial, as they will play a significant role in carrying out your wishes.

How can I ensure my will is properly executed?

To ensure your will is properly executed, follow Texas legal requirements closely. Have it signed in front of two witnesses who are not beneficiaries. Keep the original document in a safe place and inform your executor about its location. It may also be helpful to keep a copy with your attorney or in a safety deposit box.

Can I revoke my will verbally?

No, a will cannot be revoked verbally in Texas. To revoke a will, you must either create a new will that explicitly states the previous will is revoked or destroy the original will with the intention of revoking it. Written documentation is necessary to avoid confusion and ensure your wishes are clear.