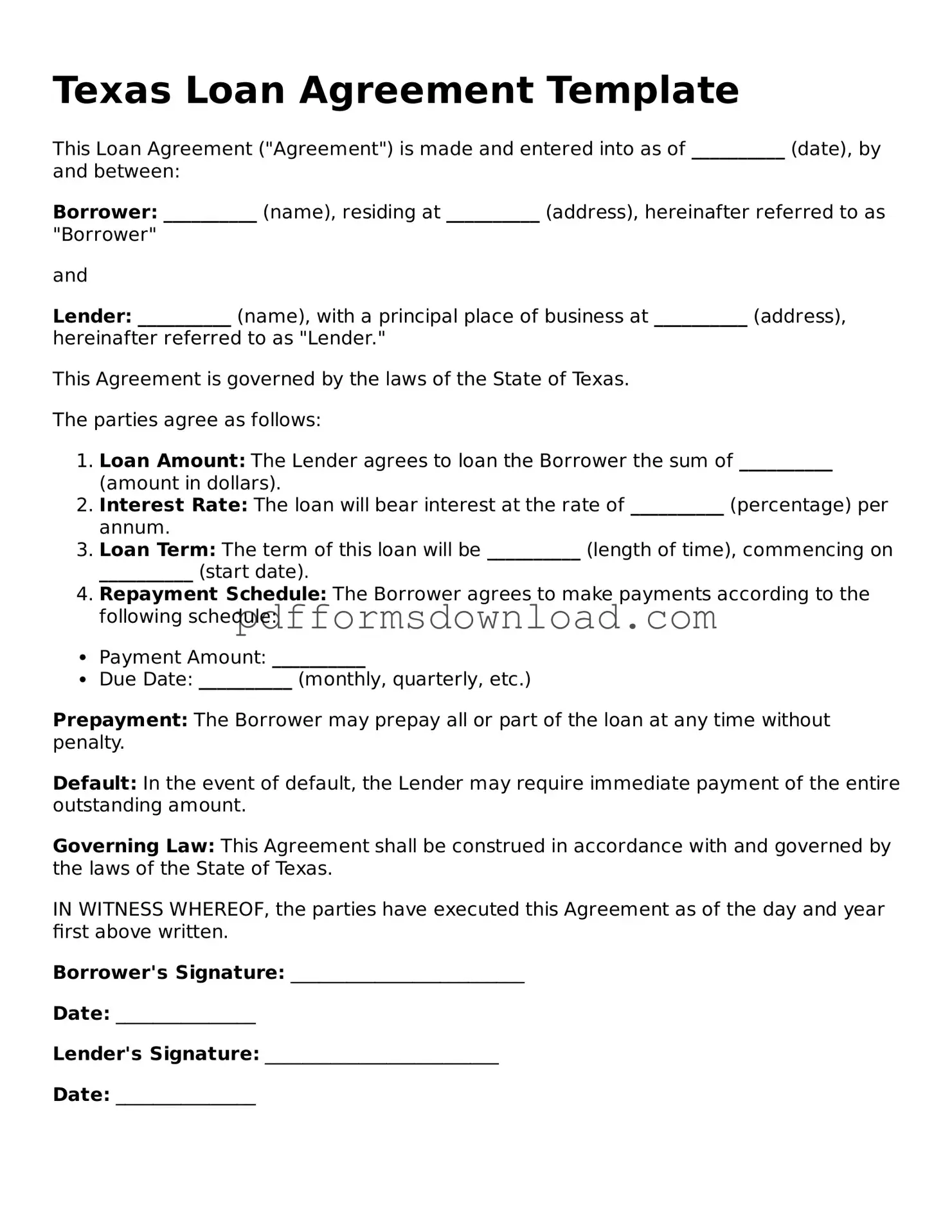

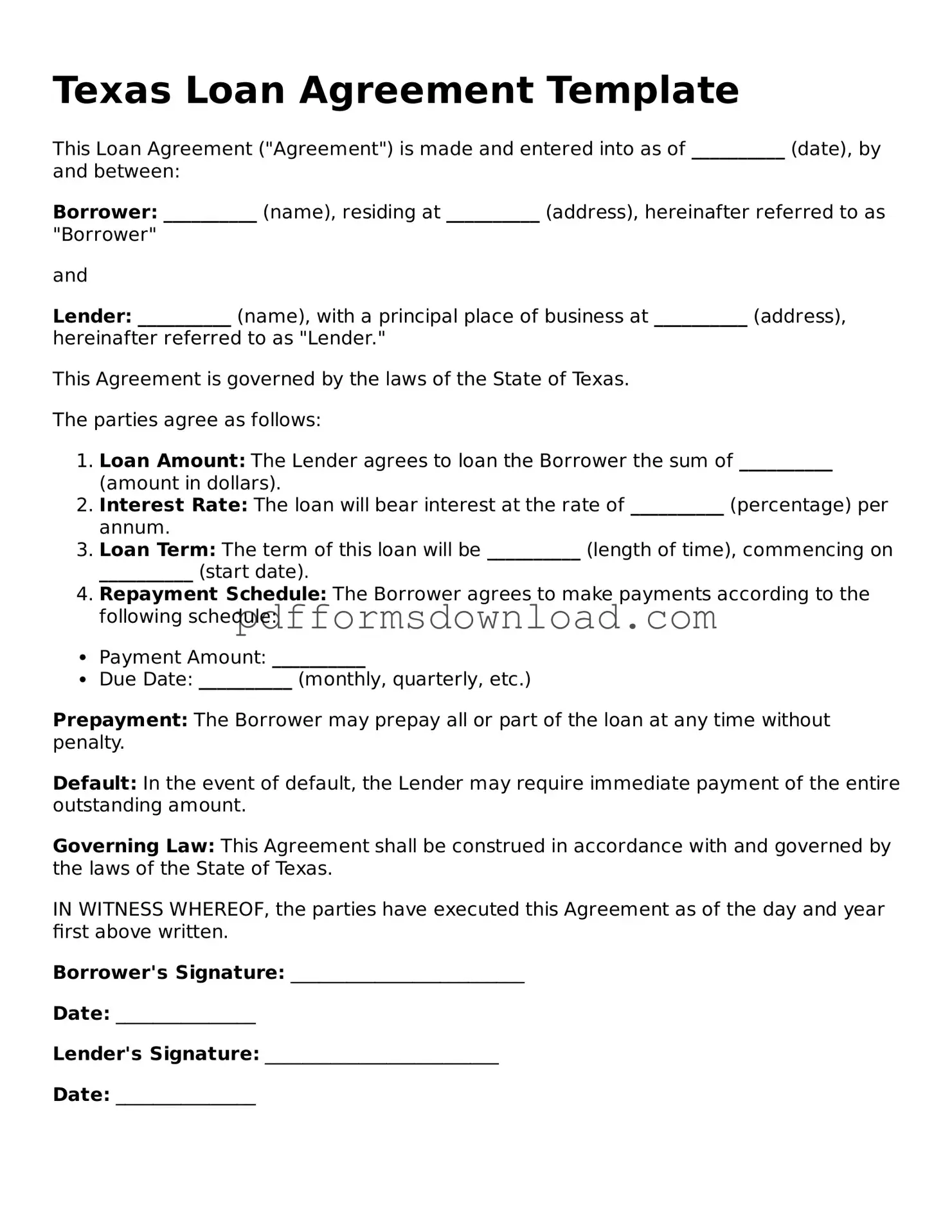

What is a Texas Loan Agreement form?

A Texas Loan Agreement form is a legal document that outlines the terms and conditions under which a loan is made between a lender and a borrower in Texas. It details the amount borrowed, interest rates, repayment schedule, and any collateral involved. This form helps protect both parties by clearly stating their rights and obligations.

Who can use a Texas Loan Agreement form?

Anyone who is lending or borrowing money in Texas can use this form. This includes individuals, businesses, and financial institutions. It’s important for both parties to understand the terms before signing, ensuring that they are comfortable with the agreement.

What information is typically included in the form?

The form usually includes the names and addresses of the lender and borrower, the loan amount, interest rate, repayment terms, and any fees or penalties for late payments. It may also specify whether the loan is secured or unsecured, and if collateral is required.

Do I need a lawyer to create a Texas Loan Agreement?

While it’s not mandatory to have a lawyer draft a Texas Loan Agreement, it can be beneficial. A legal professional can help ensure that the document complies with Texas law and meets both parties’ needs. If you’re unsure about any terms, consulting a lawyer is a wise choice.

Can the terms of the loan be changed after signing the agreement?

Yes, the terms can be changed, but both parties must agree to any modifications. It’s best to document any changes in writing and have both parties sign off on the new terms. This helps avoid misunderstandings later on.

What happens if the borrower fails to repay the loan?

If the borrower fails to repay the loan as agreed, the lender may take legal action to recover the owed amount. This could include filing a lawsuit or, if the loan is secured, taking possession of the collateral. It’s crucial for both parties to understand the consequences of defaulting on the loan.

Is a Texas Loan Agreement form legally binding?

Yes, once both parties sign the Texas Loan Agreement, it becomes a legally binding contract. This means that both the lender and borrower are obligated to adhere to the terms outlined in the agreement. If either party does not comply, the other party may seek legal recourse.

Where can I obtain a Texas Loan Agreement form?

You can find Texas Loan Agreement forms online through legal document websites or local legal offices. Ensure that you choose a reputable source to get a form that complies with Texas laws. Customizing a template to fit your specific situation is often a good approach.

Are there any specific laws governing loan agreements in Texas?

Yes, Texas has specific laws that govern loan agreements, including interest rate limits and requirements for written agreements. It’s essential to be aware of these laws to ensure that your loan agreement is valid and enforceable. Familiarizing yourself with Texas lending laws can help protect your interests.