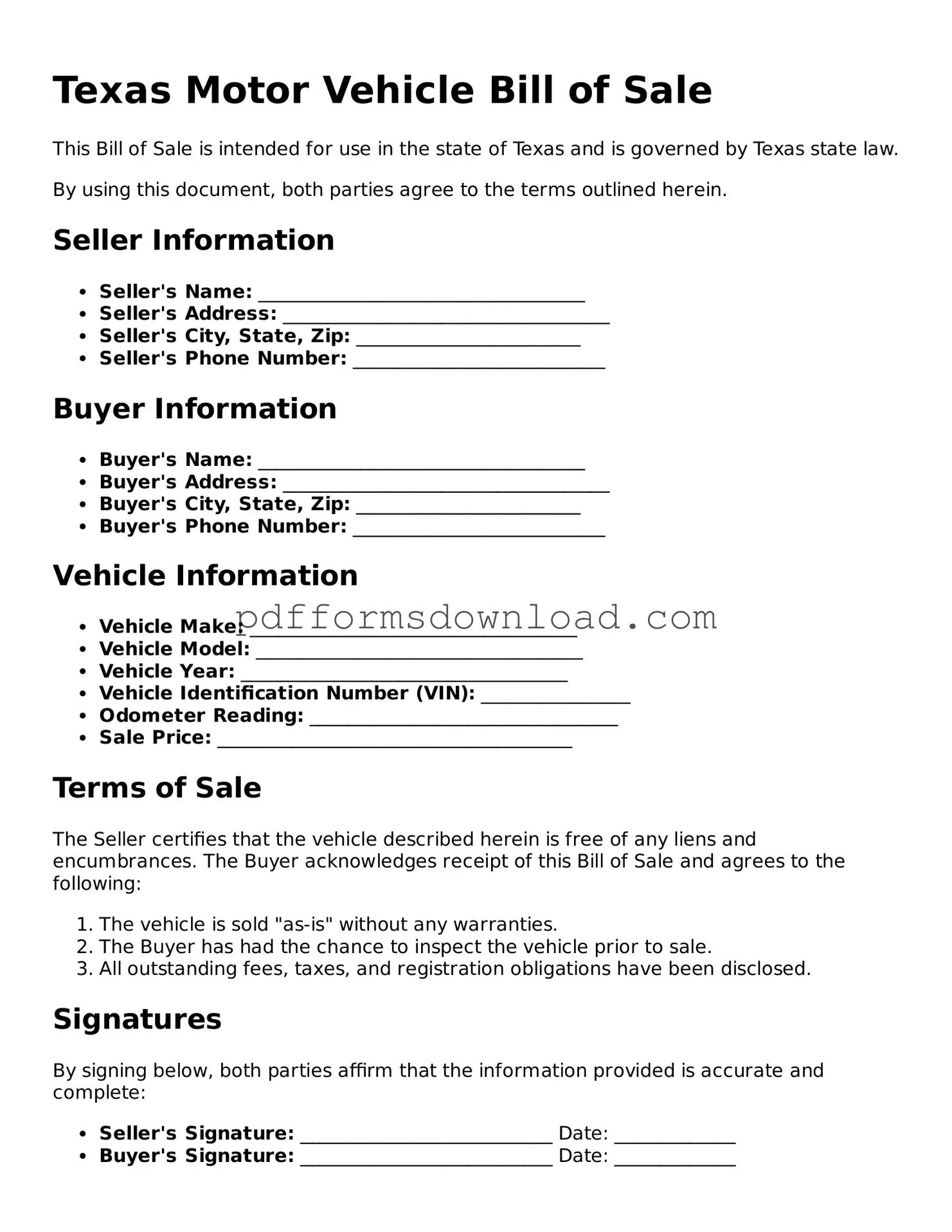

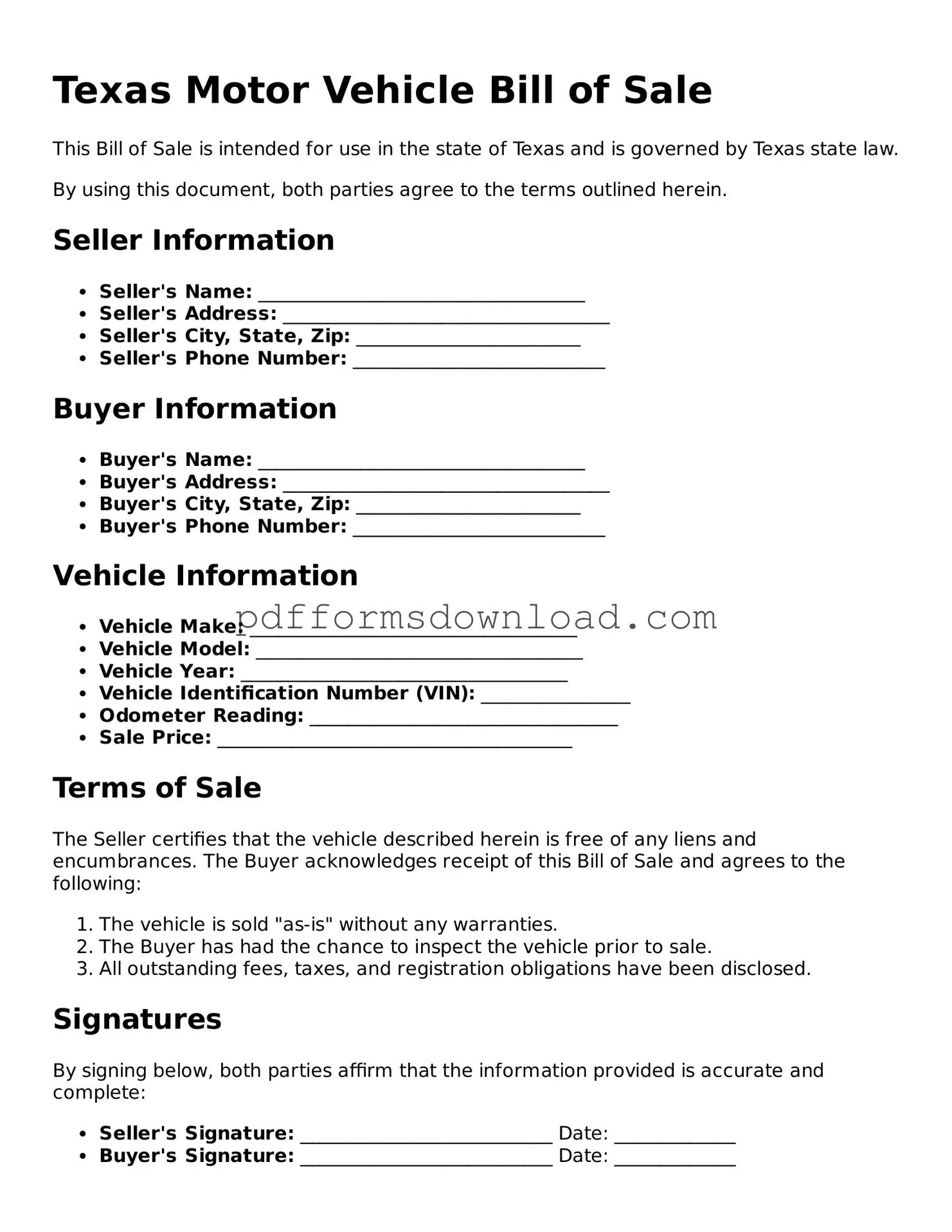

What is a Texas Motor Vehicle Bill of Sale?

A Texas Motor Vehicle Bill of Sale is a legal document that records the sale of a vehicle from one party to another. It serves as proof of the transaction and includes important details about the vehicle, the buyer, and the seller. This document is essential for transferring ownership and is often required for vehicle registration with the Texas Department of Motor Vehicles (DMV).

Why do I need a Bill of Sale when buying or selling a vehicle?

The Bill of Sale protects both the buyer and the seller. For the buyer, it provides proof of ownership and can be used to register the vehicle. For the seller, it serves as evidence that they have transferred ownership and are no longer responsible for the vehicle. This document can help prevent disputes about the sale and clarify the terms agreed upon by both parties.

What information is required on the Texas Motor Vehicle Bill of Sale?

The Bill of Sale should include several key pieces of information. This includes the names and addresses of both the buyer and seller, the vehicle's make, model, year, and Vehicle Identification Number (VIN). Additionally, the sale price and date of the transaction should be clearly stated. Including any warranties or conditions of the sale can also be beneficial.

Is a Bill of Sale required to register a vehicle in Texas?

While a Bill of Sale is not strictly required for vehicle registration in Texas, it is highly recommended. The DMV may request this document to verify the sale and ownership transfer. Having a Bill of Sale can help ensure a smoother registration process and provide peace of mind for both parties involved in the transaction.

Can I create my own Bill of Sale, or do I need a specific form?

You can create your own Bill of Sale as long as it includes all necessary information. However, using a standard form can make the process easier and ensure that you don’t miss any important details. The Texas DMV provides a template that you can use, or you can find various forms online. Just make sure that the form meets the legal requirements for your sale.

Do I need to have the Bill of Sale notarized?

In Texas, notarization of the Bill of Sale is not a requirement. However, having it notarized can add an extra layer of authenticity and may be beneficial if disputes arise in the future. It can also help in situations where proof of the transaction is necessary.

What should I do with the Bill of Sale after the sale is completed?

After the sale, both the buyer and seller should keep a copy of the Bill of Sale for their records. The buyer will need it for vehicle registration, while the seller should retain it as proof of the transaction. Keeping these documents organized can help in case any issues come up later.

Can I use a Bill of Sale for a vehicle that I inherited?

Yes, a Bill of Sale can be used for a vehicle that you inherited. However, you may also need to provide additional documentation to prove ownership, such as a death certificate or a will. It’s important to check with the Texas DMV for any specific requirements related to inherited vehicles to ensure a smooth registration process.