What is a prenuptial agreement in Texas?

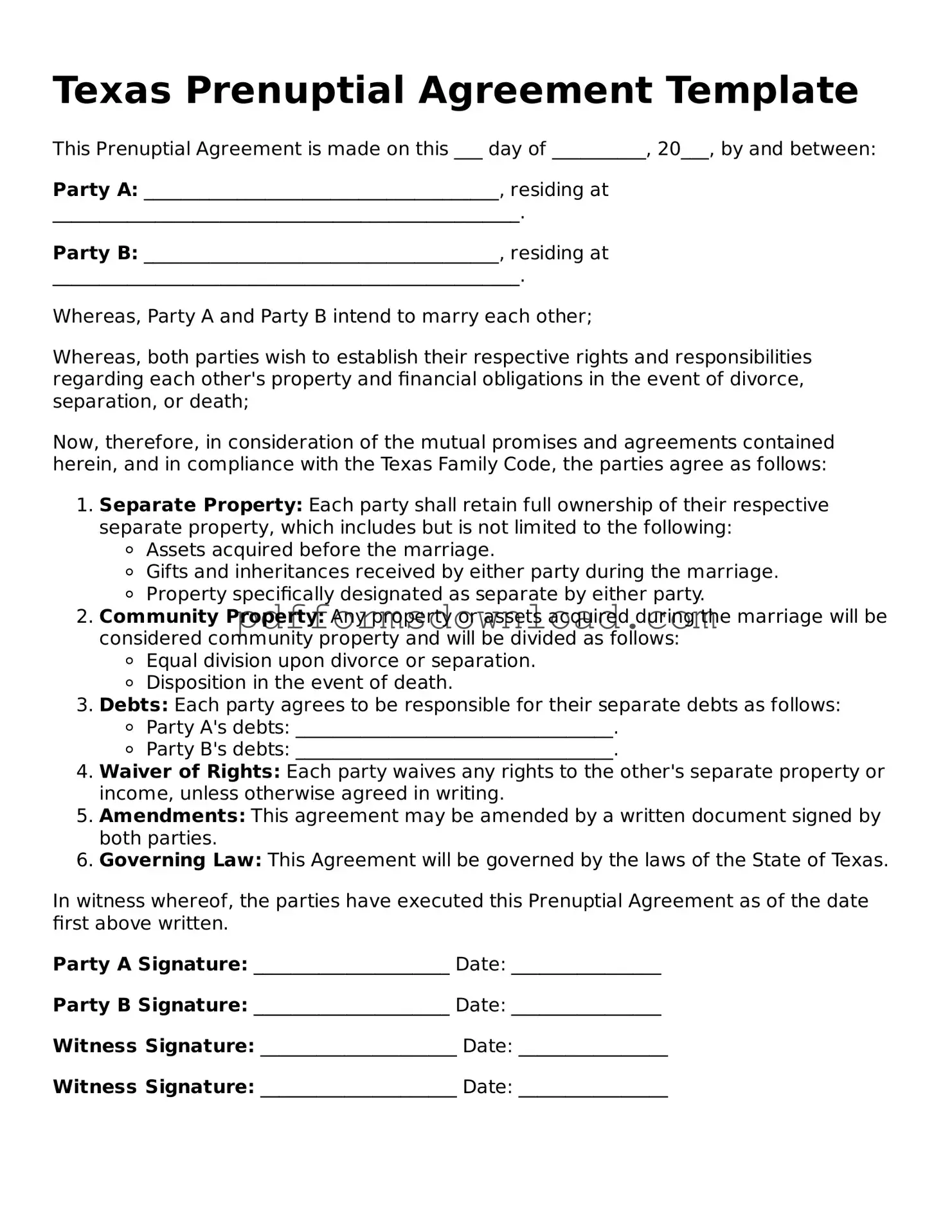

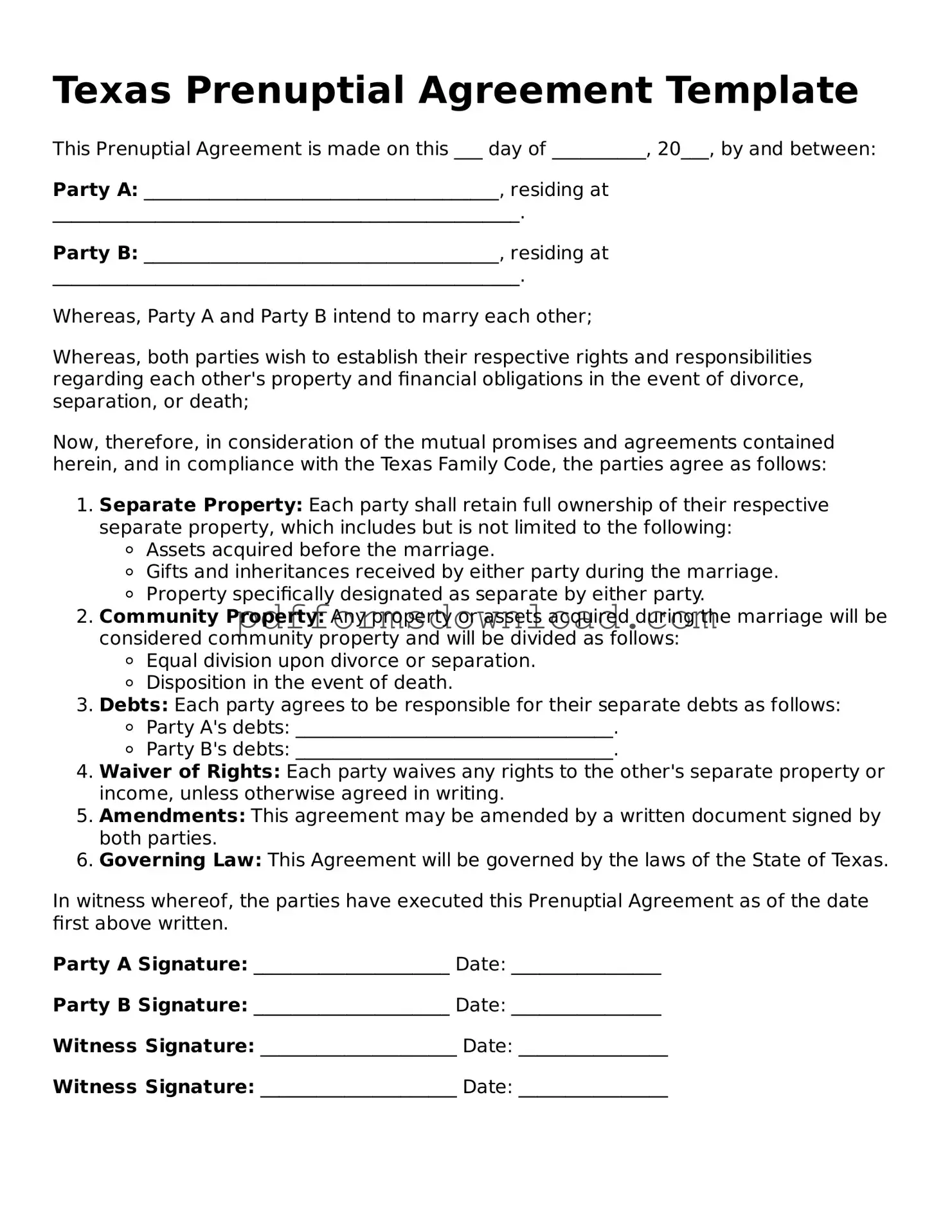

A prenuptial agreement, often called a prenup, is a legal document that a couple signs before getting married. It outlines how assets and debts will be divided in the event of a divorce or separation. In Texas, this agreement can also address issues like spousal support and property rights.

Why should I consider a prenuptial agreement?

Many people choose to create a prenup to protect their individual assets, clarify financial responsibilities, and set expectations for the marriage. It can be particularly important for those entering a second marriage, those with significant assets, or those with children from previous relationships.

What can be included in a Texas prenuptial agreement?

You can include a variety of topics in your prenup. Common items are the division of property, management of debts, and spousal support. You can also address how future earnings and inheritances will be handled. However, certain matters, like child custody and child support, cannot be predetermined in a prenup.

Is a prenuptial agreement enforceable in Texas?

Yes, a prenup is enforceable in Texas as long as it meets certain legal requirements. Both parties must voluntarily sign the agreement, and it must be in writing. It’s also crucial that both parties fully disclose their financial situations before signing.

How do we create a prenuptial agreement in Texas?

Creating a prenup involves several steps. First, both partners should discuss their financial situations and what they want to include in the agreement. Then, it’s advisable to consult with separate legal counsel to ensure that both parties understand their rights. Finally, the agreement should be drafted, reviewed, and signed well before the wedding date.

Can a prenuptial agreement be changed after marriage?

Yes, a prenup can be modified or revoked after marriage. Both parties must agree to the changes, and it’s best to document these changes in writing. Consulting with legal counsel during this process is recommended to ensure that the updated agreement is valid.

What happens if we don’t have a prenuptial agreement?

If you don’t have a prenup and later divorce, Texas law will determine how your assets and debts are divided. This may not align with your preferences. The court will generally divide community property equally, while separate property will remain with the original owner.

How much does it cost to create a prenuptial agreement in Texas?

The cost of creating a prenup can vary widely depending on the complexity of your situation and the attorney’s fees. Generally, you might expect to pay anywhere from a few hundred to several thousand dollars. Investing in a prenup can save you money and stress in the long run.

Do we need lawyers for a prenuptial agreement?

While it’s not legally required to have lawyers, it is highly recommended. Having separate legal counsel helps ensure that both parties understand the agreement and that it is fair. This can also help avoid disputes later on, making the process smoother for everyone involved.