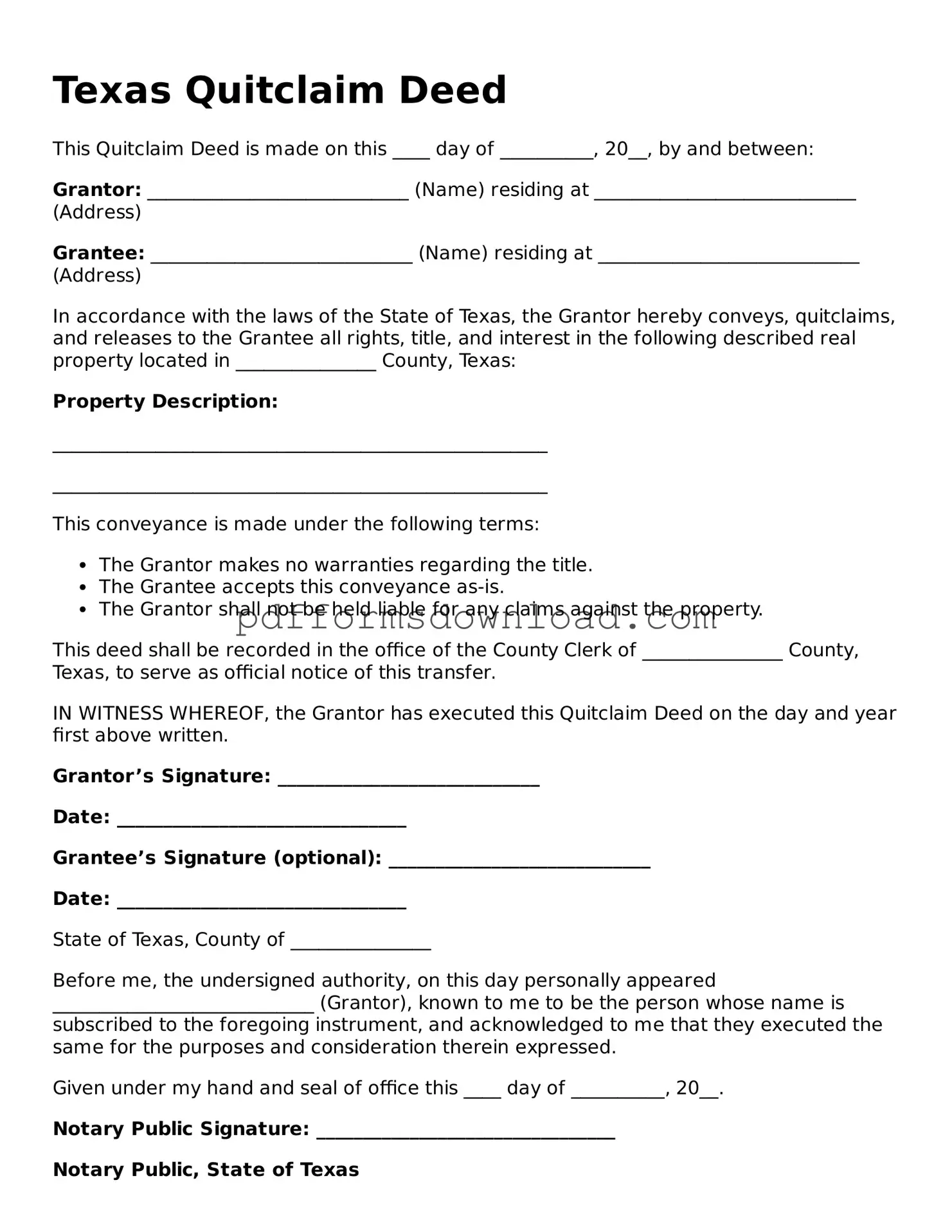

What is a Texas Quitclaim Deed?

A Texas Quitclaim Deed is a legal document used to transfer ownership of real property from one party to another. Unlike a warranty deed, a quitclaim deed does not guarantee that the property title is free from defects. It simply conveys whatever interest the grantor has in the property, if any.

When should I use a Quitclaim Deed in Texas?

Quitclaim Deeds are commonly used in situations such as transferring property between family members, clearing up title issues, or when a divorce settlement involves property division. They are also used to add or remove someone from the title.

How do I complete a Quitclaim Deed in Texas?

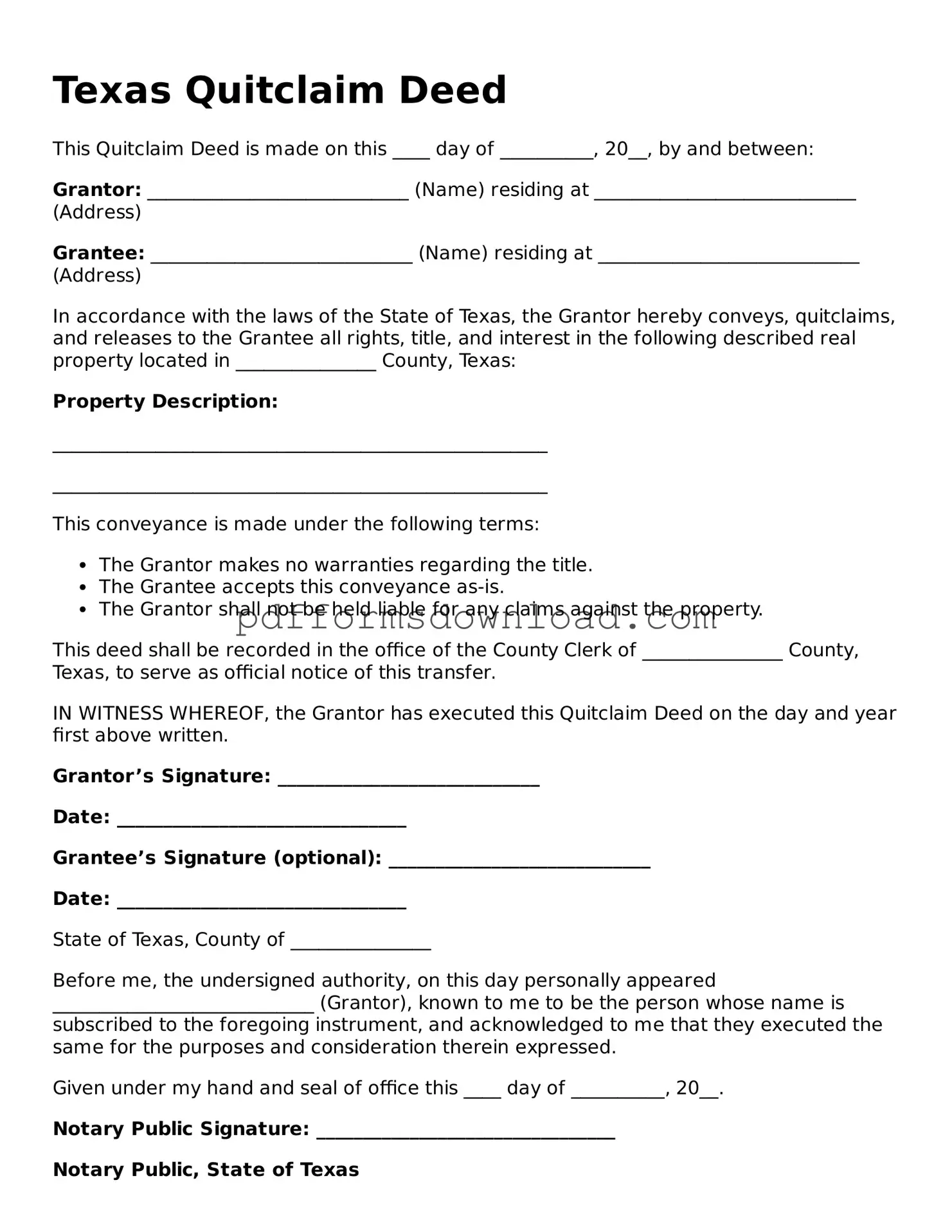

To complete a Quitclaim Deed, you need to include the names of the grantor (the person giving up the interest) and the grantee (the person receiving the interest), a legal description of the property, and the date of the transfer. Both parties must sign the document in the presence of a notary public.

Is a Quitclaim Deed the same as a Warranty Deed?

No, they are not the same. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to sell it. A Quitclaim Deed offers no such guarantees and simply transfers the grantor’s interest, if any.

Do I need to file a Quitclaim Deed with the county?

Yes, after completing the Quitclaim Deed, it should be filed with the county clerk's office where the property is located. This step is crucial for public record and to protect the interests of the grantee.

Are there any fees associated with filing a Quitclaim Deed in Texas?

Yes, there are typically filing fees that vary by county. It's important to check with your local county clerk’s office for the exact amount. Additionally, there may be costs for notarization and any related services.

Can I revoke a Quitclaim Deed once it is filed?

Once a Quitclaim Deed is executed and filed, it cannot be revoked unilaterally. However, the grantor and grantee can agree to reverse the transaction by executing another deed. Legal advice may be necessary to navigate this process.

Do I need an attorney to create a Quitclaim Deed in Texas?

While it is not legally required to have an attorney, consulting one is advisable, especially if the property has complications or if you have concerns about the implications of the transfer. An attorney can help ensure that the deed is properly executed and filed.

What happens if the Quitclaim Deed is not notarized?

If a Quitclaim Deed is not notarized, it may not be considered valid. Notarization serves to verify the identities of the parties involved and ensures that the deed can be legally enforced. Always ensure that the deed is properly notarized before filing.