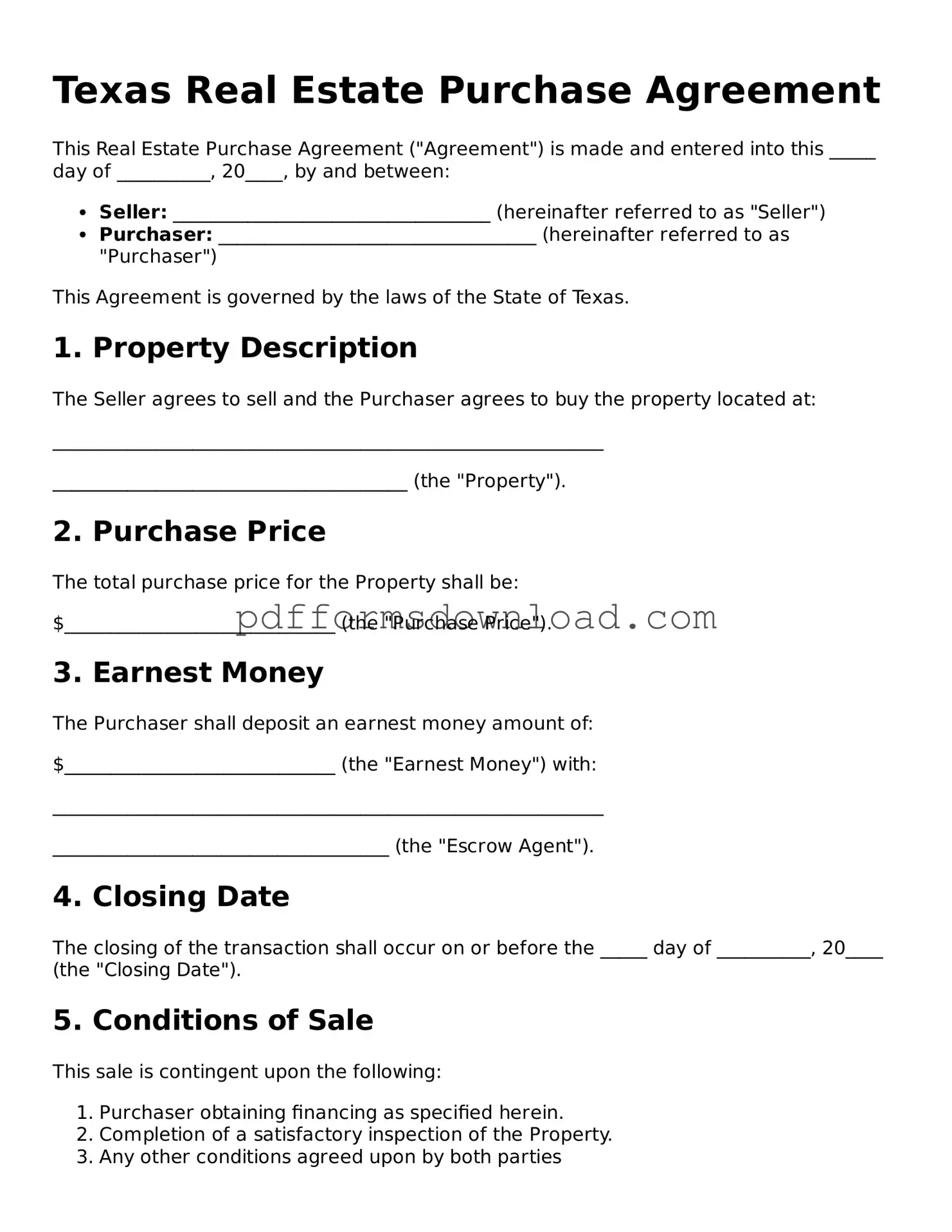

What is the Texas Real Estate Purchase Agreement?

The Texas Real Estate Purchase Agreement is a legal document that outlines the terms and conditions under which a buyer agrees to purchase a property from a seller. This agreement includes important details such as the purchase price, financing terms, and any contingencies that must be met before the sale can be finalized.

Who uses the Texas Real Estate Purchase Agreement?

This form is primarily used by buyers and sellers in real estate transactions within Texas. Real estate agents, brokers, and attorneys may also utilize this agreement to ensure that all parties are clear on the terms of the sale.

What key elements are included in the agreement?

The agreement typically includes the property description, purchase price, earnest money deposit, financing details, closing date, and any contingencies such as home inspections or appraisals. Each of these elements plays a crucial role in the overall transaction.

Is the Texas Real Estate Purchase Agreement legally binding?

Yes, once both parties sign the agreement, it becomes a legally binding contract. This means that both the buyer and seller are obligated to follow through with the terms outlined in the document, provided that all conditions are met.

Can the agreement be modified after it is signed?

Yes, the agreement can be modified, but both parties must agree to any changes in writing. It’s essential to document any amendments to avoid confusion or disputes later on.

What happens if one party breaches the agreement?

If one party fails to comply with the terms of the agreement, it is considered a breach of contract. The non-breaching party may have several options, including seeking damages or specific performance, which means they could ask the court to enforce the agreement.

Are there any contingencies that should be included?

Common contingencies include financing approval, home inspections, and appraisal conditions. These contingencies protect the buyer by allowing them to back out of the agreement if certain conditions are not met, ensuring that they are not locked into a deal that may not be favorable.

How can I ensure that my interests are protected in this agreement?

To protect your interests, consider working with a qualified real estate agent or attorney who can help you navigate the complexities of the agreement. They can ensure that all necessary terms are included and that your rights are safeguarded throughout the transaction.

Where can I obtain a Texas Real Estate Purchase Agreement form?

These forms can typically be obtained from real estate agents, brokers, or legal websites that specialize in real estate transactions. It’s important to use the most current version of the form to ensure compliance with Texas laws.