What is a Texas RV Bill of Sale?

A Texas RV Bill of Sale is a legal document that records the sale of a recreational vehicle (RV) in the state of Texas. This form serves as proof of the transaction between the buyer and the seller, detailing essential information such as the vehicle's description, sale price, and the parties involved. It protects both the buyer and seller by providing a clear record of the sale.

Why is a Bill of Sale necessary when selling an RV in Texas?

Having a Bill of Sale is crucial for several reasons. First, it provides legal protection for both parties by documenting the terms of the sale. Second, it can help prevent future disputes regarding ownership or the condition of the RV. Lastly, the Texas Department of Motor Vehicles (DMV) may require a Bill of Sale when the buyer registers the vehicle in their name.

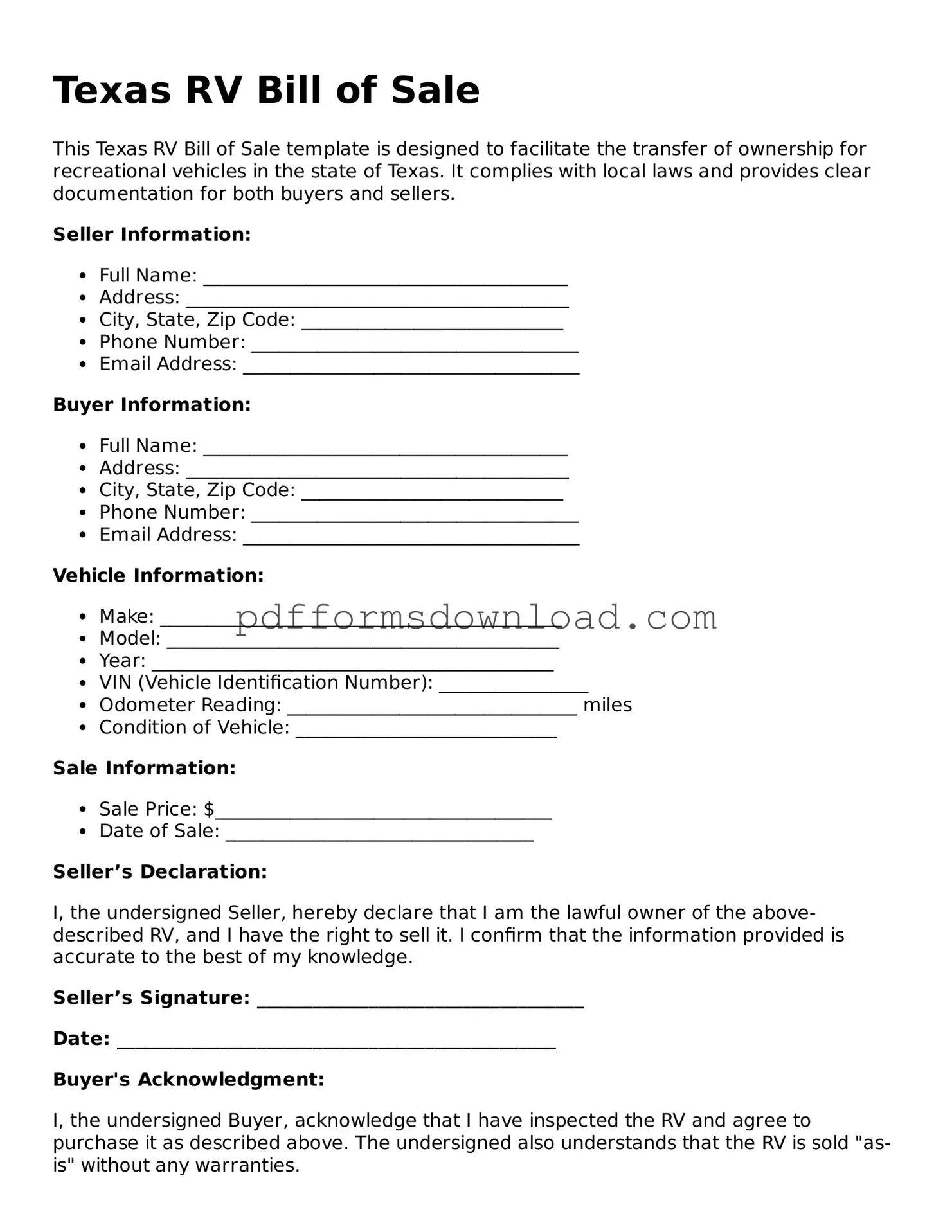

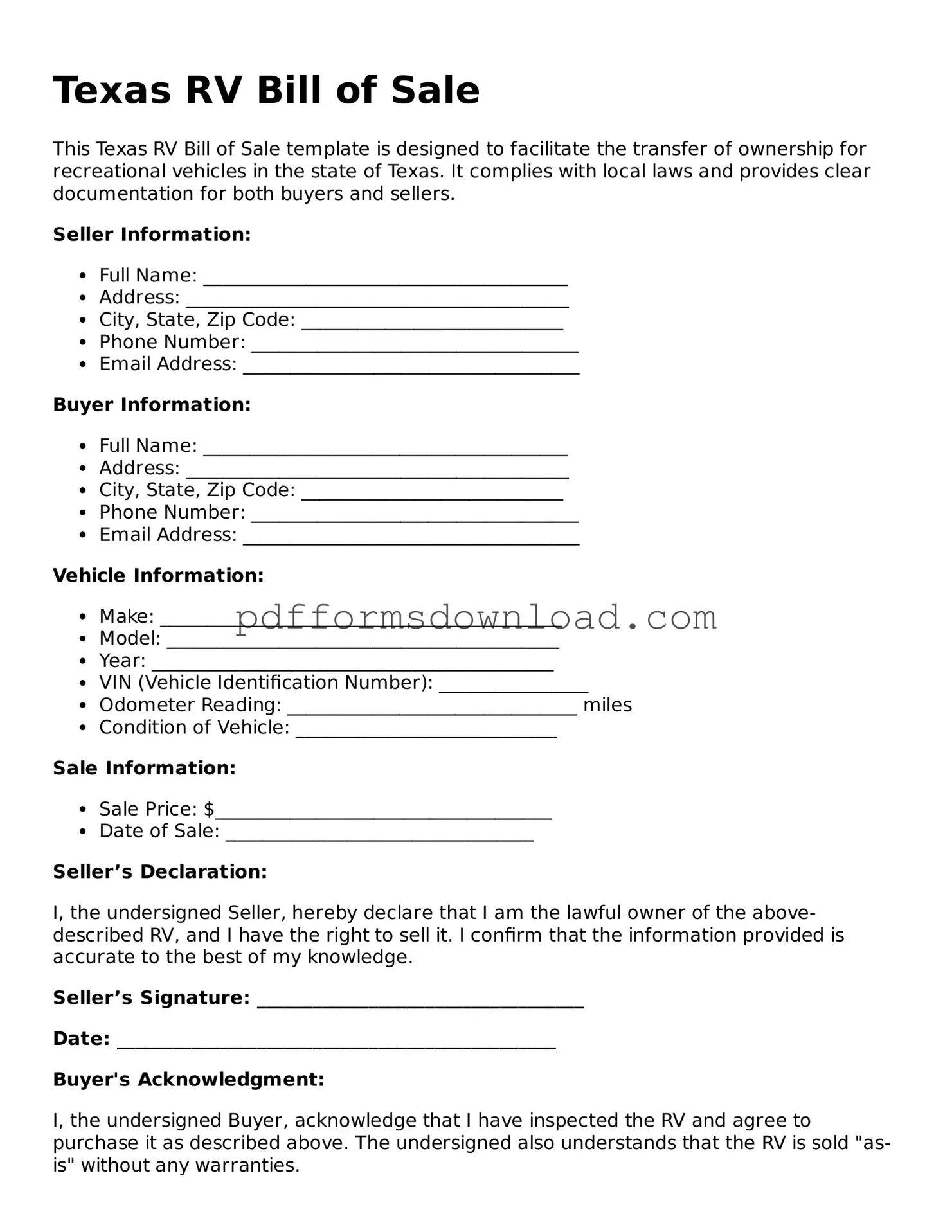

What information should be included in a Texas RV Bill of Sale?

A comprehensive Texas RV Bill of Sale should include the following details: the names and addresses of both the buyer and seller, the RV's make, model, year, and Vehicle Identification Number (VIN), the sale price, and the date of the transaction. Additionally, both parties should sign the document to validate the sale.

Can I create my own Bill of Sale, or do I need a specific form?

You can create your own Bill of Sale as long as it contains all the necessary information. However, using a specific form designed for Texas RV sales can simplify the process and ensure that you include all required details. Many resources are available online, or you can consult with a legal professional for assistance.

Is a Texas RV Bill of Sale required for all RV transactions?

While it is not legally required for all RV transactions, having a Bill of Sale is highly recommended. It serves as a safeguard for both the buyer and seller, especially in cases where the RV may need to be registered or if there are disputes regarding the sale. Some dealerships may also require a Bill of Sale for their records.

What should I do after completing the Bill of Sale?

After completing the Bill of Sale, both the buyer and seller should keep a copy for their records. The buyer will need to present the Bill of Sale to the Texas DMV when registering the RV in their name. It is also wise to ensure that the title is transferred correctly, as this is a separate but essential step in the ownership process.

Where can I obtain a Texas RV Bill of Sale form?

You can find a Texas RV Bill of Sale form through various sources. Many websites offer free downloadable templates, or you can visit the Texas DMV's official website for resources. Additionally, local legal offices or notary services may provide forms and assistance in completing them.