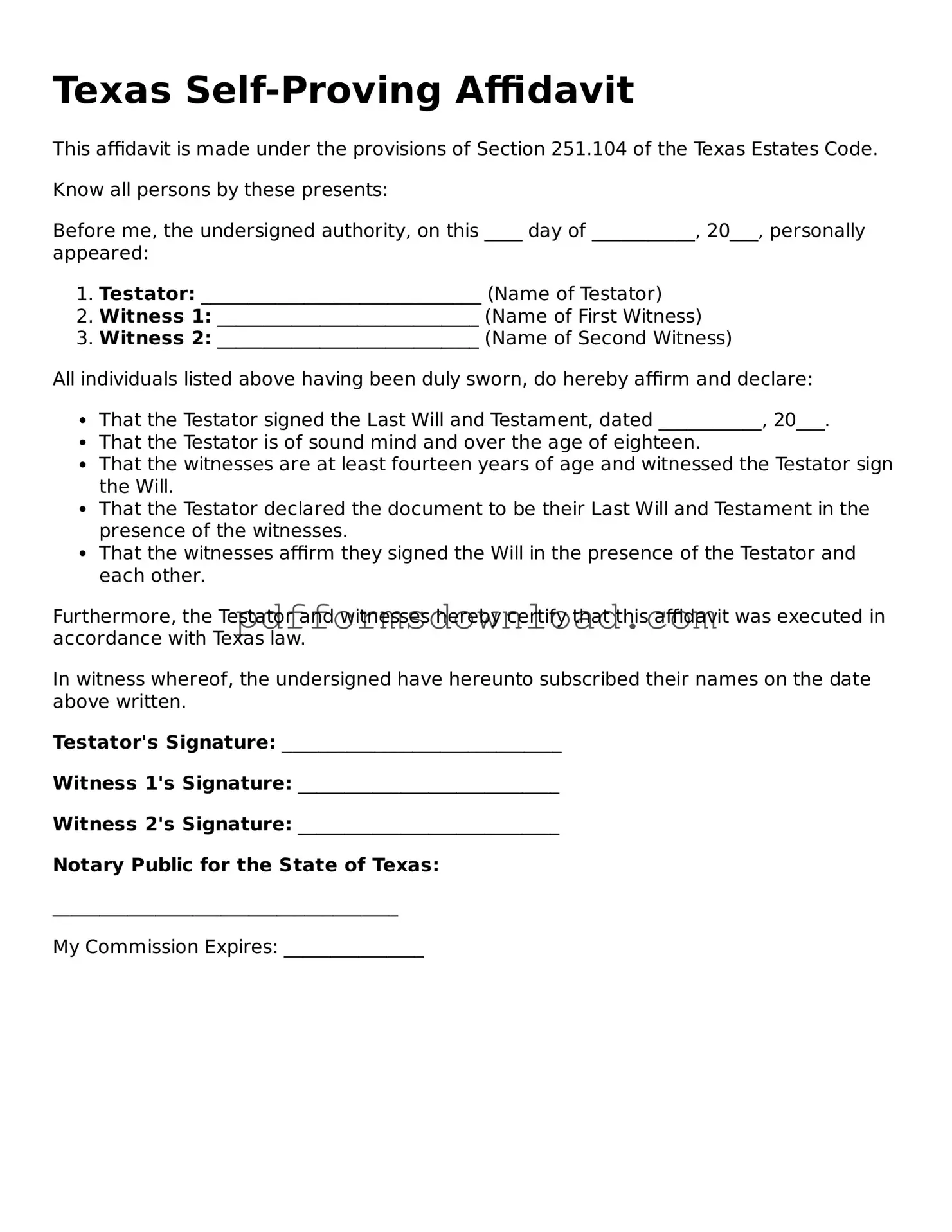

What is a Texas Self-Proving Affidavit?

A Texas Self-Proving Affidavit is a legal document that allows a testator’s will to be validated without the need for witnesses to testify in court. It serves as proof that the will was executed properly and can expedite the probate process.

Who can create a Self-Proving Affidavit?

Any person who is of sound mind and at least 18 years old can create a Self-Proving Affidavit. Typically, this is done by the testator, the person who made the will, along with the witnesses who observed the signing of the will.

What are the requirements for a Self-Proving Affidavit in Texas?

The affidavit must be signed by the testator and at least two witnesses. It must also be notarized. The document should affirm that the testator was of sound mind and that the will was executed voluntarily.

How does a Self-Proving Affidavit benefit the probate process?

This affidavit simplifies the probate process. It eliminates the need for witnesses to testify about the will’s validity, making it easier and faster to settle the estate. It also reduces potential disputes among heirs regarding the will's authenticity.

Can I create a Self-Proving Affidavit after the will is signed?

Yes, a Self-Proving Affidavit can be created after the will is signed. However, it must be done while the testator is still alive and of sound mind. It is best to do this at the same time the will is executed.

Is a Self-Proving Affidavit required for all wills in Texas?

No, a Self-Proving Affidavit is not required for a will to be valid in Texas. However, having one can make the probate process easier and quicker. It is highly recommended for those who want to avoid complications later on.

What happens if a Self-Proving Affidavit is not included with the will?

If a Self-Proving Affidavit is not included, the will can still be probated, but witnesses may need to be called to testify about the will's validity. This can prolong the probate process and increase costs.

Where can I obtain a Self-Proving Affidavit form?

Self-Proving Affidavit forms can be obtained from legal stationery stores, online legal form providers, or through an attorney. It is important to ensure that the form complies with Texas laws.

Can I modify a Self-Proving Affidavit once it is signed?

Once a Self-Proving Affidavit is signed and notarized, it cannot be modified. If changes are necessary, a new affidavit must be created and executed. It is best to consult with an attorney for guidance on this process.

Do I need an attorney to create a Self-Proving Affidavit?

While it is not legally required to have an attorney, it is advisable to seek legal advice. An attorney can ensure that the affidavit is completed correctly and complies with Texas law, helping to avoid potential issues in the future.