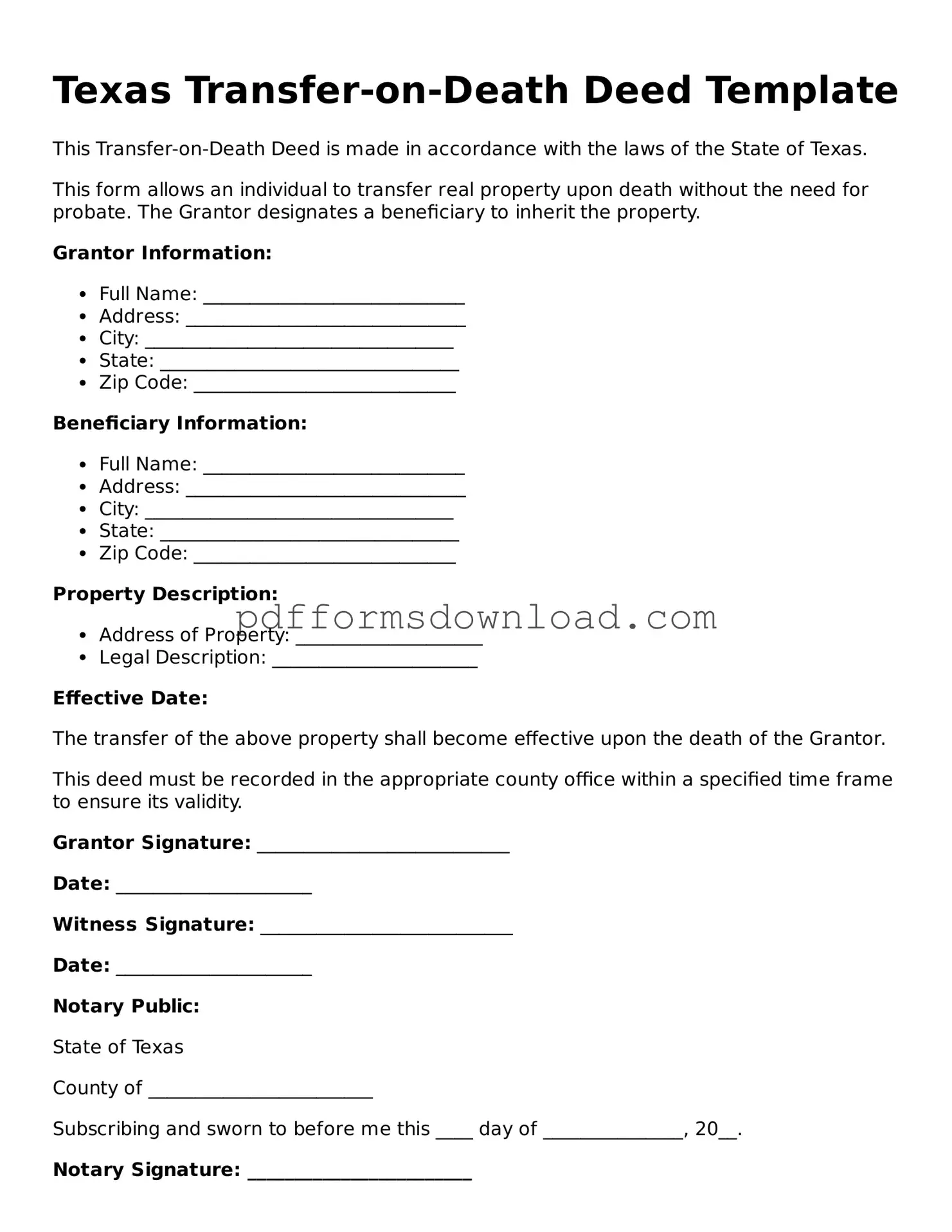

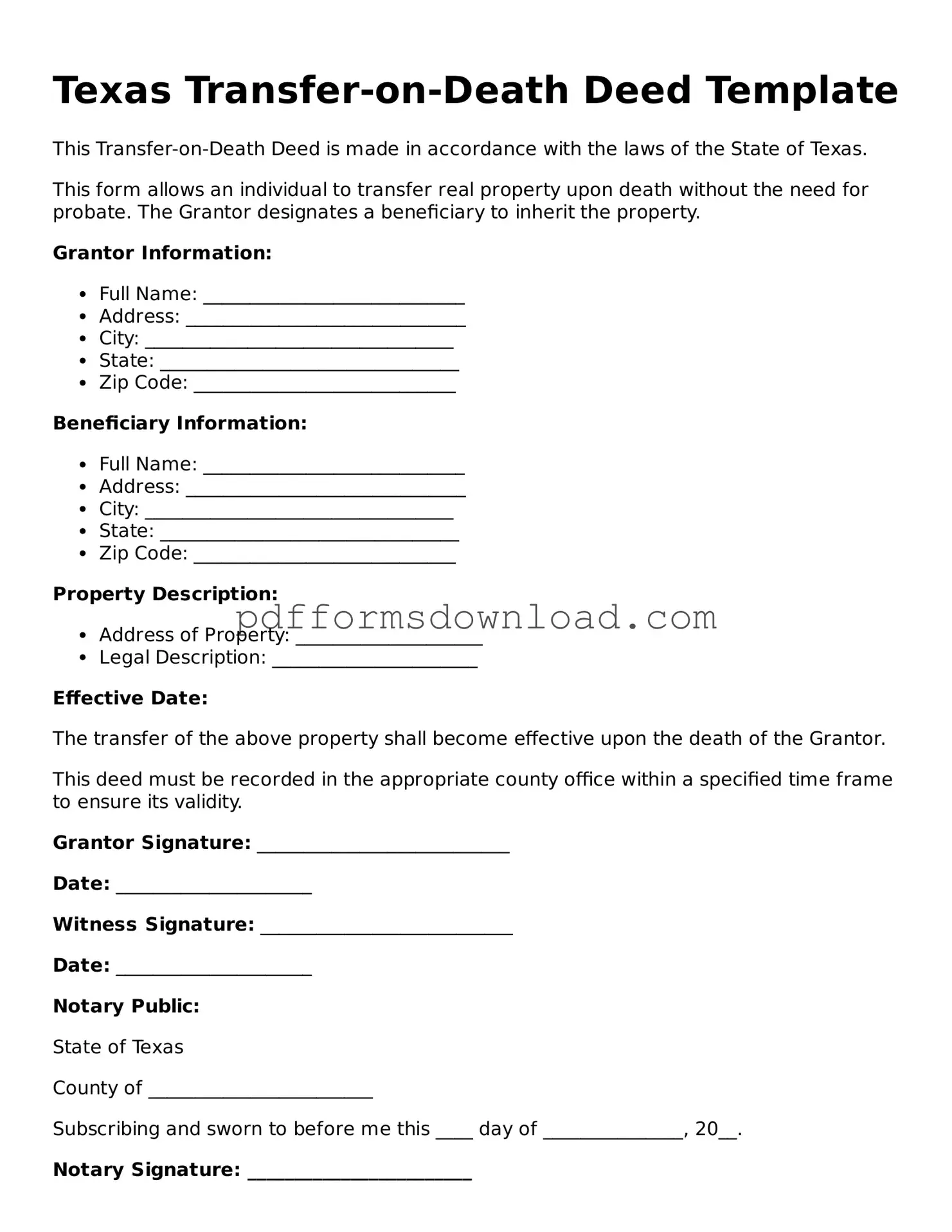

What is a Texas Transfer-on-Death Deed?

A Texas Transfer-on-Death Deed (TODD) allows an individual to transfer real estate to a designated beneficiary upon their death. This deed enables property owners to bypass the probate process, simplifying the transfer of property to heirs. It must be properly executed and recorded to be valid.

Who can create a Transfer-on-Death Deed in Texas?

Any individual who owns real property in Texas can create a Transfer-on-Death Deed. The property owner must be of sound mind and at least 18 years old. Additionally, the deed must be signed and notarized to ensure its legality.

How does a Transfer-on-Death Deed work?

The property owner fills out the TODD form, naming a beneficiary. Once the owner passes away, the property automatically transfers to the beneficiary without going through probate. This process occurs as long as the deed is properly recorded before the owner's death.

Can I change or revoke a Transfer-on-Death Deed?

Yes, a Transfer-on-Death Deed can be revoked or changed at any time before the property owner’s death. To do this, the property owner must execute a new deed or a revocation document. It is essential to record any changes with the county clerk to ensure they are recognized legally.

Are there any limitations on who can be named as a beneficiary?

Beneficiaries can be individuals or entities, such as a trust. However, the deed cannot name multiple beneficiaries for the same property unless specified as joint tenants with rights of survivorship. Additionally, naming an entity may have specific legal implications, so it is advisable to consult with a legal professional.

What happens if the beneficiary predeceases the property owner?

If the beneficiary dies before the property owner, the Transfer-on-Death Deed becomes void. The property owner can then choose to name a new beneficiary or allow the property to pass according to their will or Texas intestacy laws if no will exists.

Is there a fee to record a Transfer-on-Death Deed?

Yes, there is typically a fee to record a Transfer-on-Death Deed with the county clerk's office. The fee varies by county, so it is important to check with the local office for the exact amount. Recording the deed is a crucial step to ensure its validity.

Can a Transfer-on-Death Deed affect taxes?

A Transfer-on-Death Deed does not directly affect property taxes. However, once the property is transferred to the beneficiary, the new owner may be subject to property taxes based on the assessed value. It's important for beneficiaries to understand their tax obligations after receiving the property.