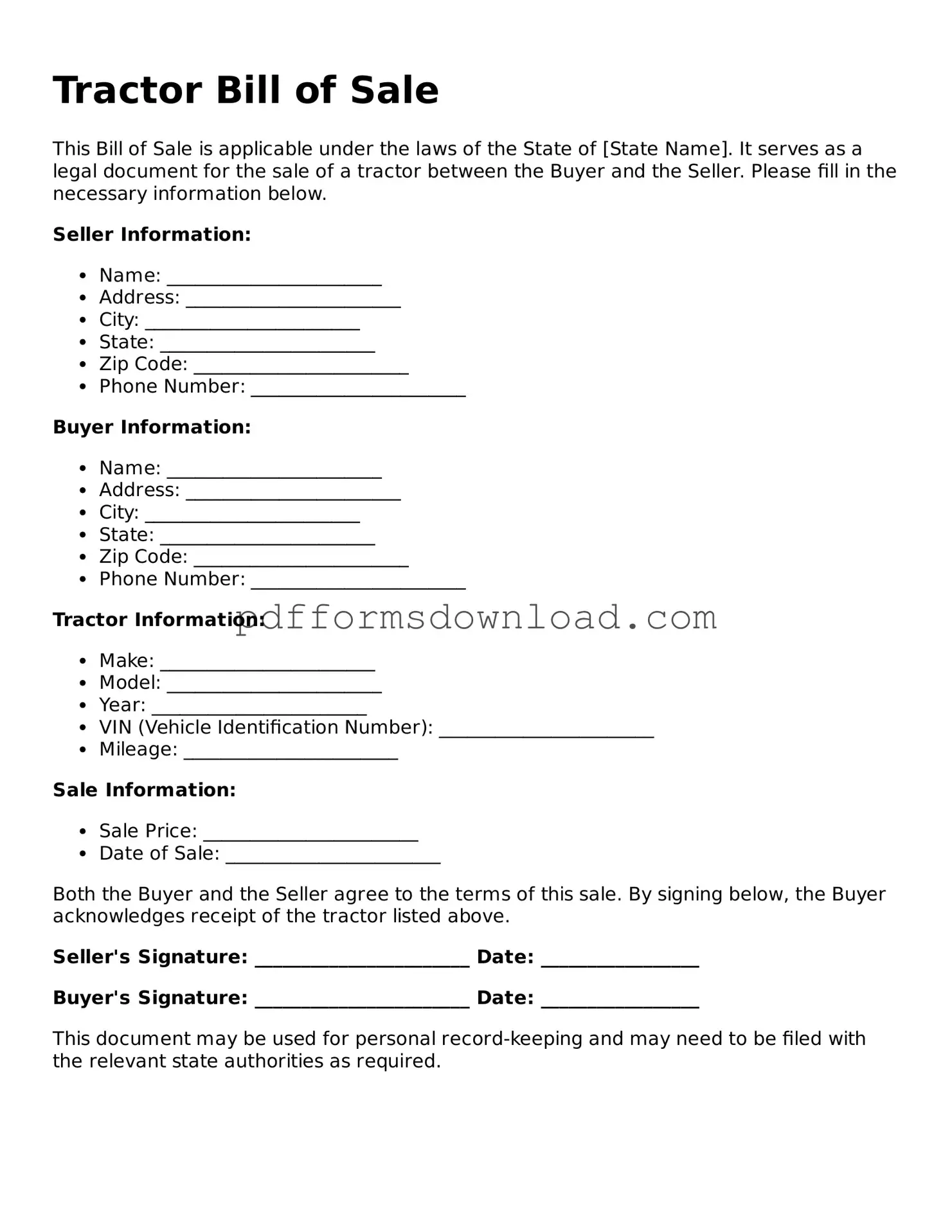

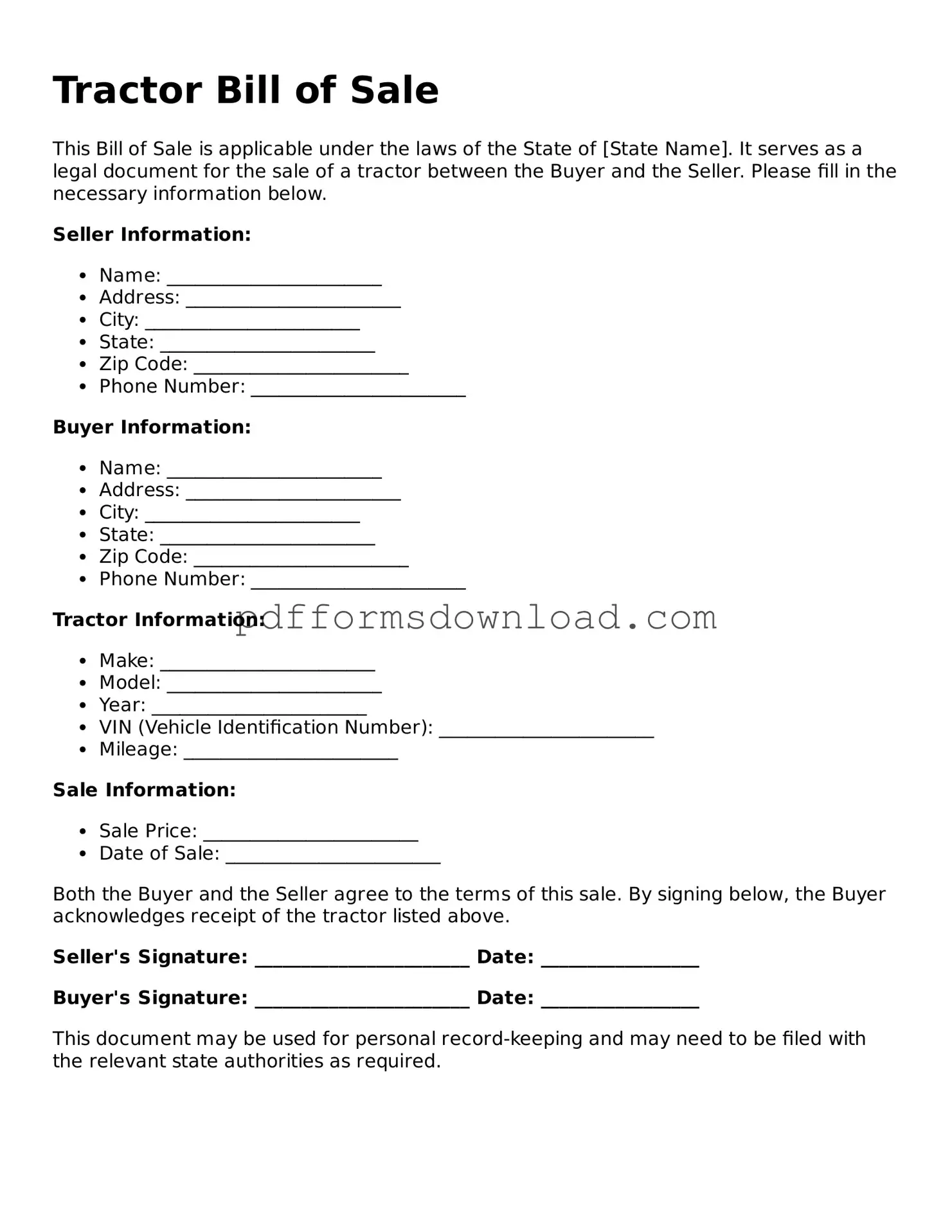

What is a Tractor Bill of Sale?

A Tractor Bill of Sale is a legal document that records the sale of a tractor from one party to another. This document outlines the details of the transaction, including the buyer, seller, and specific information about the tractor itself. It serves as proof of ownership transfer and can be essential for registration and tax purposes.

Why do I need a Tractor Bill of Sale?

This document is important for several reasons. It protects both the buyer and seller by providing a clear record of the transaction. For the buyer, it confirms ownership and can be used to register the tractor with local authorities. For the seller, it provides evidence that they have transferred ownership and are no longer responsible for the tractor.

What information should be included in a Tractor Bill of Sale?

A complete Tractor Bill of Sale should include the following details: the names and addresses of both the buyer and seller, the date of the sale, a description of the tractor (including make, model, year, and VIN), the sale price, and any terms of the sale. It’s also advisable to include signatures from both parties to validate the document.

Do I need to have the Tractor Bill of Sale notarized?

Notarization is not always required, but it can add an extra layer of security to the transaction. Some states may require a notarized bill of sale for registration purposes. It’s wise to check local regulations to determine if notarization is necessary in your area.

Can I use a generic Bill of Sale for my tractor?

While you can use a generic Bill of Sale, it’s better to use a specific Tractor Bill of Sale form. This ensures that all relevant information pertaining to the tractor and the transaction is included. A specialized form can help avoid any confusion or missing details that might arise with a generic document.

What if the tractor has a lien against it?

If there is a lien on the tractor, it’s crucial to disclose this information to the buyer. The lienholder may need to be involved in the transaction to release the lien before the sale can be finalized. Failing to disclose a lien can lead to legal issues for both parties down the line.

How do I complete the Tractor Bill of Sale?

To complete the form, fill in all required fields with accurate information. Double-check the details to ensure everything is correct. Both the buyer and seller should sign the document, and if necessary, have it notarized. Keep copies for your records, as both parties will need proof of the transaction.

Where can I obtain a Tractor Bill of Sale form?

You can find a Tractor Bill of Sale form online through various legal document websites. Many state government websites also provide templates that comply with local laws. It’s essential to choose a form that meets the legal requirements of your state to ensure a smooth transaction.