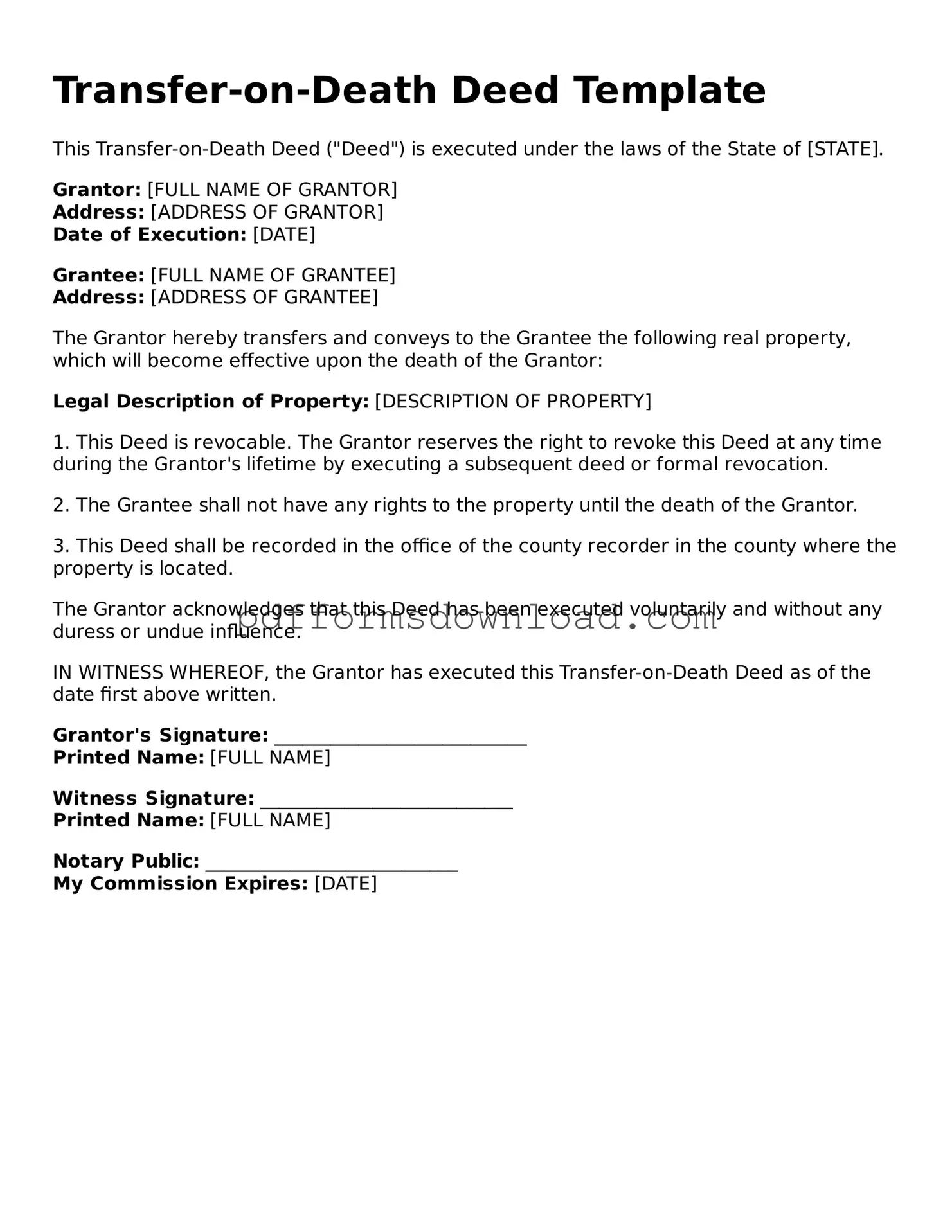

What is a Transfer-on-Death Deed?

A Transfer-on-Death Deed (TOD deed) is a legal document that allows a property owner to designate one or more beneficiaries to receive their real estate upon their death. This deed bypasses the probate process, which can be lengthy and costly. By using a TOD deed, property owners can ensure that their property passes directly to their chosen beneficiaries without the need for court involvement.

How does a Transfer-on-Death Deed work?

When a property owner executes a TOD deed, they retain full ownership of the property during their lifetime. The deed becomes effective only upon the owner's death. The designated beneficiaries do not have any rights to the property until that time. This means the property owner can sell, mortgage, or otherwise manage the property as they see fit while they are alive. After the owner's death, the beneficiaries can claim the property by providing a death certificate and the recorded TOD deed to the appropriate authorities.

Are there any restrictions on who can be named as a beneficiary in a Transfer-on-Death Deed?

Generally, a property owner can name anyone as a beneficiary in a TOD deed, including individuals, trusts, or organizations. However, it is essential to ensure that the beneficiaries are legally capable of receiving the property. For example, minors may require a guardian or conservator to manage the property until they reach adulthood. Additionally, some states may have specific laws regarding the naming of beneficiaries, so it is advisable to check local regulations.

Can a Transfer-on-Death Deed be revoked or changed?

Yes, a Transfer-on-Death Deed can be revoked or modified at any time before the property owner's death. The owner may create a new TOD deed that supersedes the previous one or formally revoke the existing deed by filing a revocation document with the appropriate local office. It is crucial to follow the proper legal procedures to ensure that the changes are valid and recognized by the authorities.

What are the tax implications of a Transfer-on-Death Deed?

Generally, the property transferred via a TOD deed does not trigger any immediate tax consequences for the property owner. The property will receive a step-up in basis upon the owner's death, which can reduce capital gains taxes for the beneficiaries when they sell the property. However, estate taxes may still apply depending on the total value of the estate. It is advisable to consult with a tax professional to understand the specific implications based on individual circumstances.