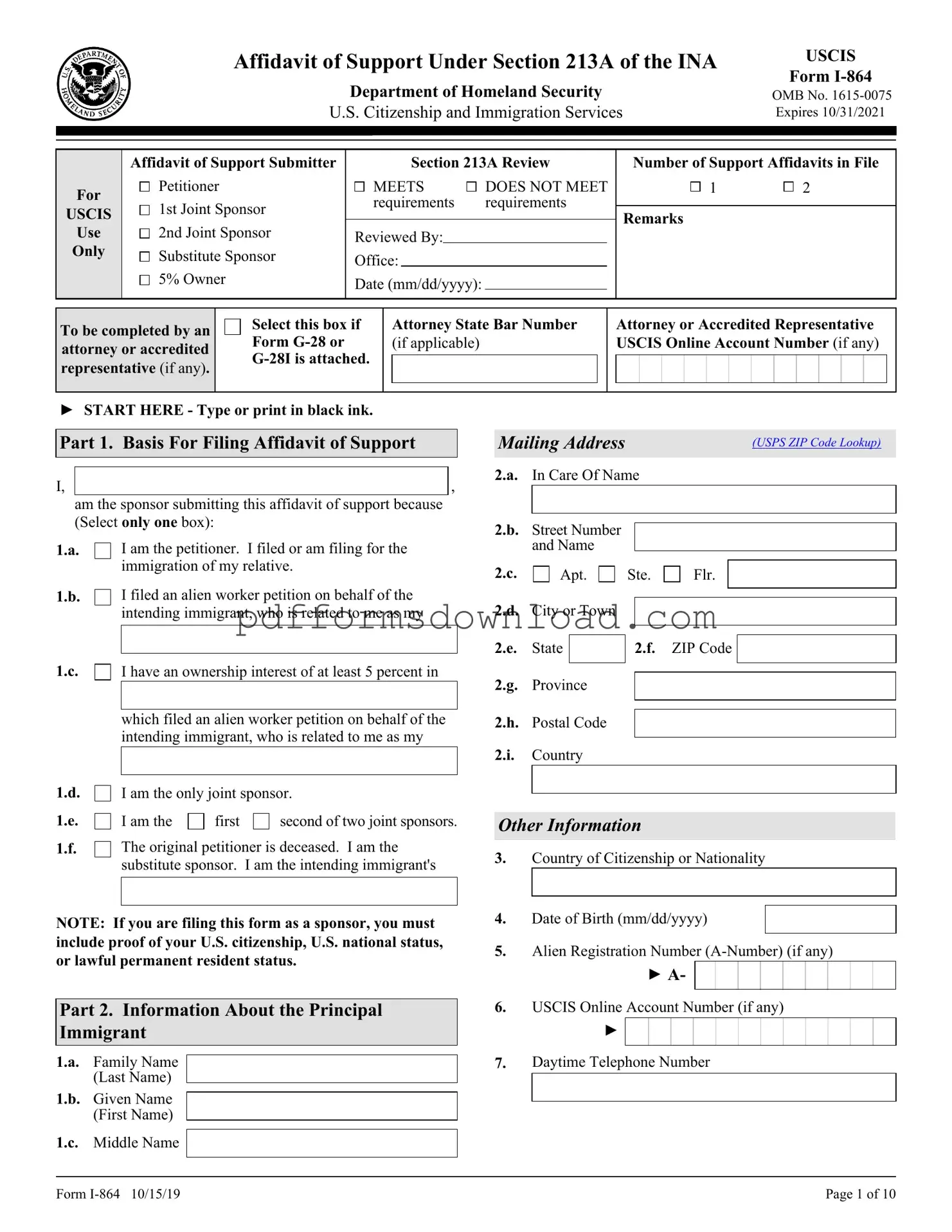

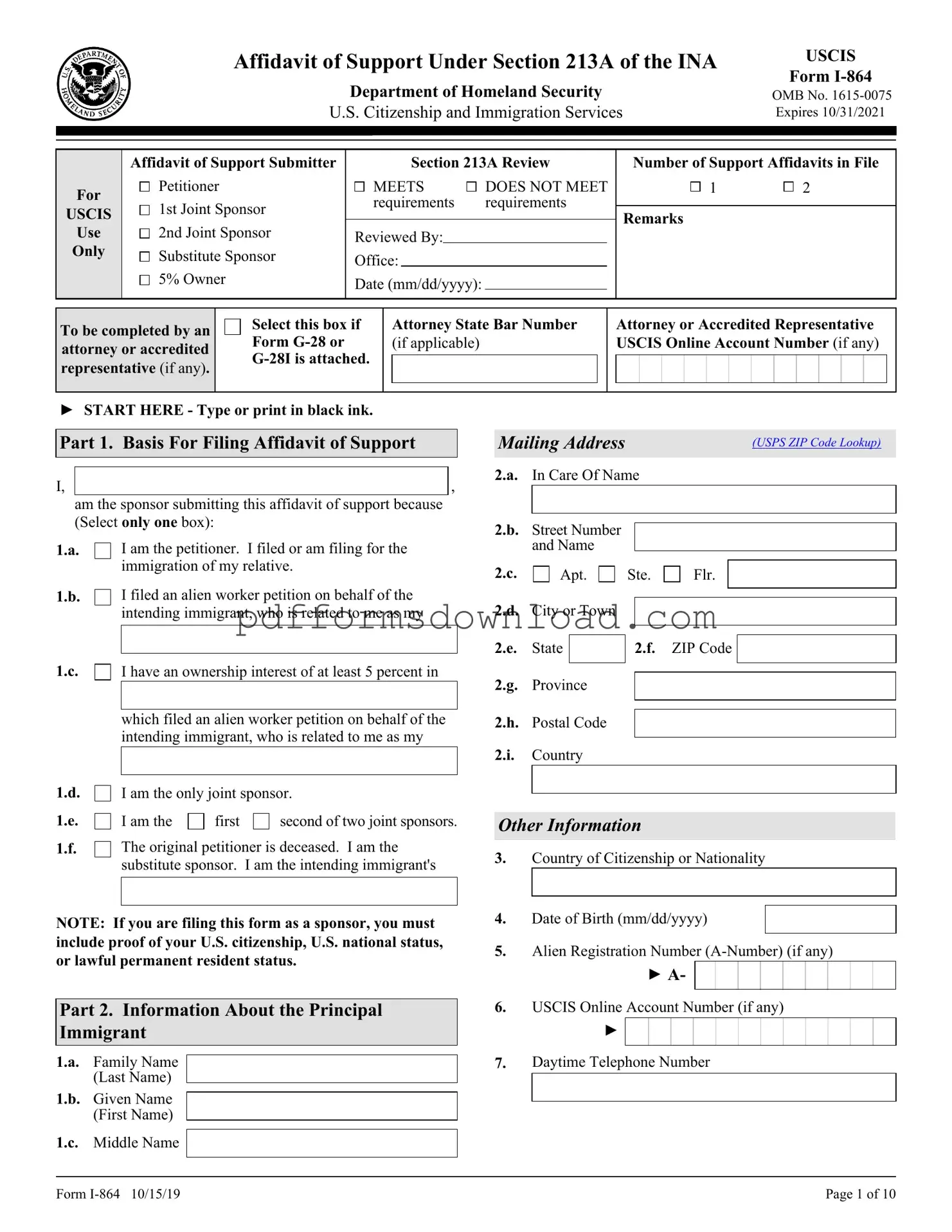

What is the USCIS I-864 form?

The USCIS I-864 form, also known as the Affidavit of Support, is a document that a sponsor files to demonstrate their ability to financially support an immigrant. This form is typically required when a family member is applying for a green card. It ensures that the immigrant will not become a public charge and will have adequate financial support in the U.S.

Who needs to file the I-864 form?

Generally, the I-864 form must be filed by a sponsor who is a U.S. citizen or a lawful permanent resident and is petitioning for a family member to immigrate. This includes spouses, children, parents, and siblings. In some cases, joint sponsors may also be needed if the primary sponsor does not meet the income requirements.

What are the income requirements for the I-864 form?

The sponsor must demonstrate an income that is at least 125% of the Federal Poverty Guidelines for their household size. For active-duty military members sponsoring their spouse or child, the requirement is 100% of the guidelines. The income can come from various sources, including wages, pensions, or assets.

Can I use assets to meet the income requirement?

Yes, assets can be used to supplement income if the sponsor’s income alone does not meet the threshold. The value of the assets must be substantial and can include savings accounts, real estate, or other investments. Generally, the assets must equal five times the difference between the sponsor’s income and the required income level.

How long is the I-864 form valid?

The I-864 form remains valid until the sponsored immigrant becomes a U.S. citizen or has worked for 40 quarters (approximately 10 years). If the immigrant does not meet these conditions, the sponsor remains financially responsible for them, even if the immigrant moves or changes their situation.

What happens if the sponsor's financial situation changes?

If a sponsor's financial situation changes significantly, they should inform USCIS. However, the obligations outlined in the I-864 remain in effect regardless of changes in income or employment. If the sponsor can no longer provide support, it may affect their immigration obligations.

Is there a penalty for not fulfilling the obligations of the I-864?

Yes, if a sponsor fails to meet their obligations under the I-864, they may face legal consequences. This could include being sued for support by the immigrant or the government if the immigrant receives public benefits. It's essential for sponsors to understand their responsibilities before signing the form.

Can I withdraw my I-864 form after it has been submitted?

Once the I-864 form is submitted and accepted, it cannot be withdrawn. The sponsor is bound by the obligations outlined in the form. If circumstances change, it’s advisable to seek legal counsel to understand the options available.

Where do I send the I-864 form?

The I-864 form should be submitted to the appropriate USCIS address as indicated in the instructions for the specific application or petition. This may vary depending on the type of application being filed, so it is crucial to check the latest guidelines on the USCIS website.

Can multiple sponsors file an I-864 for the same immigrant?

Yes, multiple sponsors can file an I-864 form for the same immigrant. This is often referred to as a joint sponsorship. Each sponsor must submit their own I-864 and meet the income requirements individually. This can be helpful if the primary sponsor does not meet the income threshold alone.