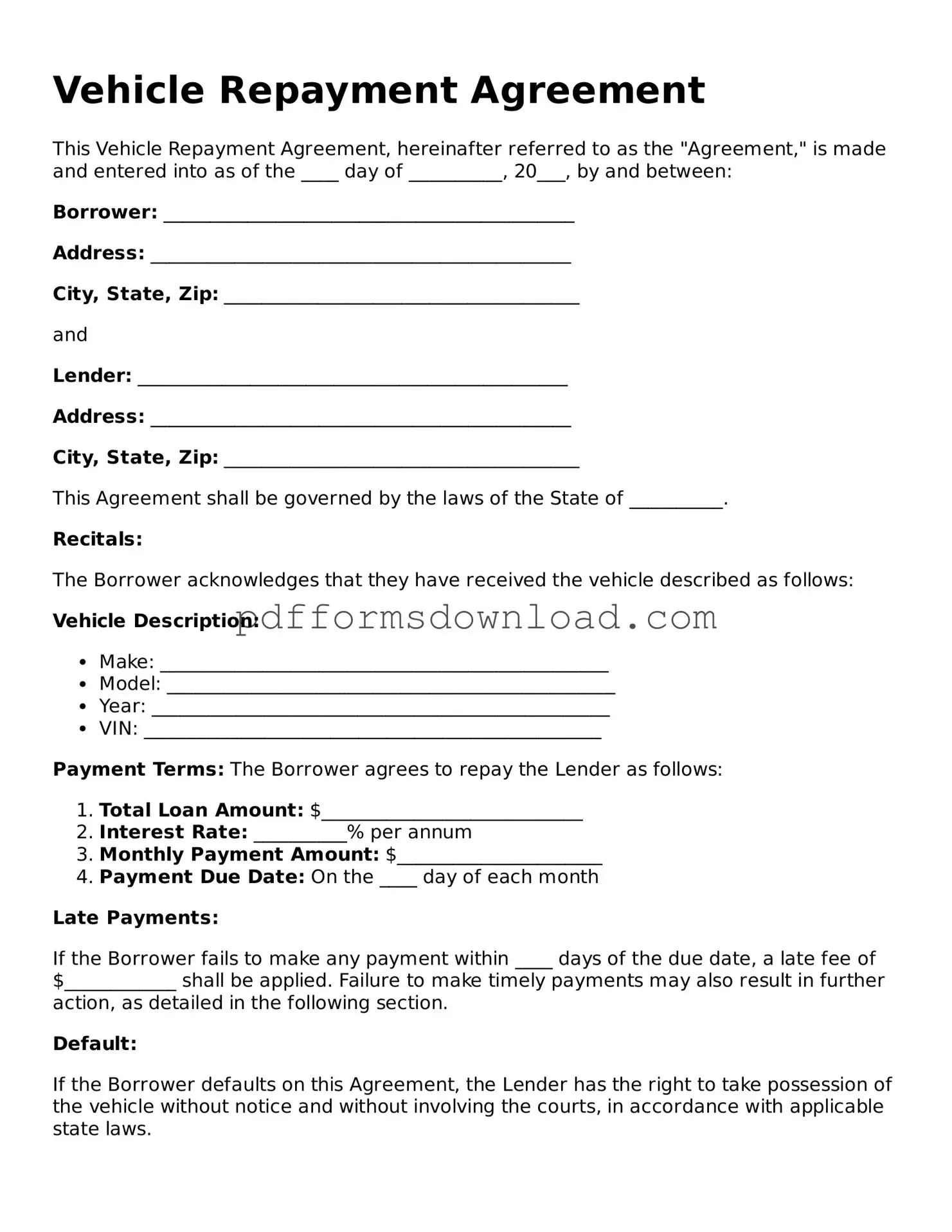

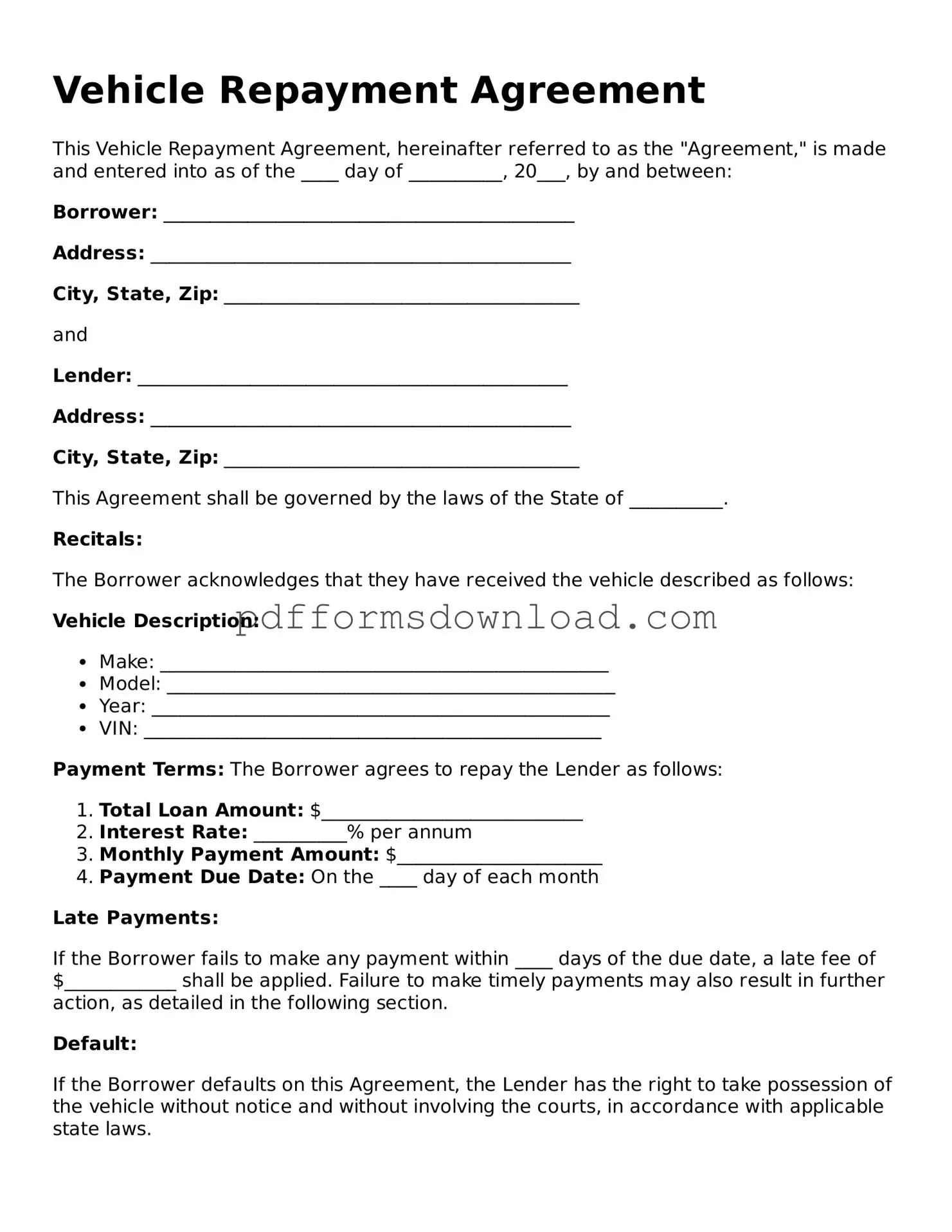

What is a Vehicle Repayment Agreement form?

The Vehicle Repayment Agreement form is a document that outlines the terms under which an individual agrees to repay a loan or debt related to a vehicle. This form helps both the lender and borrower understand their rights and responsibilities regarding the repayment process.

Who needs to fill out the Vehicle Repayment Agreement form?

Anyone who has taken out a loan or financing for a vehicle and is required to repay that loan should complete this form. This includes individuals who are purchasing a car, truck, or motorcycle through financing or leasing agreements.

What information is required on the form?

The form typically requires personal information such as the borrower's name, contact details, and the vehicle identification number (VIN). Additionally, it will include details about the loan amount, interest rate, repayment schedule, and any other relevant terms.

Is the Vehicle Repayment Agreement legally binding?

Yes, once signed by both parties, the Vehicle Repayment Agreement is legally binding. This means that both the borrower and lender are obligated to adhere to the terms outlined in the document.

What happens if I miss a payment?

If a payment is missed, it is important to contact the lender immediately. Depending on the terms of the agreement, there may be penalties or fees associated with late payments. Communication can often help in finding a solution or alternative arrangements.

Can the terms of the Vehicle Repayment Agreement be changed?

Yes, the terms can be modified, but both parties must agree to any changes. It is essential to document any amendments in writing to ensure clarity and avoid misunderstandings in the future.

How do I submit the Vehicle Repayment Agreement form?

The submission process may vary depending on the lender. Typically, you can submit the form in person, via mail, or electronically, depending on the lender's preferences. Be sure to follow the specific instructions provided by the lender.

What should I do if I have questions about the form?

If you have questions, it is best to reach out directly to the lender or financial institution. They can provide clarification on any part of the form and help you understand the terms and conditions associated with your repayment agreement.

Can I get a copy of the Vehicle Repayment Agreement?

Yes, after the form is completed and signed, you should request a copy for your records. Keeping a copy is important for tracking your payments and understanding your obligations.

What if I want to pay off my loan early?

Paying off your loan early may be possible, but it’s crucial to check the agreement for any prepayment penalties. Contact the lender to discuss the process and any potential fees associated with early repayment.