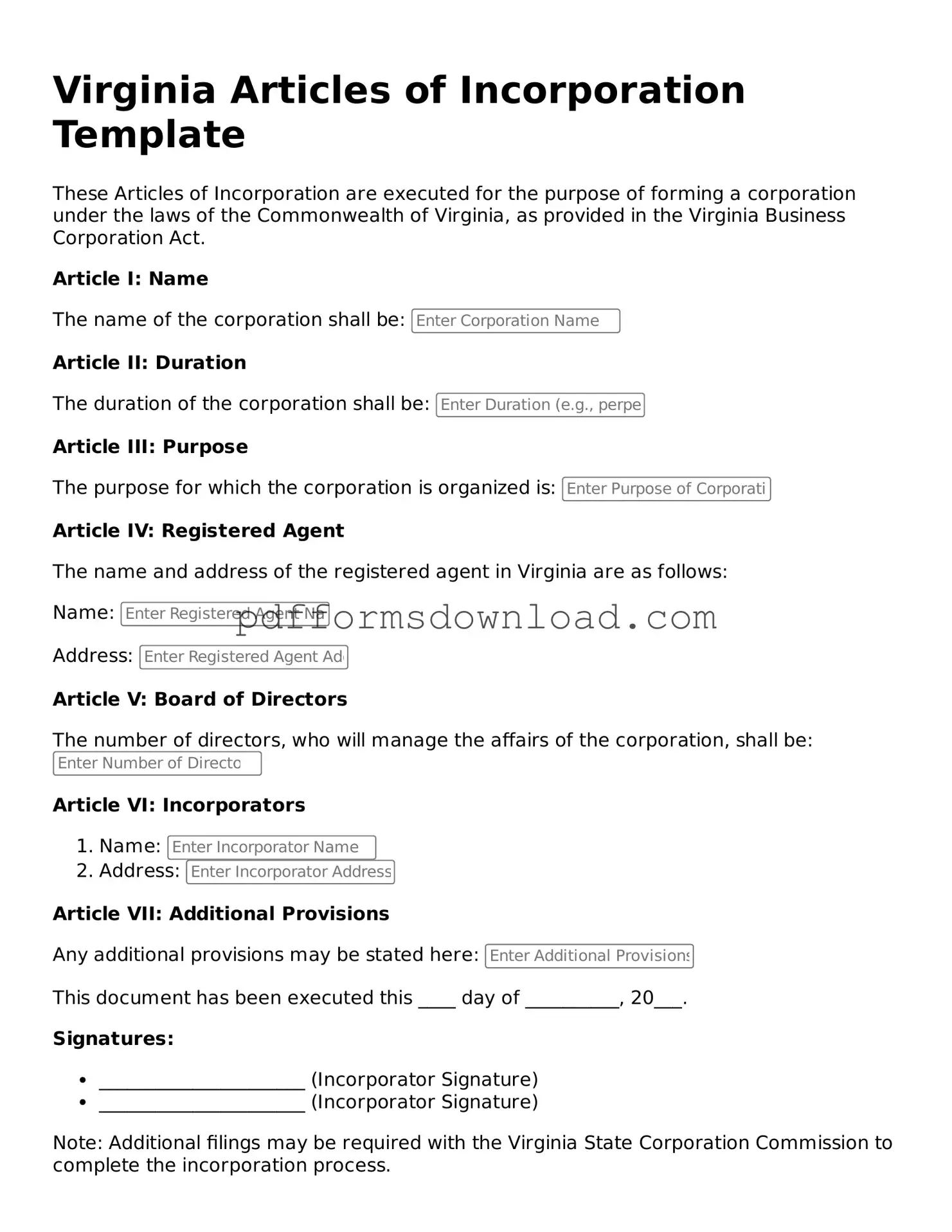

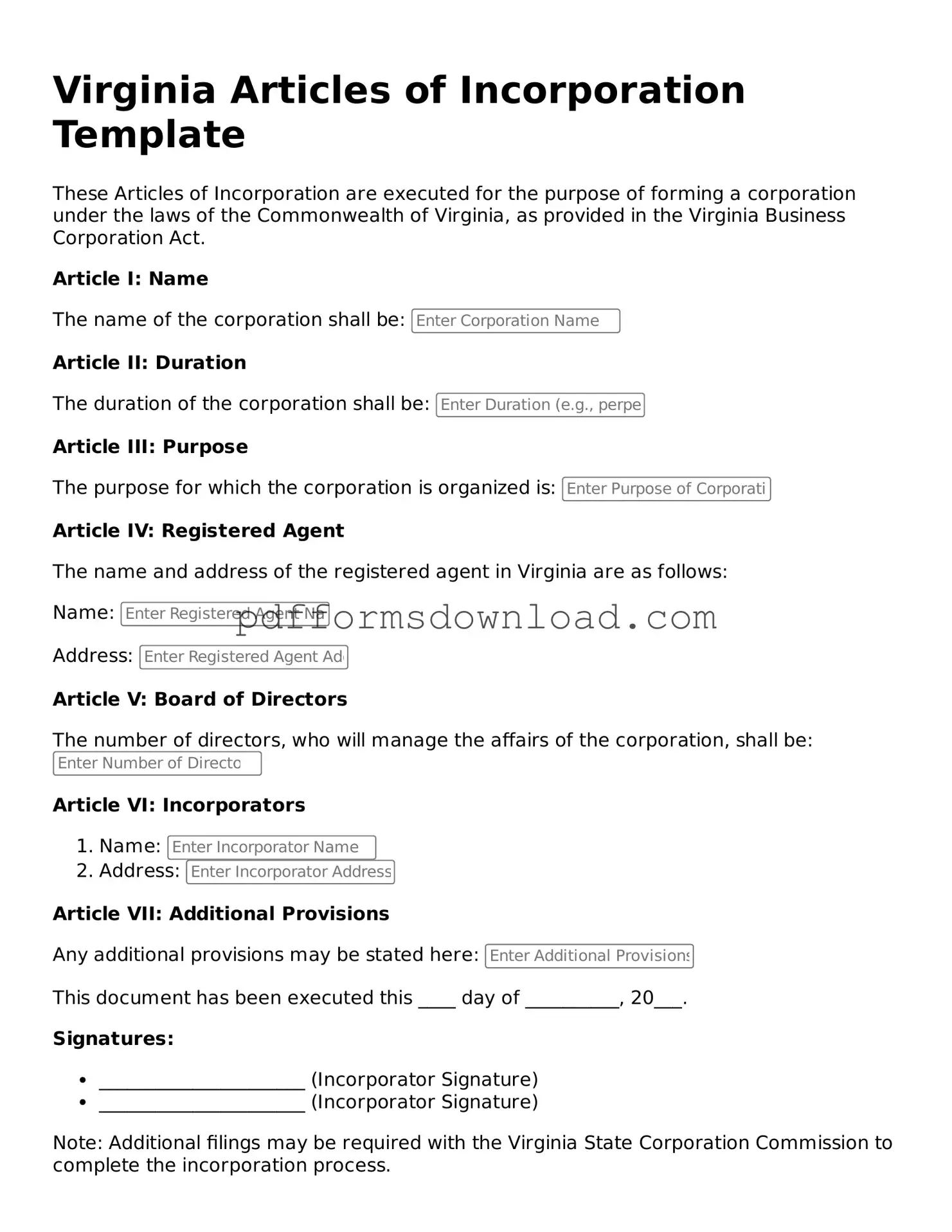

Printable Virginia Articles of Incorporation Form

The Virginia Articles of Incorporation form is a legal document used to establish a corporation in the state of Virginia. This form outlines essential information about the corporation, including its name, purpose, and registered agent. To get started on forming your corporation, fill out the Articles of Incorporation form by clicking the button below.

Make This Document Now

Printable Virginia Articles of Incorporation Form

Make This Document Now

Make This Document Now

or

Free PDF File

Your form is almost ready

Complete your Articles of Incorporation online — edit, save, and download easily.