What is a Virginia Gift Deed?

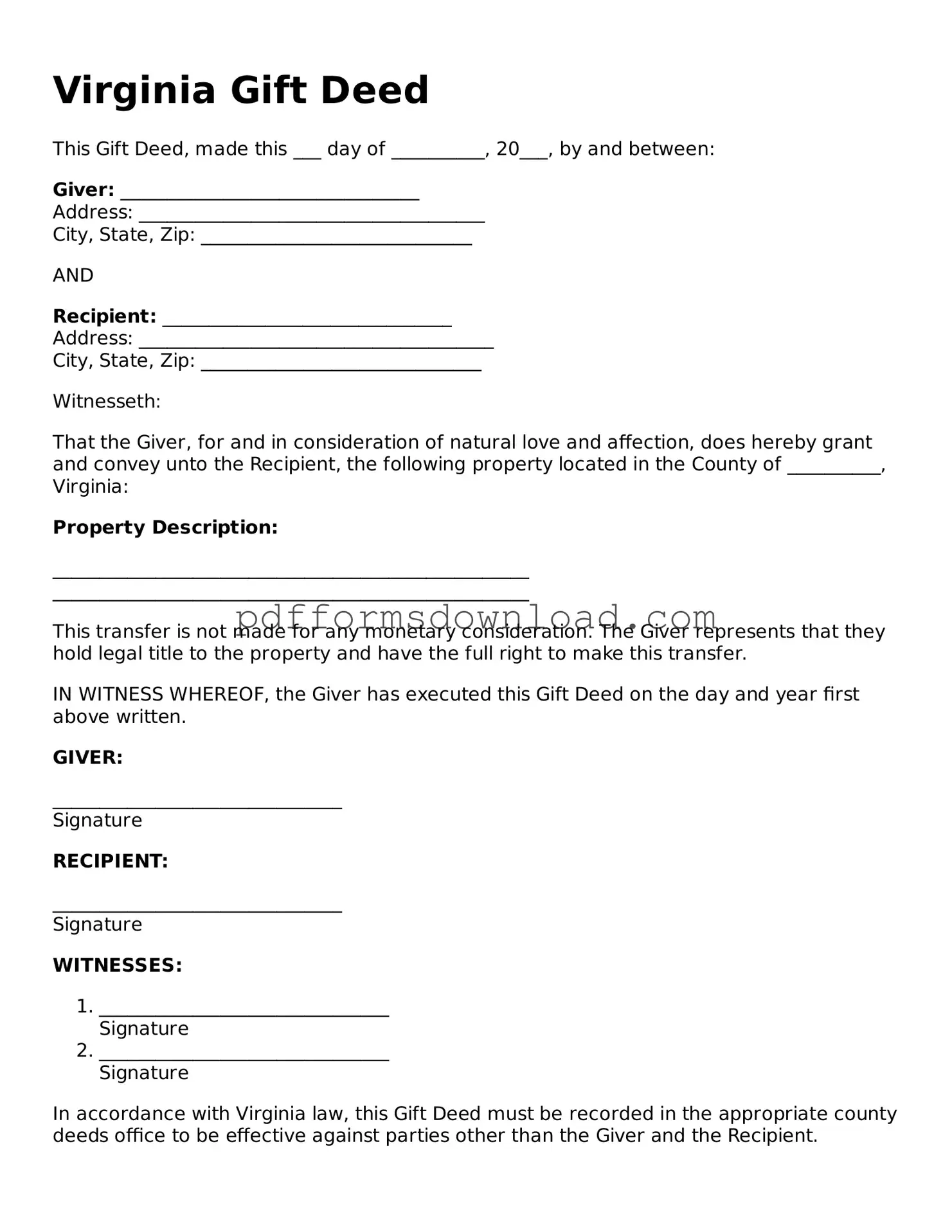

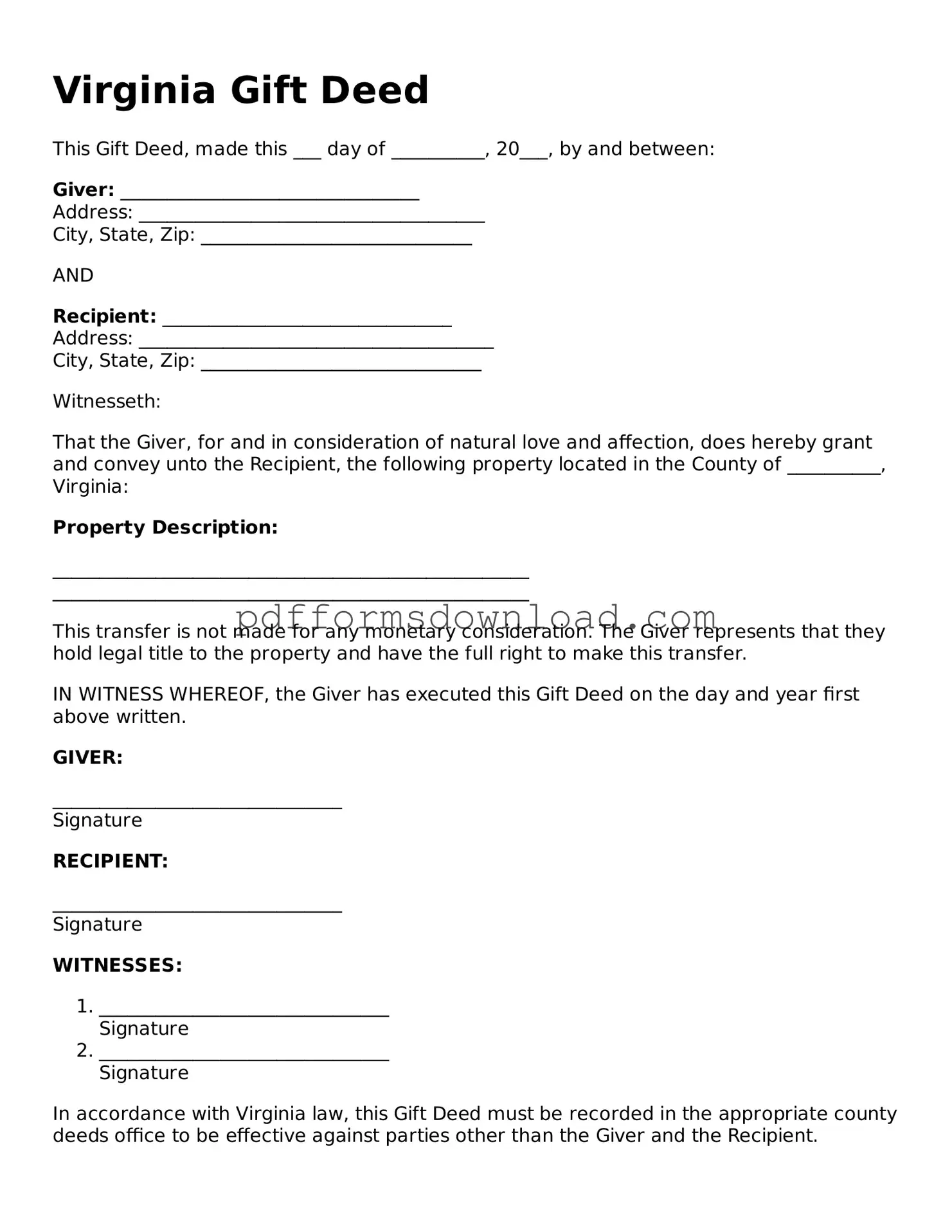

A Virginia Gift Deed is a legal document used to transfer ownership of real property from one person to another without any exchange of money. This deed is typically used when a property owner wishes to give their property as a gift to a family member or friend. It must be properly executed and recorded to be valid. The deed outlines the names of the grantor (the person giving the gift) and the grantee (the person receiving the gift), along with a description of the property being transferred.

Do I need to pay taxes on a property received through a Gift Deed?

In Virginia, receiving property as a gift may have tax implications. Generally, the recipient does not pay income tax on the value of the gift. However, the donor may need to file a gift tax return if the value exceeds the annual exclusion limit set by the IRS. It is crucial to consult with a tax professional to understand potential tax liabilities and ensure compliance with federal and state tax laws.

How do I execute a Gift Deed in Virginia?

To execute a Gift Deed in Virginia, the grantor must complete the deed form, which includes relevant details about the property and the parties involved. The grantor must sign the deed in the presence of a notary public. After signing, the deed should be recorded at the local county clerk's office where the property is located. Recording the deed ensures that the transfer of ownership is legally recognized and protects the grantee's rights to the property.

Can a Gift Deed be revoked or changed after it is executed?

Once a Gift Deed is executed and recorded, it generally cannot be revoked. The transfer of ownership is considered final. However, if the grantor retains certain rights or conditions in the deed, there may be limited circumstances under which changes can be made. If the grantor wishes to regain ownership, they may need to pursue a different legal process, such as a quitclaim deed. It is advisable to seek legal counsel before attempting to make any changes to a Gift Deed.

Are there any specific requirements for a Gift Deed in Virginia?

Yes, there are specific requirements for a Gift Deed in Virginia. The deed must clearly identify the grantor and grantee, include a legal description of the property, and state that the transfer is a gift. The grantor's signature must be notarized. Additionally, the deed must be recorded in the appropriate county office to be enforceable against third parties. Following these requirements is essential to ensure the validity of the Gift Deed.