What is a Virginia Promissory Note?

A Virginia Promissory Note is a written promise to pay a specific amount of money to a designated person or entity at a specified time or on demand. It serves as a legal document that outlines the terms of a loan agreement between the borrower and the lender. This note can be used for various purposes, including personal loans, business loans, or any situation where money is borrowed and needs to be repaid.

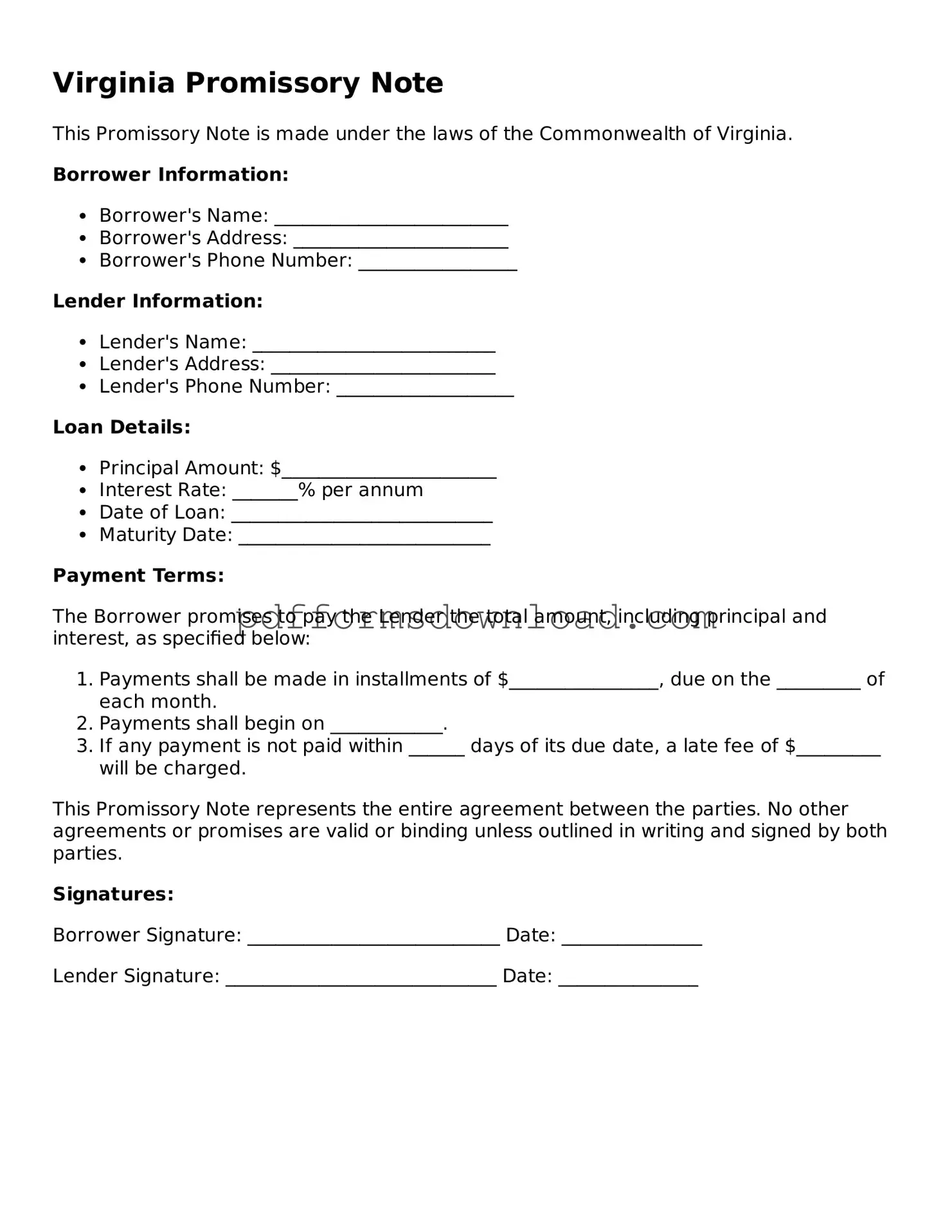

What information is typically included in a Virginia Promissory Note?

Essential details are crucial for clarity and enforceability. A typical Virginia Promissory Note includes the names and addresses of the borrower and lender, the principal amount being borrowed, the interest rate (if applicable), repayment terms (including due dates), and any collateral securing the loan. Additionally, it may include provisions for late fees, default conditions, and governing law. This comprehensive information helps protect both parties and ensures mutual understanding.

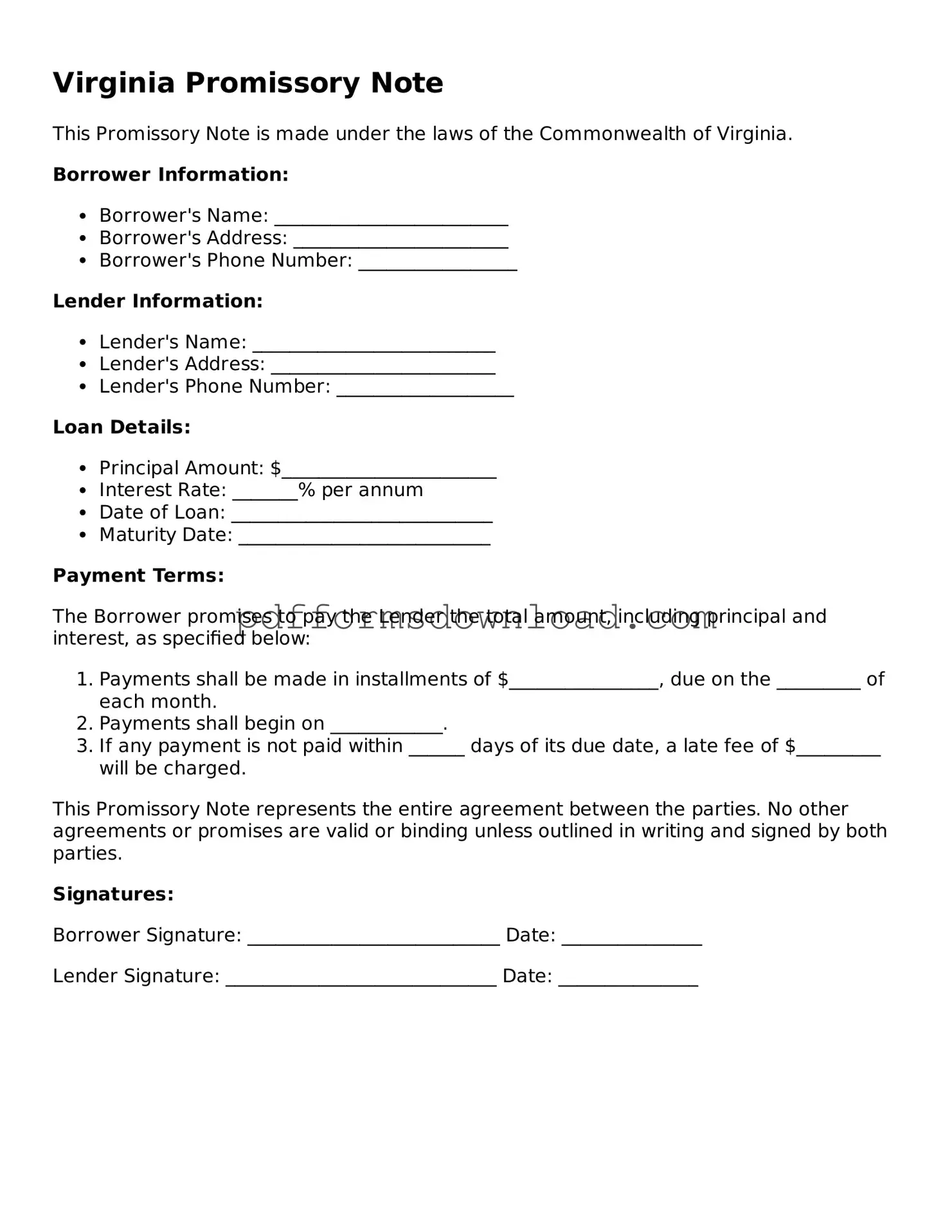

Is a Virginia Promissory Note legally binding?

Yes, a Virginia Promissory Note is legally binding once it is signed by both the borrower and the lender. It creates a formal obligation for the borrower to repay the specified amount under the agreed-upon terms. However, for the note to be enforceable, it must be clear, complete, and comply with Virginia laws. Both parties should keep a copy of the signed document for their records, as this can be crucial in case of any disputes.

Can I modify a Virginia Promissory Note after it has been signed?

Yes, modifications to a Virginia Promissory Note can be made, but they must be done in writing and signed by both parties. This ensures that any changes are documented and agreed upon, preventing misunderstandings in the future. Whether adjusting payment terms, interest rates, or other provisions, clear communication and documentation are essential to maintain a healthy borrower-lender relationship.

What should I do if the borrower defaults on the loan?

If a borrower defaults on a loan outlined in a Virginia Promissory Note, the lender has several options. First, review the note to understand the specific terms regarding default and remedies. The lender may choose to negotiate a new repayment plan with the borrower or, if necessary, pursue legal action to recover the owed amount. Consulting with a legal professional can provide guidance on the best course of action and help navigate the complexities of debt recovery.