What is a Virginia Quitclaim Deed?

A Virginia Quitclaim Deed is a legal document used to transfer ownership of real estate from one party to another without any warranties or guarantees. It essentially allows the seller, known as the grantor, to relinquish any claim they may have to the property, while the buyer, or grantee, accepts the property as-is. This type of deed is often used between family members or in situations where the parties know each other well.

When should I use a Quitclaim Deed?

You might consider using a Quitclaim Deed in various situations, such as transferring property between family members, adding or removing a spouse from the title after marriage or divorce, or clearing up title issues. It’s important to note that this deed does not provide any protection against claims from other parties, so it should be used with caution.

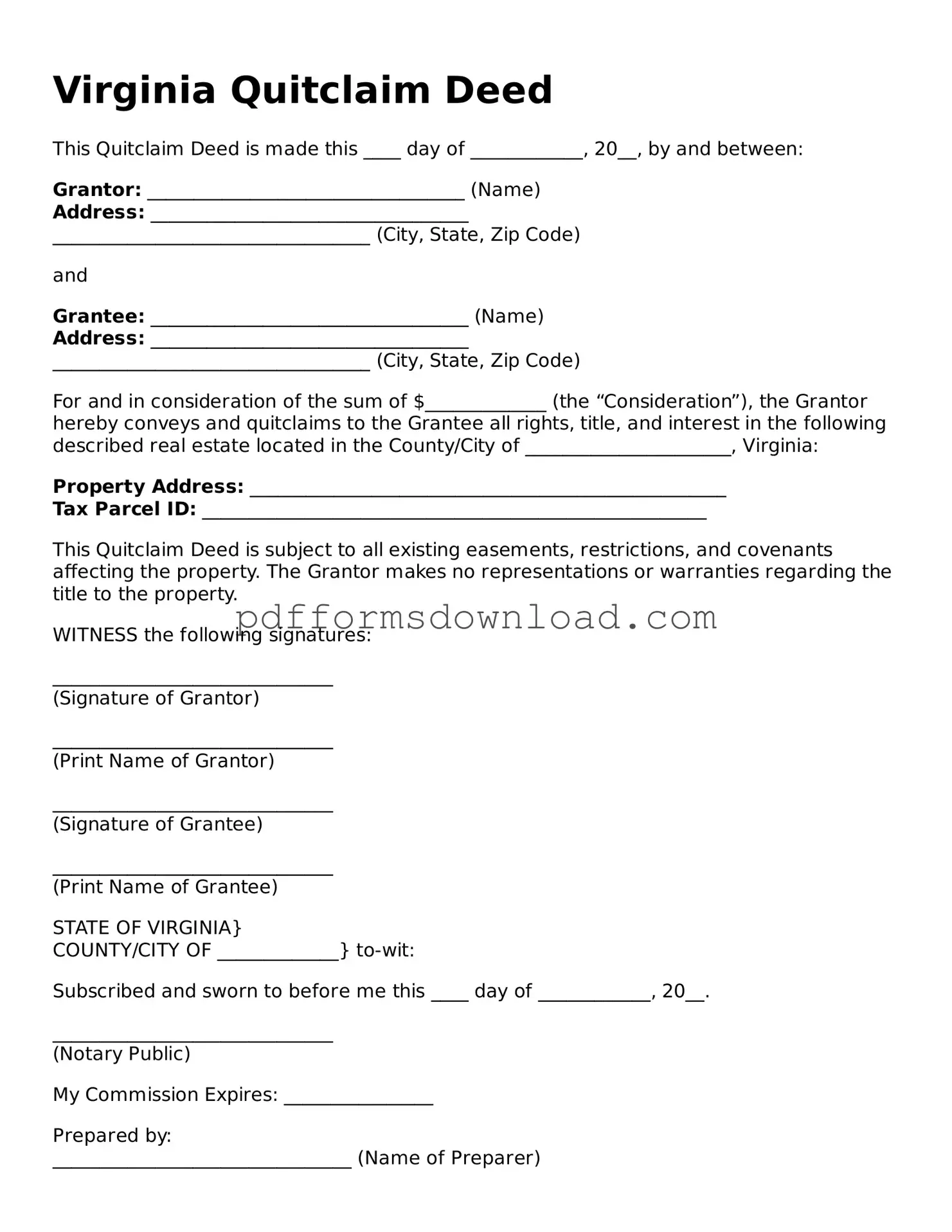

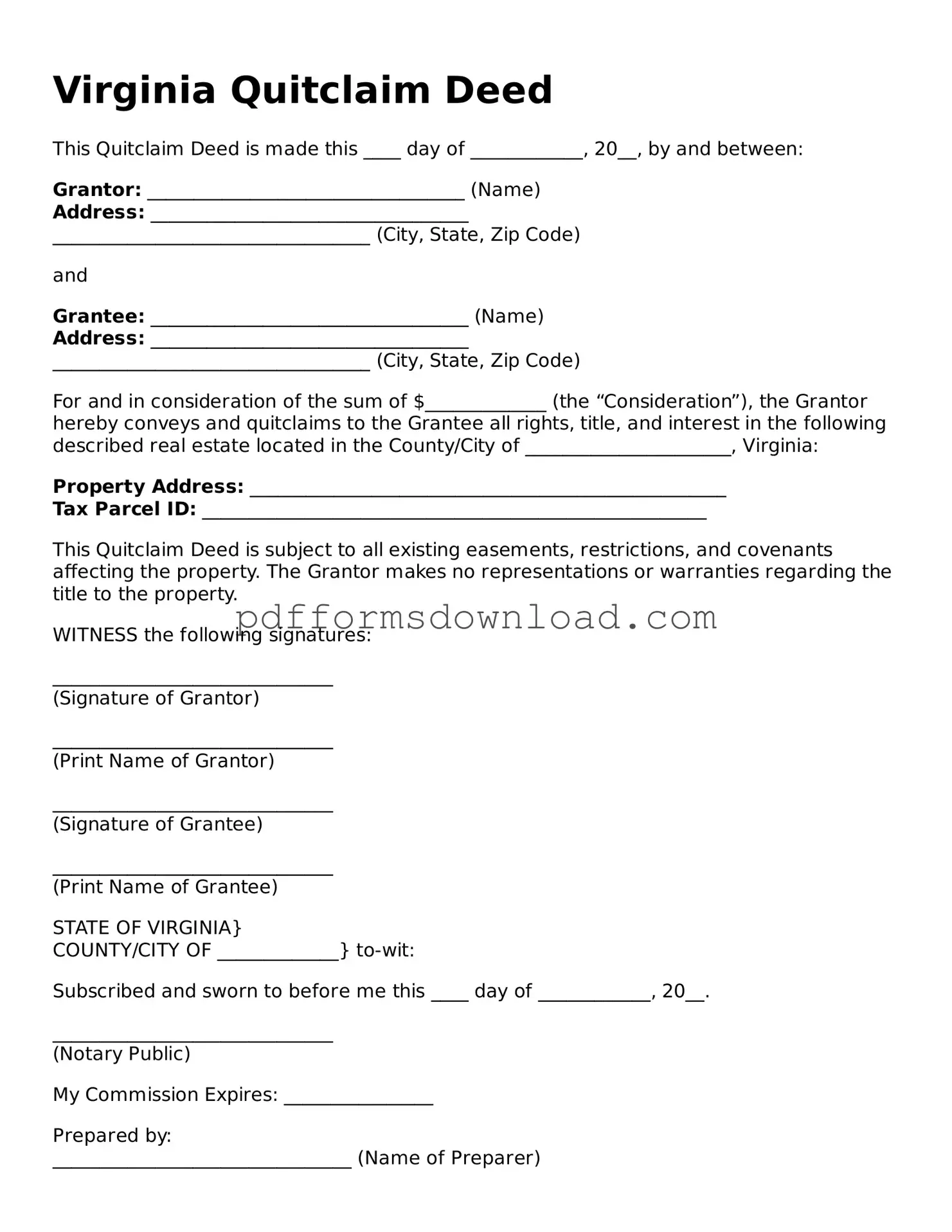

How do I complete a Virginia Quitclaim Deed?

To complete a Quitclaim Deed in Virginia, you will need to gather specific information, including the names of the grantor and grantee, a legal description of the property, and the county in which the property is located. The document must be signed by the grantor in the presence of a notary public. Once completed, it should be filed with the local land records office to ensure it is officially recorded.

Is a Quitclaim Deed the same as a Warranty Deed?

No, a Quitclaim Deed is not the same as a Warranty Deed. A Warranty Deed provides a guarantee that the grantor holds clear title to the property and has the right to transfer it. In contrast, a Quitclaim Deed transfers whatever interest the grantor has without any warranties. This means that if there are issues with the title, the grantee has no recourse against the grantor.

Are there any fees associated with filing a Quitclaim Deed in Virginia?

Yes, there are typically fees associated with filing a Quitclaim Deed in Virginia. These fees can vary by county, so it’s essential to check with your local land records office for the exact amount. Additionally, you may need to pay for notary services if you do not have access to a notary public.

Do I need an attorney to create a Quitclaim Deed?

Can a Quitclaim Deed be revoked?

Once a Quitclaim Deed is executed and recorded, it generally cannot be revoked unilaterally. If the grantor wishes to regain ownership, they would need to execute another legal document, such as a new deed, to transfer the property back. It’s crucial to understand that once the deed is recorded, the transfer is usually considered final.

What happens if there are multiple owners on a Quitclaim Deed?

If there are multiple owners listed on a Quitclaim Deed, all owners must agree to any future transfers of the property. This means that if one owner wants to sell or transfer their interest, they may need the consent of the other owners. It’s important to discuss ownership rights and responsibilities among all parties involved before executing the deed.

Where do I file a Quitclaim Deed in Virginia?

A Quitclaim Deed must be filed with the local land records office in the county where the property is located. This office is typically part of the circuit court. After filing, the deed will be recorded and become part of the public record, which helps protect the rights of the new owner.